Kentucky Fried Chicken 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

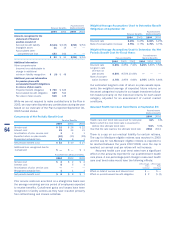

In 1997, we filed a shelf registration statement with

theSecuritiesandExchangeCommissionforofferingsofup

to $2billion of seniorunsecured debt. The following table

summarizesallSeniorUnsecuredNotesissuedunderthisshelf

registrationthatremainoutstandingatDecember25,2004:

Principal InterestRate

IssuanceDate MaturityDate Amount Stated Effective)(d)

May1998 May2008)(a) 250 7.65% 7.81%

April2001 April2006)(b) 200 8.50% 9.04%

April2001 April2011)(b) 650 8.88% 9.20%

June2002 July2012)(c) 400 7.70% 8.04%

(a)InterestpaymentscommencedonNovember15,1998andarepayablesemi-

annuallythereafter.

(b)Interest payments commenced on October 15, 2001 and are payable semi-

annuallythereafter.

(c)InterestpaymentscommencedonJanuary1,2003andarepayablesemi-annually

thereafter.

(d)Includestheeffectsoftheamortizationofany(1)premiumordiscount;(2)debt

issuancecosts;and(3)gainorlossuponsettlementofrelatedtreasurylocks.

ExcludestheeffectofanyinterestrateswapsasdescribedinNote16.

We have $150million remaining for issuance under the

$2billionshelfregistration.

InconnectionwithouracquisitionofYGRin2002,we

assumedapproximately$168millioninpresentvalueoffuture

rentobligationsrelatedtothreeexistingsale-leasebackagree-

mentsenteredintobyYGRinvolvingapproximately350LJS

units.Asaresultofliensheldbythebuyer/lessoroncertain

personalpropertywithintheunits,thesale-leasebackagree-

mentswereaccountedforasfinancingsuponacquisition.On

August15,2003,weamendedtwoofthesesale-leaseback

agreements to remove theliensonthe personal property

within the units. As the two amended agreements qualify

for sale-leaseback accounting, they are accounted for as

operatingleases.Accordingly,thefuturerentobligationsasso-

ciatedwiththetwoamendedagreements,previouslyrecorded

aslong-termdebtof$88million,werenolongerreflectedon

ourConsolidatedBalanceSheetsatDecember25,2004or

December27,2003.Therewasnogainorlossrecordedasa

resultofthistransaction.

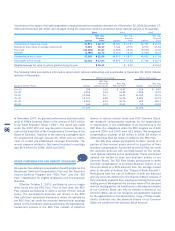

The annual maturities of long-term debt as of

December25, 2004, excluding capital lease obligations

of $128million and derivative instrument adjustments of

$21million,areasfollows:

Yearended:

2005 $ 1

2006 202

2007 2

2008 253

2009 22

Thereafter 1,118

Total $1,598

Interestexpenseonshort-termborrowingsandlong-termdebt

was$145million,$185millionand$180millionin2004,

2003and2002,respectively.

LEASES

NOTE15

AtDecember25,2004weoperatedover7,700restaurants,

leasingtheunderlyinglandand/orbuildinginover5,500of

thoserestaurantswithourcommitmentsexpiringatvarious

datesthrough2087.Wealsoleaseofficespaceforhead-

quartersandsupportfunctions,aswellascertainofficeand

restaurantequipment.Wedonotconsideranyoftheseindi-

vidualleasesmaterialtoouroperations.Mostleasesrequire

us to payrelated executory costs,which includeproperty

taxes,maintenanceandinsurance.

Future minimum commitments and amounts to be

receivedaslessororsublessorundernon-cancelableleases

aresetforthbelow:

Commitments LeaseReceivables

Direct

Capital Operating Financing Operating

2005 $ 18 $ 342 $ 7 $ 21

2006 17 298 7 18

2007 15 266 6 15

2008 14 234 7 12

2009 14 208 7 11

Thereafter 106 1,163 67 80

$184 $2,511 $101 $157

AtDecember25,2004andDecember27,2003,thepresent

value of minimum payments under capital leases was

$128millionand$112million,respectively.AtDecember25,

2004andDecember27,2003,unearnedincomeassociated

withdirectfinancingleasereceivableswas$48millionand

$41million,respectively.

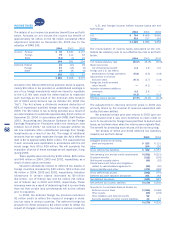

Thedetailsofrentalexpenseandincomearesetforth

below:

2004 2003 2002

Rentalexpense

Minimum $376 $329 $303

Contingent 49 44 40

$425 $373 $343

Minimumrentalincome $ 13 $ 14 $ 11

FINANCIALINSTRUMENTS

NOTE16

InterestRateDerivativeInstruments Weenterintointerest

rateswapswith theobjectiveofreducingour exposure to

interestrateriskandloweringinterestexpenseforaportion

ofourdebt.Underthecontracts,weagreewithotherparties

toexchange,atspecifiedintervals,thedifferencebetween

variablerateandfixedrateamountscalculatedonanotional

principalamount.AtDecember25,2004,interestratederiv-

ativeinstrumentsoutstandingincludedpay-variableinterest

61

Yum!Brands,Inc.