Kohl's 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

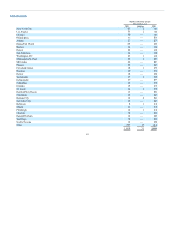

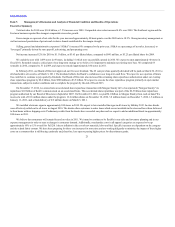

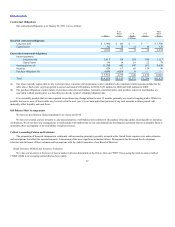

Drivers of the changes in comparable store sales were as follows:

Selling price per unit 2.3% 1.9%

Units per transaction (4.3) (2.9)

Average transaction value (2.0) (1.0)

Number of transactions 2.4 (5.9)

Comparable store sales 0.4% (6.9)%

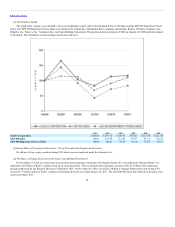

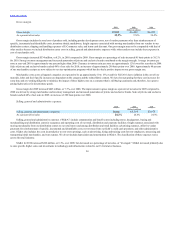

The Southeast region reported the strongest 2010 sales growth with comparable store sales increases in the mid-single digits. In 2010, the Southeast

region benefited from implementing merchandising and marketing tactics similar to those that were implemented in the West region in 2009. All other regions

reported comparable store sales increases of two to three percent for the year.

By line of business, Footwear, Men’s and Home outperformed our total company comparable store sales growth for the year. Footwear was led by

strength in women’s and juniors’ shoes. Men’s was led by active and basics. Home was strong in electronics and small electrics. Women’s was similar to the

company average and was led by Sonoma, juniors, active and updated sportswear. Accessories and Children’s were below the company average. Accessories

was strongest in watches, fashion jewelry and sterling silver jewelry. The Children’s business had strength in toys.

E-Commerce sales, which exclude shipping and other revenues, increased 51.7% to $717 million for 2010. The number of E-Commerce transactions

increased almost 60% due to increased customer traffic, increased style and size selections offered on-line compared with our in-store selection and the

expansion of product categories not available in our stores.

Net sales per selling square foot increased $5 to $222 in 2010. The increase is primarily due to higher comparable store sales.

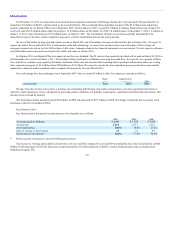

Net sales for 2009 increased 4.8% over 2008 and comparable store sales increased 0.4%. From a line of business perspective, Accessories reported the

strongest comparable store sales in 2009 with strength in sterling silver jewelry, fashion jewelry and handbags. Footwear and Home outperformed the

comparable store sales for the year, while Women’s and Children’s trailed the company. Men’s was similar to the company average. The West region, which

was favorably impacted by the closure of Mervyn’s department stores, reported the strongest comparable store sales for 2009. E-Commerce sales increased

approximately 40% to $473 million for 2009.

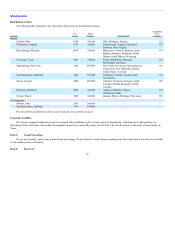

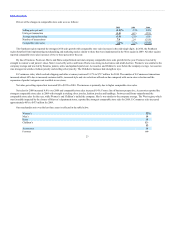

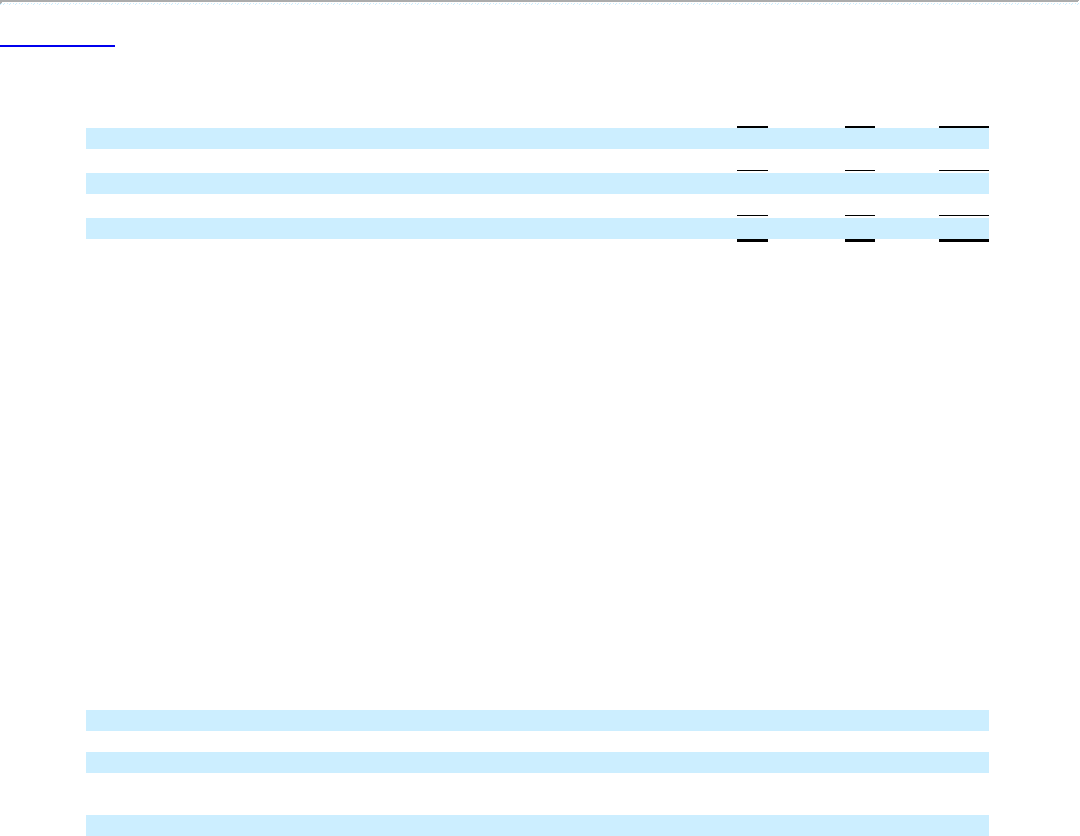

Our merchandise mix over the last three years is reflected in the table below:

Women’s

Men’s

Home

Children’s

Accessories

Footwear

23