Kohl's 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

F-8

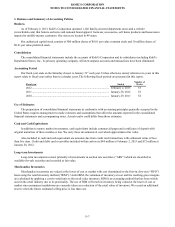

1. Business and Summary of Accounting Policies (continued)

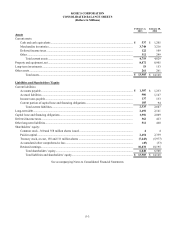

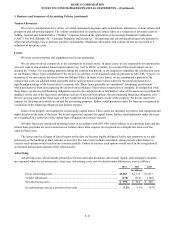

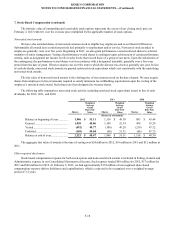

Property and Equipment

Property and equipment consist of the following:

Feb 2,

2013 Jan 28,

2012

(In Millions)

Land................................................................................................................................. $ 1,089 $ 1,081

Buildings and improvements:

Owned ...................................................................................................................... 7,575 7,318

Leased....................................................................................................................... 1,820 1,792

Store fixtures and equipment........................................................................................... 2,517 2,367

Computer hardware and software.................................................................................... 849 700

Construction in progress.................................................................................................. 130 204

Total property and equipment.......................................................................................... 13,980 13,462

Less accumulated depreciation........................................................................................ (5,108)(4,557)

$ 8,872 $ 8,905

Construction in progress includes land and improvements for locations not yet opened and for the expansion and

remodeling of existing locations in process at the end of each year.

Property and equipment is recorded at cost, less accumulated depreciation. Depreciation is calculated using the straight-

line method over the estimated useful lives of the assets. Leased property and improvements to leased property are amortized

on a straight-line basis over the term of the lease or useful life of the asset, whichever is less.

The annual provisions for depreciation and amortization generally use the following ranges of useful lives:

Buildings and improvements...................................................................................................... 5-40 years

Store fixtures and equipment...................................................................................................... 3-15 years

Computer hardware and software............................................................................................... 3-8 years

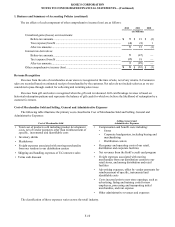

Long-Lived Assets

All property and equipment and other long-lived assets are reviewed when events or changes in circumstances indicate

that the asset’s carrying value may not be recoverable. If such indicators are present, it is determined whether the sum of the

estimated undiscounted future cash flows attributable to such assets is less than their carrying amounts. No material

impairments were recorded in 2012, 2011, or 2010 as a result of the tests performed.

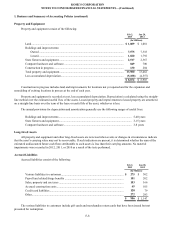

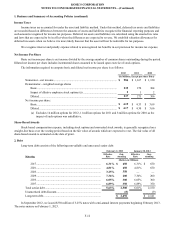

Accrued Liabilities

Accrued liabilities consist of the following:

Feb 2,

2013 Jan 28,

2012

(In Millions)

Various liabilities to customers....................................................................................... $ 275 $ 302

Payroll and related fringe benefits .................................................................................. 101 202

Sales, property and use taxes .......................................................................................... 153 166

Accrued construction costs ............................................................................................. 65 105

Credit card liabilities....................................................................................................... 120 79

Other................................................................................................................................ 272 293

$ 986 $ 1,147

The various liabilities to customers include gift cards and merchandise return cards that have been issued but not

presented for redemption.