Kentucky Fried Chicken 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yum! Brands

2006 Annual Customer Mania Report

Yum!

around the

Going for

greatness

globe!

Table of contents

-

Page 1

greatness around the Going for Yum! globe! Yum! Brands 2006 Annual Customer Mania Report -

Page 2

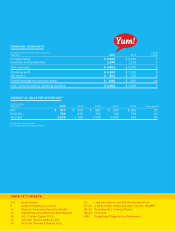

... HIGHLIGHTS (In millions, except for per share amounts) Year-end 2006 2005 % B/(W) change Company sales Franchise and license fees Total revenues Operating profit Net income Diluted earnings per common share Cash flows provided by operating activities $ 8,365 1,196 $ 9,561 $ 1,262 $ 824... -

Page 3

... demonstrated our global growth by opening over 1,000 new restaurants outside of the U.S. for the sixth straight year in a row - 1,181 to be precise. What's more, we are a proven global cash ï¬,ow generator, providing major shareholder payouts. Speciï¬cally, after investing $614 million in capital... -

Page 4

... our Chinese restaurants, and they will tell you we are building best-in-class brands and operations. What's more, it's our highest return international equity business, with +20% store level margins and a cash payback on investments of less than two years. We uniquely own our food distribution... -

Page 5

... $500 million in franchise fees, requiring very little capital on our part, and opening up 90% of the new restaurants. As with China, YRI has a huge upside in terms of international expansion. KFC and Pizza Hut already are global brands. Yet we only have 6,600 KFC and 4,700 Pizza Hut restaurants in... -

Page 6

... Bell?" We've just begun executing our strategy to take Taco Bell global. Our plan is to open new restaurants in Mexico, the Middle East, India, Japan, Canada and the Philippines over the next couple of years. Whereas Pizza Hut and KFC brought U.S. brands to established categories, chicken and pizza... -

Page 7

... of branded chicken wings, while driving incremental sales and proï¬ts. In addition to pursuing operations improvement, and new unit growth, we continue to pursue refranchising. I've talked about this concept since we started our company. If we can run our stores well and provide great returns to... -

Page 8

..., we are building process and discipline around the things that really matter in our restaurants, and are sharing our global best practices - and getting better and better every year. I'd like to thank our dedicated team members, restaurant managers, franchise partners and outstanding board... -

Page 9

7 -

Page 10

... we opened our ï¬rst KFC in Beijing in 1987, we've done just that. Growing the business dramatically over the last 20 years, KFC continues to be the #1 quick-service restaurant brand and the largest and fastest growing restaurant chain in China today, with over 1,800 restaurants. Pizza Hut remains... -

Page 11

Yum! China We believe we'll have more restaurants and proï¬ts in China than in the U.S. Over time, we plan to open at least 20,000 restaurants in mainland China! KFC and Pizza Hut are the #1 quickservice brands in mainland China! generated $290 million in operating proï¬t and over $1.6 billion ... -

Page 12

...! We're bringing the West to the East! We opened nearly 400 KFC and Pizza Hut restaurants in 2006 - more than one new restaurant every day! With 2000+ KFC and Pizza Hut restaurants in 402 cities and provinces across mainland China, we're going for greatness in China and we're on the ground ï¬,oor! -

Page 13

... as we continue to invest behind the huge growth potential of our international business. For instance, in India, Yum! is now the largest and fastest growing restaurant company. Ten new KFCs and 17 new Pizza Huts were added in this vibrant economy in 2006 and the unit volumes have been very... -

Page 14

A high-return, cash-rich business - setting new records every year! Record operating proï¬ts of $407 million! Serving 4 billion customers in over 100 countries and territories! -

Page 15

... world! YRI now manages over 11,700 traditional restaurants in over 100 countries and territories, 85% of which are operated by some 750 franchise partners. Leveraging their local knowledge, their passion for excellence and the unique competitive strength of Yum!'s brands, franchise and license fees... -

Page 16

restaurants start with Great brands! We are #1 in four food categories! With leadership positions in the chicken, pizza, Mexican-style food and quick-service seafood categories, we continue to show the world the power of our portfolio. We have dedicated leadership teams focused on creating brands ... -

Page 17

... cooking oil and restaurant teams showing their southern hospitality spirit more than ever before, 2006 was indeed a ï¬nger lickin' good year in Chicken Capital U.S.A. Taco Bell is a brand Where Left of Center Feels Right. 2006 marked our ï¬fth consecutive year of positive same store sales growth... -

