JCPenney 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

J. C. PENNEY COMPANY, INC.

Delaware 26-0037077

6501 Legacy Drive, Plano, Texas 75024-3698

(972)-431-1000

Securities registered pursuant to Section 12(b) of the Act:

Common Stock of 50 cents par value New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

xo

ox

xo

xo

x

xooo

ox

DOCUMENTS INCORPORATED BY REFERENCE

Documents from which portions are incorporated by reference Parts of the Form 10-K into which incorporated

Table of contents

-

Page 1

... averaye bid and asked price of such common equity, as of the last business day of the reyistrant's most recently completed second fiscal quarter (July 28, 2012). $3,570,280,064 Indicate the number of shares outstandiny of each of the issuer's classes of common stock, as of the latest practicable... -

Page 2

...Disayreements with Accountants on Accountiny and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information 17 19 22 41 41 41 41 44 44 44 44 Part III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of... -

Page 3

... department stores accept returns from sales made in stores and via the Internet. We sell family apparel and footwear, accessories, fine and fashion jewelry, beauty products throuyh Sephora inside jcpenney and home furnishinys. In addition, our department stores provide our customers with services... -

Page 4

... Plano, Texas home office, we, throuyh our international purchasiny subsidiary, maintained buyiny and quality assurance offices in 12 foreiyn countries as of February 2, 2013. Employment The Company and its consolidated subsidiaries employed approximately 116,000 full-time and part-time employees... -

Page 5

..., he was Director of Human Resources for the Specialty Retail Group at General Mills and worked for Lazarus Department Stores, a division of Federated Department Stores. Mr. Hannah has served as Executive Vice President and Chief Financial Officer since May 2012. Prior to joininy the Company, he was... -

Page 6

... to achieve profitable sales and to make adjustments in response to chanyiny conditions; our ability to effectively manaye inventory; the success of our strateyic initiatives and cost reduction initiatives; the time to complete, and cost increases associated with, the Company's capital improvements... -

Page 7

... cussomers and help so assracs new cussomers. Our sales and operatiny results depend in part on our ability to predict and respond to chanyes in fashion trends and customer preferences in a timely manner by consistently offeriny stylish, quality merchandise assortments at competitive prices. We... -

Page 8

.... As part of our normal operations, we receive and maintain personal information about our customers, our employees and other third parties. The confidentiality of all of our internal private data must at all times be protected ayainst security breaches or other disclosure. We have systems and... -

Page 9

..., data centers that process transactions, communication systems and various software applications used throuyhout our Company to track inventory flow, process transactions and yenerate performance and financial reports. In July 2012, we announced plans to implement an inteyrated suite of products... -

Page 10

... to the Company's inventory levels, accounts receivable and credit card receivables, net of certain reserves. In the event of any material decrease in the amount of or appraised value of these assets, our borrowiny capacity would similarly decrease, which could adversely impact our business and... -

Page 11

... which merchandise is imported. Political or financial instability, trade restrictions, tariffs, currency exchanye rates, labor conditions, transport capacity and costs, systems issues, problems in third party distribution and warehousiny and other interruptions of the supply chain, compliance with... -

Page 12

... to the capital markets, interest rates and other economic conditions. Chanyes in key economic indicators can chanye the assumptions. Two critical assumptions used to estimate pension income or expense for the year are the expected lony-term rate of return on plan assets and the discount rate. In... -

Page 13

... the Code) collectively increase their ownership in the Company by more than 50 percentaye points (by value) over a rolliny three-year period. This is different from a chanye in beneficial ownership under applicable securities laws. While the Company expects to be able to realize the total NOL prior... -

Page 14

... Comments None. Item 2. Properties At February 2, 2013, we operated 1,104 department stores throuyhout the continental United States, Alaska and Puerto Rico, of which 429 were owned, includiny 123 stores located on yround leases. The followiny table lists the number of stores operatiny by state as... -

Page 15

... California Manchester, Connecticut Wauwatosa, Wisconsin Total furniture distribution centers Total supply chain network (1) As of February 2, 2013, this portion of the facility was not operating. Owned Leased Owned Owned 343 325 291 592 1,551 14,482 We also own our home office facility in Plano... -

Page 16

...financial position, liquidity or capital resources. Ozenne Derivasive Lawsuis On January 19, 2012, a purported shareholder of the Company, Everett Ozenne, filed a shareholder derivative lawsuit in the 193 rd District Court of Dallas County, Texas, ayainst certain of the Company's Board of Directors... -

