Kohl's 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Without question, 2003 was a very difficult year for Kohl’s.

Although we achieved record sales for our twelfth consecutive

year as a public company, our earnings performance was a

disappointment.

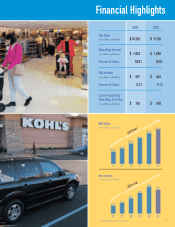

Net sales crossed the $10 billion milestone, increasing 12.7%

to $10.3 billion. Net income, however, decreased 8.1% to

$591 million or $1.72 per diluted share in fiscal 2003 and

comparable store sales were down 1.6%. Clearly, we did not

achieve our goal of 20% earnings growth. Profitably increasing

our comparable store sales is our number-one priority.

How Did it Happen?

We could take the easy way out and blame it on external factors

such as the weather, the war and the economy. The reality is

we did not execute to our normally high standards. We got off

track, and we are responsible for getting things back on track.

We did not execute to our standards in three key areas:

inventory levels and content, the customer shopping experience

and marketing. Our stores were over-stocked and difficult

to shop. Our assortment in misses and women’s was not what

our customer was looking for. And, our marketing was no

longer unique in a highly promotional retail environment.

To validate our conclusions, we conducted extensive

customer research, both quantitative and qualitative.

This research verified our analysis. At the same time,

our customer confirmed that our mission statement is what

she’s looking for, a value-oriented department store offering

national brand merchandise in a clean, friendly, convenient

environment. We’ve learned from our mistakes and are

taking the actions needed to correct them. We recognize

that we need to restore her trust in us.

We are confident that our business model is sound and we

are positioned to increase market share. We have reduced our

inventory levels appropriately and made modifications to our

merchandise assortment. We are encouraged by the start to the

spring season. That being said, we will remain conservative in

our inventory levels and rely upon our strong vendor partnerships

to replenish seasonal product based upon rate of sale.

Financially Strong

Although we were extremely disappointed with our

performance in 2003, Kohl’s continues to be financially strong.

Our sales per square foot are among the highest in the

industry. Our operating margin of 10% in 2003 is also one

of the highest in the industry. Our capital structure is well

positioned to continue to support our expansion plans.

Internally generated cash flows will continue to be the primary

source of the funding required for our future growth.

As always, we remain committed to managing our business

both ethically and responsibly and to representing the

best interest of our shareholders through good corporate

governance. After thorough review by its Governance and

Nominating Committee, the Board of Directors believes

the company is in full compliance with all applicable

corporate governance rules of the Securities and Exchange

Commission and the New York Stock Exchange.

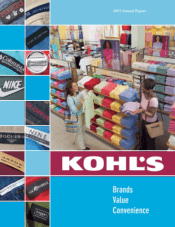

“While many department store chains try to imitate

us, there is only one Kohl’s. The foundation for our

success is our well-established concept of brands,

value and convenience.”

Dear Shareholders:

Kevin Mansell,

Arlene Meier and

Larry Montgomery