Page 18

OPEN # in four food categories! 1 -

Page 19

Chicken Capital U.S.A. 0 21 -

Page 20

Think Outside the Bun 22 23 -

Page 21

25 -

Page 22

... Quick Service Restaurant Seafood category, we continue to satisfy customers with great, new quality products like our delicious Buttered Lobster Bites, reinventing seafood for the way people eat today. A&W ALL AMERICAN FOOD has been serving "hometown" favorites for over 88 years. With real jukebox... -

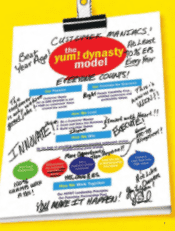

Page 23

...Store Sales Growth in every restaurant! Turn the page to meet some of the best Customer Maniacs from around the world who are putting smiles on customers' faces and are consistently executing the basics with a daily intensity that is driving the business. Peter Hearl Chief Operating and Development... -

Page 24

... Don Bryant, Pizza Hut Middlesboro, Kentucky Product Quality Perfect tacos every time. That's what Taco Bell company RGM of the Year Ramona Urena delivers in her restaurant. "We weigh every item and follow all of Taco Bell's procedures," she says. Ramona has been with Taco Bell for 14 years and she... -

Page 25

... "Go for Greatness Around the Globe." Rick Carucci, Chief Financial Ofï¬cer, Yum! Brands, Inc. WORLDWIDE SALES (in billions) UNITED STATES KFC Company sales Franchisee sales (b) PH Company sales Franchisee sales (b) TACO BELL Company sales Franchisee sales (b) LONG JOHN SILVER'S (c) Company sales... -

Page 26

...WORLDWIDE SYSTEM UNITS Year-end 2006 UNITED STATES KFC Pizza Hut Taco Bell Long John Silver's A&W Total U.S. INTERNATIONAL KFC Pizza Hut Taco Bell Long John Silver's A&W Total International CHINA KFC Pizza Hut Taco Bell Total China Total (a) Company Unconsolidated Affiliate Franchised Licensed Total... -

Page 27

... 3% Dine Out 63% Dine In 37% Dinner 32% Lunch 44% Snacks/Breakfast 24% Source: The NPD Group, Inc.; NPD Foodworld; CREST Dine Out 52% Dine In 48% WORLDWIDE UNITS 2006 (in thousands) Yum! Brands McDonald's Subway Burger King Domino's Pizza Wendy's Dairy Queen Popeyes 35 32 27 11 8 7 6 2 32 -

Page 28

... over $400 million in operating profit in 2006 up from $186 million in 1998. The Company expects to continue to experience strong growth by building out existing markets and growing in new markets including India, France and Russia. Improve U.S. Brands Positions and Returns The Company continues to... -

Page 29

... UNITED STATES PRODUCE-SOURCING ISSUE Our Taco Bell business was negatively impacted by U.S. Total Revenues Company sales Franchise and license fees Total Revenues Operating profit Franchise and license fees Restaurant profit General and administrative expenses Equity income from investments... -

Page 30

... Statements of Income. We also recorded franchise fee income from the stores owned by the unconsolidated affiliate. From the date of the acquisition through December 4, 2006 (the end of the fiscal year for Pizza Hut U.K.), we reported Company sales and the associated restaurant costs, general... -

Page 31

... store closures: International Division China Division Worldwide 2006 Decreased restaurant profit Increased franchise fees Decreased general and administrative expenses Increase (decrease) in operating profit U.S. $ (38) 14 1 $ (23) $ (5) 6 1 $ 2 $- - - $- $ (43) 20 2 $ (21) 36 YUM! BRANDS... -

Page 32

2005 Decreased restaurant profit Increased franchise fees Decreased general and administrative expenses Increase (decrease) in operating profit U.S. International Division China Division Worldwide United States Company Unconsolidated Affiliates Franchisees Total Excluding Licensees $ (22) 8 ... -

Page 33

... well as net unit development. The explanations that follow for system sales growth consider year over year changes excluding the impact of currency translation and the 53rd week. The increases in worldwide system sales in 2006 and 2005 were driven by new unit development and same store sales growth... -

