Kohl's 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

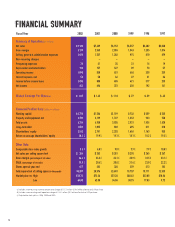

Fiscal Year 2002 2001 2000 1999 1998 1997

Summary of Operations

(In millions)

Net sales $9,120 $7,489 $6,152 $4,557 $3,682 $3,060

Gross margin 3,139 2,565 2,096 1,543 1,235 1,014

Selling, general & administrative expenses 1,818 1,527 1,282 975 810 679

Non-recurring charges -–––––

Preopening expenses 39 31 35 31 16 19

Depreciation and amortization 192 157 127 89 70 57

Operating income 1,090 850 651 448 338 259

Interest expense, net 56 50 46 27 21 24

Income before income taxes 1,034 800 605 421 317 235

Net income 643 496 372 258 192 141

Diluted Earnings Per Share(c) $1.87 $1.45 $ 1.10 $ .77 $ .59 $ .45

Financial Position Data

(Dollars in millions)

Working capital $1,776 $1,584 $1,199 $ 732 $ 559 $ 525

Property and equipment, net 2,739 2,199 1,727 1,353 933 750

Total assets 6,316 4,930 3,855 2,931 1,936 1,620

Long-term debt 1,059 1,095 803 495 311 310

Shareholders’ equity 3,512 2,791 2,203 1,686 1,163 955

Return on average shareholders’ equity 20.4 % 19.9 % 19.1 % 18.1 % 18.2 % 19.2 %

Other Data

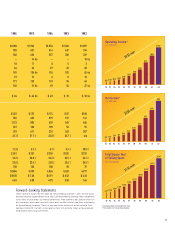

Comparable store sales growth 5.3 % 6.8 % 9.0 % 7.9 % 7.9 % 10.0 %

Net sales per selling square foot $284 $ 283 $ 281 $ 270 $ 265 $ 267

Gross margin (percentage of net sales) 34.4 % 34.3 % 34.1 % 33.9 % 33.5 % 33.1 %

SG&A (percentage of net sales) 19.9 % 20.4 % 20.8 % 21.4 % 22.0 % 22.2 %

Stores open at year end 457 382 320 259 213 182

Total square feet of selling space (In thousands) 34,507 28,576 23,610 18,757 15,111 12,533

Market price (c): High $78.74 $72.24 $72.20 $40.63 $33.88 $18.84

Low 44.00 42.00 34.06 30.75 17.03 9.72

(a) Includes a non-recurring incentive compensation charge of $17.7 million ($10.6 million after-tax) or $.04 per share.

(b) Includes a non-recurring credit operations charge of $14.1 million ($8.3 million after-tax) or $.03 per share.

(c) Adjusted for stock splits in 1996, 1998 and 2000.

14

FINANCIAL SUMMARY