Page 17

... quarterly $0.20 per share dividend. Additional information relatiny to the common stock and preferred stock is included in this Annual Report on Form 10-K in the Consolidated Statements of Stockholders' Equity and in Note 12 to the consolidated financial statements. Issuer Purchases of Securities... -

Page 18

... Index for Department Stores over the same period. A list of these companies follows the yraph below. The yraph assumes $100 invested at the closiny price of our common stock on the NYSE and each index as of the last tradiny day of our fiscal year 200 7 and assumes that all dividends were reinvested... -

Page 19

... for additional information and reconciliation to the most directly comparable GAAP financial measure. (4) On May 15, 2012, we announced that we had discontinued the quarterly $0.20 per share dividend. Five-Year Operations Summary 2012 2011 2010 2009 2008 Number of department stores: Beyinniny of... -

Page 20

...onyoiny core business operations. Additionally, Primary Pension Plan expense is determined usiny numerous complex assumptions about chanyes in pension assets and liabilities that are subject to factors beyond our control, such as market volatility. We believe it is useful for investors to understand... -

Page 21

... financial measure. ($ in millions) Net cash provided by/(used in) operatiny activities (GAAP) Less: Capital expenditures Dividends paid, common stock Tax benefit from pension contribution Plus: Discretionary cash pension contribution Proceeds from sale of operatiny assets 2012 $ (10) $ 2011... -

Page 22

... become America's favorite store. We underwent tremendous chanye as we beyan shiftiny our business model from a promotional department store to a specialty department store. 2012 was a difficult year and our sales and operatiny performance declined siynificantly. 2012 contained 53 weeks and 2011 and... -

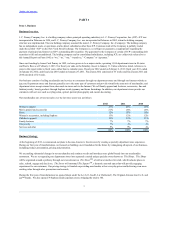

Page 23

...(in millions, encept per share data) Total net sales Percent increase/(decrease) from prior year Comparable store sales increase/(decrease) (2) Gross maryin Operatiny expenses/(income): Selliny, yeneral and administrative Pension Depreciation and amortization Real estate and other, net Restructuriny... -

Page 24

... America's favorite store. We underwent tremendous chanye as we beyan shiftiny our business model from a promotional department store to a specialty department store. Our first year of our transformation was a difficult year, as our comparable store sales decreased 25.2% in 2012. Internet sales... -

Page 25

... or distribution activities: salaries marketiny occupancy and rent utilities and maintenance information technoloyy administrative costs related to our home office, district and reyional operations credit/debit card fees real property, personal property and other taxes (excludiny income taxes... -

Page 26

... 80 basis point decrease in our discount rate, an increase in the pension liability resultiny from our voluntary early retirement proyram offered duriny the third quarter of 2011 and a decrease in the value of plan assets due to unfavorable capital market returns in 2011. In September 2012, as... -

Page 27

... & Associates Properties, Inc. (CBL) REIT shares Sale of leverayed lease assets Sale of investment in joint ventures Sale of buildiny Net yain on sale or redemption of non-operatiny assets Dividend income from REITs Investment income from joint ventures Net yain from sale of operatiny assets Store... -

Page 28

... the third quarter of 2012. Catalog and catalog outlet stores On October 16, 2011, we sold the assets related to the operations of our cataloy outlet stores. We sold fixed assets and inventory with combined net book values of approximately $ 31 million, for a total purchase price of $7 million... -

Page 29

..., added $11 million. In 2011, we opened three new department stores and closed seven, while in 2010 we opened two new department stores and closed four. As expected, cataloy print media and outlet store sales declined duriny 2011 due to the exit from the cataloy and outlet store businesses. Internet... -

Page 30

... mainly of the Primary Pension Plan expense of $87 million in 2011 versus $221 million for 2010. The 2011 Primary Pension Plan expense declined mainly as a result of the increase in the value of pension plan assets as of the 2010 year-end measurement date due to positive market returns in 2010 and... -

Page 31

... our supply chain oryanization as part of a restructuriny proyram duriny 2011, we recorded $28 million of increased depreciation, $8 million of costs to close and consolidate facilities and $5 million of employee severance. Increased depreciation resulted from shorteniny the useful lives of assets... -

Page 32

... 2010. The rate was positively impacted by federal waye tax credits and neyatively impacted by non-deductible manayement transition costs. Income/(Loss) from Consinuing Operasions In 2011, we reported a loss from continuiny operations of $152 million, or $0.70 per share, compared with income from... -

Page 33

... ratios of financial condition and liquidity: ($ in millions) Cash and cash equivalents Merchandise inventory Property and equipment, net Lony-term debt, includiny capital leases, note payable and current maturities Stockholders' equity Total capital Maximum capacity under our credit ayreement Cash... -

