KeyBank 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

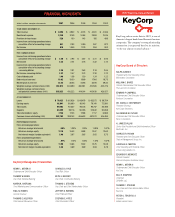

2007 PERFORMANCE

Henry, you indicated early last year that

2007 likely would be a tough year for

banks. It turned out to be far more chal-

lenging for the industry than anyone

might have predicted. How would you

broadly describe Key’s performance?

Looking back, 2007 can be divided

into two markedly different periods.

During the first half of the year, we

were effectively executing on our

strategy, exceeding our profit plan

and earning recognition for strong

financial results. We were on track to

achieve our third consecutive year of

record earnings. Then came serious

market disruptions, beginning in

August, that negatively affected all

financial services companies. Key’s

homebuilder portfolio and certain

types of capital markets and trading

activities were the major areas of

underperformance.

How would you characterize 2007 financial

results?

As noted, we had every intention of

achieving another record year. We are,

of course, disappointed that we did

not. However, given market condi-

tions in the second half of the year,

our 2007 results were very compara-

ble to those of our peer banks. I would

add a reminder that Key’s results in

2006 and 2005 demonstrate what we

are capable of achieving in a more

stable interest rate environment.

In 2007, we reported $5.0 billion in

revenues, a modest increase over the

previous year, and our total assets

reached $100 billion for the first time.

Still, our earnings of $941 million

fell short of our record earnings of

$1.193 billion in 2006.

How do you analyze that performance?

On a relative basis, we avoided

some of the major issues that heavily

affected others in our industry. The

strategic decisions we made in prior

years protected us to a large extent

from the more severe earnings decline

of financial institutions active in the

residential or subprime mortgage

markets, or that issued certain types

of mortgage-backed securities or

complex investment vehicles.

Though the market disruptions defi-

nitely slowed our financial momentum

in the last half of the year, and will

continue to affect us as we enter 2008,

we moved ahead with several major

projects to improve our businesses,

and adopted additional expense-

control actions at year end to sustain

our competitiveness.

Would you elaborate on Key’s strategic

decisions?

In recent years we’ve made a number

of strategic decisions regarding our

mix of businesses and loan portfolio,

including exiting the subprime home

equity and indirect automobile lending

businesses. We decided two years ago

to sharply curtail our condominium

development lending in places where

we thought the market was becoming

overbuilt. Key also has limited its

participation in large and leveraged

syndicated financing transactions.

Moreover, we have no meaningful

exposure to complex securities such

as collateralized loan obligations

(CLOs), collateralized debt obligations

(CDOs), asset-backed commercial

paper (ABCP) and structured invest-

ment vehicles (SIVs).

What were the bright spots in the company’s

2007 performance?

Commercial loan growth was solid

last year, increasing to $52.7 billion at

year end, from $48.3 billion a year ago.

Our institutional asset management

unit, Victory Capital Management,

as well as several other fee-based busi-

nesses, had favorable performances.

Excluding the impact of the sale of our

McDonald Investments branch net-

work last year, trust and investment

services income increased by 14 percent,

driven by growth in both personal and

institutional asset management income.

Key’s Board of Directors in December

increased the quarterly dividend for the

43rd consecutive year. That puts Key in

a pretty select group of American com-

panies, right?

Absolutely. Very few U.S. companies

have such an impressive record. In fact,

Standard and Poor’s tracks companies

that have increased their dividends

KEY 2007 5 3