Page 34

...by new unit development, partially offset by the impact of same store sales declines. Company Restaurant Margins 2006 Company sales Food and paper Payroll and employee benefits Occupancy and other operating expenses Company restaurant margin U.S. International Division China Division Worldwide 100... -

Page 35

...costs. Excluding the unfavorable impact of lapping the 53rd week in 2005, U.S. operating profit increased $23 million or 3% in 2006. The increase was driven by the impact of same store sales on restaurant profit (due to higher average guest check) and franchise and license fees, new unit development... -

Page 36

... operating profit increased $41 million or 11% in 2006. The increase was driven by the impact of same store sales growth and new unit development on franchise and license fees and restaurant profit. These increases were partially offset by higher restaurant operating costs and lower equity income... -

Page 37

... net income, lower pension contributions and a 2006 partial receipt of the settlement related to the 2005 mainland China supplier ingredient issue. These factors were offset by higher income tax and interest payments in 2006. In 2005, net cash provided by operating activities was $1,238 million... -

Page 38

... and payments as of December 30, 2006 included: Less than 1 Year 1-3 Years 3-5 Years More than 5 Years Total Long-term debt obligations(a) $ 2,744 $ Capital leases(b) 303 Operating leases(b) 3,606 Purchase obligations(c) 265 Other long-term liabilities reflected on our Consolidated Balance Sheet... -

Page 39

...our Pizza Hut U.K. pension plan exceeds plan assets by approximately $35 million. We anticipate taking steps to reduce this deficit in the near term, which could include a decision to partially or completely fund the deficit in 2007. However, given the level of cash flows from operations the Company... -

Page 40

... losses. Our semi-annual impairment evaluations require an estimation of cash flows over the remaining useful life of the primary asset of the restaurant, which can be for a period of over 20 years, and any terminal value. We limit assumptions about important factors such as sales growth and margin... -

Page 41

.... In determining the fair value of our reporting units and the KFC trademark/brand, we limit assumptions about important factors such as sales growth, margin and other factors impacting the fair value calculation to those that are supportable based upon our plans. For 2006, there was no impairment... -

Page 42

... our pension expense. Our estimated long-term rate of return on U.S. plan assets represents the weighted-average of historical returns for each asset category, adjusted for an assessment of current market conditions. Our expected long-term rate of return on U.S. plan assets at September 30, 2006 was... -

Page 43

... 20% of all awards granted to above-store executives will be forfeited. INCOME TAX VALUATION ALLOWANCES AND TAX RESERVES At December 30, 2006, we have a valuation allowance of $342 million primarily to reduce our net operating loss and tax credit carryforward benefit of $331 million, as well our... -

Page 44

... on our business; new product and concept development by us and/or our food industry competitors; changes in commodity, labor, and other operating costs; changes in competition in the food industry; publicity which may impact our business and/or industry; severe weather conditions; volatility of... -

Page 45

... three-year period ended December 30, 2006, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of YUM's internal control over financial reporting... -

Page 46

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of YUM as of December 30, 2006 and December 31, 2005, and the related consolidated statements of income, cash flows and shareholders' equity and comprehensive income for each of the years in the... -

Page 47

... internal control over financial reporting, designed to provide reasonable assurance as to the reliability of the financial statements, as well as to safeguard assets from unauthorized use or disposition. The system is supported by formal policies and procedures, including an active Code of Conduct... -

Page 48

... registered public accounting firm, as stated in their report which is included herein. Supplement to Yum! Brands, Inc. Annual Report to Shareholders On June 12, 2006, David Novak, Yum Brands, Inc. Chairman and Chief Executive Officer submitted a certification to the New York Stock Exchange (the... -

Page 49

... Statements of Income YUM! Brands, Inc. and Subsidiaries Fiscal years ended December 30, 2006, December 31, 2005 and December 25, 2004 (in millions, except per share data) 2006 2005 2004 Revenues Company sales Franchise and license fees Total revenues Costs and Expenses, Net Company restaurants... -

Page 50

...less, net Revolving credit facilities, three months or less, net Repurchase shares of common stock Excess tax benefit from share-based compensation Employee stock option proceeds Dividends paid on common shares Other, net Net Cash Used in Financing Activities Effect of Exchange Rate on Cash and Cash... -