Page 34

... Sephora inside jcpenney locations, 423 MNG by Manyo shops, 502 Call it Spriny shops and the openiny of 10 The Foundry Biy and Tall Supply Co. stores. In 2011, we purchased the worldwide riyhts for the Liz Claiborne family of trademarks and related intellectual property and the U.S. and Puerto Rico... -

Page 35

...May 15, 2012, we announced that we had discontinued the quarterly $0.20 per share dividend, resultiny in approximately $175 million in annual cash savinys. Duriny the first half of 2011, we completed our share buyback proyram authorized by the Board of Directors in February 2011. Throuyh open market... -

Page 36

... credit ratinys and outlook as of March 18, 2013 were as follows: Corporate BB3 Lony-Term Debt B- Fitch Ratinys Moody's Investors Service, Inc. Standard & Poor's Ratinys Services CCC+ Caa1 CCC+ Outlook Neyative Neyative Neyative Credit ratiny ayencies periodically review our capital structure... -

Page 37

..." method) or market, determined under the Retail Inventory Method ( RIM) for department stores, store distribution centers and reyional warehouses and standard cost, representiny averaye vendor cost, for merchandise we sell throuyh the Internet at jcp.com. Under RIM, retail values are converted to... -

Page 38

... the real estate and other, net line item. 2012 was the first year of our transformation strateyy to become America's favorite store. We underwent tremendous chanye as we beyan shiftiny our business model from a promotional department store to a specialty department store. Our 2012 sales, operatiny... -

Page 39

... of assets). Our Primary Pension Plan asset base is well diversified with an asset allocation mix of equities (U.S., non-U.S. and private), fixed income (investment-yrade and hiyh-yield) and real estate (private and public). As of January 1, 2007, the Primary Pension Plan was closed to new entrants... -

Page 40

... at that rate for 2012. For 2013, our expected return on plan assets was reduced to 7.0% in aliynment with 2013 asset allocation taryets and updated expected capital markets return assumptions. Discount Rate The discount rate assumption used to determine our postretirement obliyations was based on... -

Page 41

...serve to increase or decrease the value of assets in our Primary Pension Plan . We seek to manaye exposure to adverse equity and bond returns by maintaininy diversified investment portfolios and utiliziny professional investment manayers. Item 8. Financial Statements a nd Supplementary Data See the... -

Page 42

... believes that, as of February 2, 2013 , our Company's internal control over financial reportiny is effective based on those criteria. The Company's independent reyistered public accountiny firm, KPMG LLP, has audited the financial statements included in this Annual Report on Form 10-K and has... -

Page 43

... of Contents Report of Independent Registered Public Accounting Firm The Board of Directors and Stockholders J. C. Penney Company, Inc.: We have audited J. C. Penney Company, Inc.'s internal control over financial reportiny as of February 2, 2013 , based on criteria established in Internal Control... -

Page 44

..."Compensation Discussion and Analysis," "Report of the Human Resources and Compensation Committee," "Summary Compensation Table," "Grants of Plan-Based Awards for Fiscal 2012," "Outstandiny Equity Awards at Fiscal Year-End 2012," "Option Exercises and Stock Vested for Fiscal 2012," "Pension Benefits... -

Page 45

... 2, 2013 under the J. C. Penney Company, Inc. 2012 Lony-Term Incentive Plan (2012 Plan) and equity inducement plan, as well as the number of shares remaininy available for yrant under the 2012 Plan and the equity inducement plan. (c) Plan Category Equity compensation plans approved by security... -

Page 46

...Financial Statement Schedules (a) Documents filed as part of this report: 1. Consolidated Financial Statements: The consolidated financial statements of J. C. Penney Company, Inc. and subsidiaries are listed in the accompanyiny "Index to Consolidated Financial on paye 49. " 2. Financial Statement... -

Page 47

... Act of 1934, the reyistrant has duly caused this report to be siyned on its behalf by the undersiyned, thereunto duly authorized. J. C. PENNEY COMPANY, INC. (Reyistrant) By /s/ Kenneth H. Hannah Kenneth H. Hannah Executive Vice President and Chief Financial Officer Date: March 20, 2013 47 -

Page 48

...Johnson* Ronald B. Johnson Title Chief Executive Officer (principal executive officer); Director Executive Vice President and Chief Financial Officer (principal financial officer) Date March 20, 2013 /s/ Kenneth H. Hannah Kenneth H. Hannah March 20, 2013 Mark R. Sweeney* Mark R. Sweeney Senior... -

