Kentucky Fried Chicken 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 YUM! BRANDS, INC.

Significant Known Events, Trends or Uncertainties

Impacting or Expected to Impact Comparisons of

Reported or Future Results

The following factors impacted comparability of operating

performance for the years ended December 30, 2006, Decem-

ber 31, 2005 and December 25, 2004 and could impact

comparability with our results in 2007.

EXTRA WEEK IN 2005 Our fiscal calendar results in a 53rd

week every five or six years. Fiscal year 2005 included a 53rd

week in the fourth quarter for the majority of our U.S. busi-

nesses as well as our international businesses that report

on a period, as opposed to a monthly, basis. In the U.S., we

permanently accelerated the timing of the KFC business clos-

ing by one week in December 2005, and thus, there was no

53rd week benefit for this business. Additionally, all China

Division businesses report on a monthly basis and thus did

not have a 53rd week.

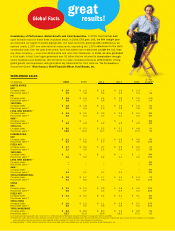

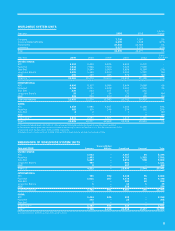

The following table summarizes the estimated increase

(decrease) of the 53rd week on fiscal year 2005 revenues

and operating profit:

Inter-

national Unallo-

U.S. Division cated Total

Revenues

Company sales $ 58 $ 27 $ — $ 85

Franchise and license fees 8 3 — 11

Total Revenues $ 66 $ 30 $ — $ 96

Operating profit

Franchise and license fees $ 8 $ 3 $ — $ 11

Restaurant profit 14 5 — 19

General and administrative

expenses (2) (3) (3) (8)

Equity income from

investments in

unconsolidated affiliates — 1 — 1

Operating profit $ 20 $ 6 $ (3) $ 23

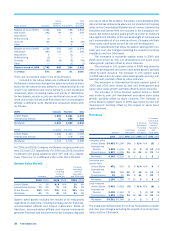

MAINLAND CHINA RECOVERY Our KFC business in mainland

China was negatively impacted by the interruption of product

offerings and negative publicity associated with a supplier

ingredient issue experienced in late March 2005 as well as

consumer concerns related to Avian Flu in the fourth quar-

ter of 2005. As a result of the aforementioned issues, the

China Division experienced system sales growth in 2005 of

11% excluding currency translation which is below our ongo-

ing target of at least 22%. During the year ended December

30, 2006, the China Division recovered from these issues

and achieved growth rates of 23% for both system sales and

Company sales, both excluding currency translation. During

2005, we entered into agreements with the supplier of the

aforementioned ingredient. As a result, we recognized recover-

ies of approximately $24 million in Other income (expense)

in our Consolidated Statement of Income for the year ended

December 31, 2005.

UNITED STATES RESTAURANT PROFIT Restaurant profits in

the U.S. were positively impacted by a decline of approxi-

mately $45 million in commodity costs (principally meats

and cheese) for the year ended 2006 versus the year ended

2005. We expect commodity inflation in the U.S. of 2% to

3% in 2007.

Our U.S. restaurant profits were also positively impacted

by lower self-insured property and casualty insurance expenses

of $31 million for the year ended 2006 versus 2005. These

lower insurance expenses were the result of improved loss

trends, which we believe are driven by safety and other mea-

sures we have implemented over time, on our insurance

reserves and lower property related losses (including the lap-

ping of the unfavorable impact of Hurricane Katrina in 2005

and a small, related insurance recovery in 2006). While we

anticipate that these favorable loss trends will continue, it

is difficult to forecast their impact, including the impact of

large property and casualty losses that may occur. However,

we anticipate that given the significant favorability in 2006,

property and casualty insurance expense in 2007 will be flat

to slightly higher in comparison.

TACO BELL NORTHEAST UNITED STATES PRODUCE-SOURCING

ISSUE Our Taco Bell business was negatively impacted by

adverse publicity related to a produce-sourcing issue dur-

ing November and December 2006. As a result, Taco Bell

experienced significant sales declines at both company and

franchise stores, particularly in the northeast United States

where an outbreak of illness associated with a particular

strain of E. coli 0157:H7 took place. According to the Centers

for Disease Control this outbreak was associated with eating

at Taco Bell restaurants in Pennsylvania, New Jersey, New

York and Delaware. In the fourth quarter of 2006, Taco Bell’s

company same store sales were down 5%, driven largely by

a very significant negative sales impact during the month of

December. Overall, we estimate this issue negatively impacted

operating profit by $20 million in the fourth quarter of 2006

due primarily to lost Company sales and franchise and license

fees as well as incremental marketing costs. Same store

sales at Taco Bell have begun to recover from their lowest

point in the third week of December. While we anticipate that

Taco Bell will fully recover from this issue by the middle of

2007, our experience has been that recoveries of this type

vary in duration and could take longer. The timing of such

recovery will determine the impact on 2007 operating profit.

We currently forecast same store sales growth at Taco Bell in

2007 of one to two percent.

U.S. BEVERAGE AGREEMENT CONTRACT TERMINATION During

the first quarter of 2006, we entered into an agreement with

a beverage supplier to certain of our Concepts to terminate

a long-term supply contract. As a result of the cash payment

we made to the supplier in connection with this termination,

we recorded a pre-tax charge of $8 million to Other (income)

expense in the quarter ended March 25, 2006. The affected

Concepts have entered into an agreement with an alterna-

tive beverage supplier. The contract termination charge we

recorded in the quarter ended March 25, 2006 was partly

offset by more favorable beverage pricing for our Concepts in

2006. We expect to continue to benefit from the more favor-

able pricing in 2007 and beyond.