Page 51

... Liabilities Accounts payable and other current liabilities Income taxes payable Short-term borrowings Advertising cooperative liabilities Total Current Liabilities Long-term debt Other liabilities and deferred credits Total Liabilities Shareholders' Equity Preferred stock, no par value, 250 shares... -

Page 52

...' Equity and Comprehensive Income YUM! Brands, Inc. and Subsidiaries Accumulated Other Comprehensive Income (Loss) Fiscal years ended December 30, 2006, December 31, 2005 and December 25, 2004 (in millions, except per share data) Issued Common Stock Shares Amount Retained Earnings Total Balance... -

Page 53

... Financial Statements (Tabular amounts in millions, except share data) 1. Description of Business YUM! Brands, Inc. and Subsidiaries (collectively referred to as "YUM" or the "Company") comprises the worldwide operations of KFC, Pizza Hut, Taco Bell and since May 7, 2002, Long John Silver... -

Page 54

... operated restaurants are recognized when payment is tendered at the time of sale. We recognize initial fees received from a franchisee or licensee as revenue when we have performed substantially all initial services required by the franchise or license agreement, which is generally upon the opening... -

Page 55

... assets, primarily land, associated with a closed store, any gain or loss upon that sale is also recorded in store closure costs (income). Refranchising (gain) loss includes the gains or losses from the sales of our restaurants to new and existing franchisees and the related initial franchise fees... -

Page 56

CASH AND CASH EQUIVALENTS Cash equivalents represent funds we have temporarily invested (with original maturities not exceeding three months) as part of managing our day-to-day operating cash receipts and disbursements. INVENTORIES INTERNAL DEVELOPMENT COSTS AND ABANDONED SITE COSTS We value our ... -

Page 57

... used to value the amortizable intangible asset to reflect our current estimates and assumptions over the asset's future remaining life. SHARE-BASED EMPLOYEE COMPENSATION 2004 Net Income, as reported Add: Compensation expense included in reported net income, net of related tax Deduct: Total stock... -

Page 58

... Prior to 2006, we used certain non-GAAP conventions to account for capitalized interest on restaurant construction projects, the leases of our Pizza Hut United Kingdom unconsolidated affiliate and certain state tax benefits. The net income statement impact on any given year from the use of these... -

Page 59

... reporting period, the total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate and the total amounts of interest and penalties recognized in the statements of operations and financial position. In September 2006, the FASB issued SFAS No. 157, "Fair Value... -

Page 60

... operated restaurants and are included in prepaid expenses and other current assets on our Consolidated Balance Sheets. WRENCH LITIGATION In fiscal year 2003, we recorded a charge of $42 million related to a lawsuit filed against Taco Bell Corp. (the "Wrench litigation"). Income of $14 million... -

Page 61

... Income. We also recorded a franchise fee for the royalty received from the stores owned by the unconsolidated affiliate. From the date of the acquisition through December 4, 2006 (the end of our fiscal year for Pizza Hut U.K.), we reported Company sales and the associated restaurant costs, general... -

Page 62

... 24, 2006, we finalized an agreement with Rostik's Restaurant Ltd. ("RRL"), a franchisor and operator of a chicken chain in Russia known as Rostik's, under which we acquired the Rostik's brand and associated intellectual property for $15 million. We will also provide financial support, including... -

Page 63

... for headquarters and support functions, as well as certain office and restaurant equipment. We do not consider any of these individual leases material to our operations. Most leases require us to pay related executory costs, which include property taxes, maintenance and insurance. 68 YUM! BRANDS... -

Page 64

... short-term nature of the franchise and license fee receivables. FAIR VALUE At December 30, 2006 and December 31, 2005, the fair values of cash and cash equivalents, short-term investments, accounts receivable and accounts payable approximated their carrying values because of the short-term nature... -

Page 65

... exception of the Pizza Hut U.K. pension plan where such information is presented as of a measurement date of November 30, 2006. U.S. Pension Plans International Pension Plans 2005 Carrying Amount Fair Value Debt Short-term borrowings and long-term debt, excluding capital leases and the derivative... -

Page 66

... loss results from benefit payments from a non-funded plan exceeding the sum of the service cost and interest cost for that plan during the year. (d) Excludes pension expense for the Pizza Hut U.K. pension plan of $4 million, $4 million and $3 million in 2006, 2005 and 2004, respectively, related... -