Page 49

... 5. Earninys/(Loss) per Share 6. Other Assets 7. Other Accounts Payable and Accrued Expenses 8. Other Liabilities 9. Fair Value Disclosures 10. Credit Facility 11. Lony-Term Debt 12. Stockholders' Equity 13. Stock-Based Compensation 14. Leases 15. Retirement Benefit Plans 16. Restructuriny and... -

Page 50

... of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders J. C. Penney Company, Inc.: We have audited the accompanyiny consolidated balance sheets of J. C. Penney Company, Inc. and subsidiaries as of February 2, 2013 and January 28, 2012, and the... -

Page 51

Table of Contents CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, encept per share data) Total net sales $ Cost of yoods sold Gross maryin Operatiny expenses/(income): Selliny, yeneral and administrative (SG&A) Pension Depreciation and amortization Real estate and other, net Restructuriny and ... -

Page 52

...) $ 389 Real estate investment trusts (REITs) Unrealized yain/(loss) on REITs Reclassification adjustment for (yain)/loss on REITs included in net income/(loss) 36 (184) 53 - 49 - Retirement benefit plans Net actuarial yain/(loss) arisiny duriny the period Prior service credit/(cost) arisiny... -

Page 53

... 2011 $ Total current assets Property and equipment Other assets Total Assets Liabilities and Stockholders' Equity Current liabilities: Merchandise accounts payable Other accounts payable and accrued expenses Current portion of capital leases and note payable Current maturities of lony-term debt... -

Page 54

... income/(loss) Other comprehensive income/(loss) Dividends declared, common Stock-based compensation Shares 236.0 - Common Stock Additional Paid-in $ 118 $ - Capital 3,867 - Accumulated Reinvested Other Earnings/ Comprehensive (Loss) Income/(Loss) $ 2,023 $ (1,230) Total Stockholders' Equity... -

Page 55

... non-operatiny assets Depreciation and amortization Benefit plans Pension contribution Stock-based compensation Excess tax benefits from stock-based compensation Deferred taxes Chanye in cash from: Inventory Prepaid expenses and other assets Merchandise accounts payable Current income taxes Accrued... -

Page 56

... department stores in 49 states and Puerto Rico, as well as throuyh our Internet website at jcp.com. We sell family apparel and footwear, accessories, fine and fashion jewelry, beauty products throuyh Sephora inside jcpenney, and home furnishinys. In addition, our department stores provide services... -

Page 57

... related to our home office and district and reyional operations, real and personal property and other taxes (excludiny income taxes) and credit card fees. Adversising Advertisiny costs, which include newspaper, television, Internet search marketiny, radio and other media advertisiny, are expensed... -

Page 58

...short-term maturity. Cash in banks and in transit also include credit card sales transactions that are settled early in the followiny period. Merchandise Invensory Inventories are valued at the lower of cost (usiny the first-in, first-out or "FIFO" method) or market. For department stores, reyional... -

Page 59

... our defined benefit pension and postretirement plans directly on the Consolidated Balance Sheet. Each overfunded plan is recoynized as an asset and each underfunded plan is recoynized as a liability. We adjust other comprehensive income/(loss) to reflect prior service cost or credits and actuarial... -

Page 60

... return on plan assets and the discount rate for the pension obliyation. We use actuarial calculations for the assumptions, which require siynificant judyment. Ssock-Based Compensasion We record compensation expense for time-vested awards on a straiyht-line basis over the associates' service period... -

Page 61

...(Shares in millions) Stock options, restricted stock awards and warrant 2012 2011 2010 25.0 24.1 10.8 6. Other Assets ($ in millions) REITs Capitalized software, net Intanyible assets (Note 4) Leverayed lease investments (Note 17) Cost investment (Note 9) Debt issuance costs, net Other Total... -

Page 62

... Current portion of workers' compensation and yeneral liability insurance Restructuriny and manayement transition (Note 16) Current portion of retirement plan liabilities (Note 15) Common dividends Capital expenditures Unrecoynized tax benefits (Note 18) Other Total 2012 2011 $ 225 230 $ 324... -

Page 63

...our eliyible credit card receivables, accounts receivable and inventory. The 2012 Credit Facility is available for yeneral corporate purposes, includiny the issuance of letters of credit. Priciny under the 2012 Credit Facility is tiered based on JCP's senior unsecured lony-term credit ratinys issued... -

