Kohl's 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

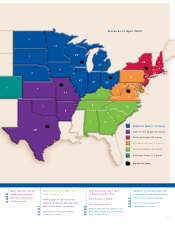

Kohl’s went public in 1992 with the objective of

building value for our shareholders over the long term.

Our record of consistently strong financial results

is reflected in the performance of Kohl’s stock.

Shareholders who invested $1,000 in Kohl’s initial public

offering in May 1992 have seen their investment grow

to more than $37,000 at the end of fiscal 2001. This

results in a compounded annual growth rate of 45%.

Over this time period, our shareholders have participated

in three stock splits as a result of our success.

Consistent Growth

The increasing value of Kohl’s shares reflects

the successful execution of our growth strategy and

our consistently strong financial performance.

While many companies can grow the top line, consistent

increases in earnings are more difficult to achieve.

Kohl’s goal has always been to grow both the top line

and bottom line at 20% per year. We have exceeded

this goal year after year. Sales have grown at a compounded

annual growth rate of 23.8% since 1992, while net

income has grown 32.7% as a result of the increased

sales and our emphasis on controlling expenses. Over

the last ten years, our comparable store sales increase

has averaged 8.4% per year.

The last five years have been even more impressive, with

sales growing at an annual compounded growth rate of

25.7% and net income at 37.2%. This growth has been

driven by a combination of increases in comparable

store sales and the contribution from our new stores.

Another important financial measure is return on

investment. We set a goal of achieving a 20% return

on investment each year. In 2001, we exceeded our

goal, generating a 21% return on investment.

We remain committed to continuing our successful

expansion strategy and maintaining our goal of a 20%

return on investment.

Strong Capital Structure

Kohl’s capital structure is well positioned to support our

expansion plans. Internally generated cash flow continues

to be our most important source of capital and, along

with our ability to access the capital markets, provide

funding for our expansion plans. A key to our access

to liquidity and capital markets is maintaining strong

investment-grade debt ratings. Currently, our long-term

debt is rated A3 by Moody’s and A- by Standard & Poor’s.

In recognition of our growth and strong performance,

Kohl’s was added to the Standard & Poor’s 500 Index

in 1998.

As we continue to execute our expansion strategy, our

commitment to building shareholder value will remain

the cornerstone for our future growth.

11

Since o ur Initial Public Offering in 1992, Ko hl’s has be co me

a leading natio nal retailer with a reco rd of co nsistently strong

financ ial perfo rmanc e.

0101009998979695949392

28.7%

CAGR*

$0.15 $0.19 $0.23 $0.27 $0.34

$0.45

$0.59

$0.77

$1.10

$1.45

Dilut ed Earnings Per Share( 1 )

* Co mpo unded annual growth rate.

( 1) Excludes no n-recurring c harges and extrao rdinary items.

Adjusted fo r sto c k splits in 19 96, 1998 and 2000.