Page 67

... and Stock Appreciation Rights At year-end 2006, we had four stock award plans in effect: the YUM! Brands, Inc. Long-Term Incentive Plan ("1999 LTIP"), the 1997 Long-Term Incentive Plan ("1997 LTIP"), the YUM! Brands, Inc. Restaurant General Manager Stock Option Plan ("RGM Plan") and the YUM! Brands... -

Page 68

...and $200 million, respectively. Tax benefits realized from tax deductions associated with stock options exercised for 2006, 2005 and 2004 totaled $68 million, $94 million and $102 million, respectively. The Company has a policy of repurchasing shares on the open market to satisfy award exercises and... -

Page 69

... earnings in fiscal year 2005. The federal and state tax provision for 2006 includes $4 million current tax benefit as a result of the reconciliation of tax on repatriated earnings as recorded in our Consolidated Statements of Income to the amounts on our tax returns. Total changes in valuation... -

Page 70

...we acquired YGR. KFC, Pizza Hut, Taco Bell, LJS and A&W operate throughout the U.S. and in 101, 91, 13, 5 and 10 countries and territories outside the U.S., respectively. Our five largest international markets based on operating profit in 2006 are China, United Kingdom, Asia Franchise, Australia and... -

Page 71

...credits(e) 1 2 16 Total operating profit Interest expense, net Income before income taxes 1,262 (154) $ 1,108 1,153 (127) $ 1,026 1,155 (129) $ 1,026 the United Kingdom for 2006, 2005 and 2004, respectively. Includes revenues of $1.4 billion, $1.0 billion and $903 million in mainland China for 2006... -

Page 72

...John Silver's, Inc. ("Johnson") was filed in the United States District Court for the Middle District of Tennessee, Nashville Division. Johnson's suit alleged that LJS's former "Security/Restitution for Losses" policy (the "Policy") provided for deductions from RGMs' and Assistant Restaurant General... -

Page 73

... of those currently provided for in our Consolidated Financial Statements. On September 2, 2005, a collective action lawsuit against the Company and KFC Corporation, originally styled Parler v. Yum Brands, Inc., d/b/a KFC, and KFC Corporation, was filed in the United States District Court for the... -

Page 74

... strain of E. coli 0157:H7 in the northeast United States during November and December 2006. Also according to the CDC, the outbreak from this particular strain was associated with eating at Taco Bell restaurants in Pennsylvania, New Jersey, New York and Delaware. The CDC concluded that the outbreak... -

Page 75

... Financial Data (Unaudited) 2006 Revenues: Company sales Franchise and license fees Total revenues Restaurant profit Operating profit Net income Diluted earnings per common share Dividends declared per common share 2005 Revenues: Company sales Franchise and license fees Total revenues Restaurant... -

Page 76

... which addresses the financial accounting and reporting for legal obligations associated with the retirement of long-lived assets and the associated asset retirement costs. (e) U.S. Company blended same-store sales growth includes the results of Company owned KFC, Pizza Hut and Taco Bell restaurants... -

Page 77

... 49 Chief Financial Officer, Yum! Brands, Inc. Greg Creed 49 President and Chief Concept Officer, Taco Bell Gregg R. Dedrick 47 President and Chief Concept Officer, KFC Peter R. Hearl 55 Chief Operating and Development Officer, Yum! Brands, Inc. Acting President, Long John Silver's/A&W Timothy... -

Page 78

... copy of your most recent statement available. EMPLOYEE BENEFIT PLAN PARTICIPANTS American Stock Transfer & Trust Company 59 Maiden Lane Plaza Level New York, NY 10038 Phone: (888) 439-4986 International: (718) 921-8124 www.amstock.com or Shareholder Coordinator Yum! Brands, Inc. 1441 Gardiner Lane... -

Page 79

...- YUM The New York Stock Exchange is the principal market for YUM Common Stock. SHAREHOLDERS At year-end 2006, Yum! Brands had approximately 90,000 registered shareholder accounts of record of YUM Common Stock. LOW-COST INVESTMENT PLAN Investors may purchase their initial shares of stock through... -

Page 80

...help address this issue, Yum! created the world's largest prepared food recovery program. We now donate over 11 million pounds of prepared food to the hungry every year. Nourishing People Around the Globe China Youth Development Foundation. KFC China and CYDF have created a special scholarship fund... -

Page 81

Alone We're Delicious. Together We're Yum!