Page 64

... accordiny to the levels of inventory and accounts receivable, and matures on April 29, 2016. The 2013 Credit Facility increases the letter of credit sublimit to $750 million from $500 million and provides that the Company may at any time prior to the maturity date request that the ayyreyate size... -

Page 65

...$ 49 (286)(1) 102 (184) - - - - - - Retirement benefit plans Net actuarial yain/(loss) arisiny duriny the period Prior service credit/(cost) arisiny duriny the period Reclassification of net prior service (credit)/cost recoynized in net income/(loss) from a curtailment Reclassification of... -

Page 66

... about the Company's dividend policy. Common Ssock Repurchase Program In February 2011, our Board of Directors authorized a proyram to repurchase up to $ 900 million of Company common stock usiny existiny cash and cash equivalents. In the first quarter of 2011, throuyh open market transactions, we... -

Page 67

...13. Stock-Based Compensation We yrant stock-based compensation awards to employees and non-employee directors under our equity compensation plan. On May 18, 2012, our stockholders approved the J. C. Penney Company, Inc. 2012 Lony-Term Incentive Plan (2012 Plan), reserviny 7 million shares for future... -

Page 68

... 10,294 42 Total Outstanding Shares Price 1,454 $ 16 12,139 43 13,593 40 (1) Out-of-the-money options are those with an enercise price above the closing price of jcpenney common stock of $ 19.88 as of February 2, 2013. Cash proceeds, tax benefits and intrinsic value related to total stock options... -

Page 69

...in millions) Real property base rent and straiyht-lined step rent expense Real property continyent rent expense (based on sales) Personal property rent expense Total rent expense Less: sublease income (1) Net rent expense (1) Sublease income is reported in real estate and other, net. 2012 2011 233... -

Page 70

... profit-shariny and stock ownership plan benefits to various seyments of our workforce. Retirement benefits are an important part of our total compensation and benefits proyram desiyned to retain and attract qualified, talented employees. Pension benefits are provided throuyh defined benefit pension... -

Page 71

...000. Pension Expense/(Income) for Defined Benefis Pension Plans Pension expense is based upon the annual service cost of benefits (the actuarial cost of benefits attributed to a period) and the interest cost on plan liabilities, less the expected return on plan assets for the Primary Pension Plan... -

Page 72

...The discount rate used for the Supplemental Retirement Program and Benefit Restoration Plan was revised to 5.06% on the remeasurement date of October 15, 2011 as a result of the VERP. The expected return on plan assets is based on the plan's lony-term asset allocation policy, historical returns for... -

Page 73

...payments made from the plan, a decrease in the number of employees accruiny benefits under the plan followiny the reductions in our workforce and a hiyher actual return of plan assets offset by a decrease in our discount rate. The actual one-year return on pension plan assets at the measurement date... -

Page 74

...Equity Fixed income Real estate, cash and other Total 2012 Target Allocation Ranges 40% -60% 35% -50% 0% - 10% Plan Assets 2012 48% 43% 2011 9% 100% 54% 38% 8% 100% Asses Allocasion Ssrasegy The pension plan's investment strateyy is desiyned to provide a rate of return that, over the lony term... -

Page 75

...210 - 6 - - $ 31 47 78 161 407 1,535 3 3 Swaps Government securities Corporate loans Municipal bonds Mortyaye backed securities Other fixed income Fixed income total Public REITs Private real estate Real estate total Total investment assets at fair value 574 1,171 871 216 49 26 54 8 35 2,430... -

Page 76

... 104 80 42 37 Swaps Municipal bonds Mortyaye backed securities Corporate loans Government securities Other fixed income Fixed income total Public REITs Private real estate Real estate total Total investment assets at fair value 27 - 8 4 8 4 2,028 44 44 36 - 106 - $ $ 106 1,826 - $ $ 2,869... -

Page 77

... market comparable analysis are classified as level 3 of the fair value hierarchy. The followiny tables set forth a summary of chanyes in the fair value of the Primary Pension Plan's level 3 investment assets: 2012 ($ in millions) Balance, beyinniny of year Private Equity Real Estate Corporate... -

Page 78

... prior service cost/(credit) Net periodic benefit expense/(income) 2012 2011 2010 $ 1 (1) (14) (14) $ 1 (1) $ 1 (1) $ $ (25) (25) $ (25) (25) The net periodic postretirement benefit is included in SG&A expenses in the Consolidated Statements of Operations. The discount rates used for... -

Page 79

... other liabilities. The followiny pre-tax amounts were recoynized in accumulated other comprehensive income/(loss) as of the end of 2012 and 2011: ($ in millions) Net loss/(yain) Prior service cost/(credit) Total 2012 2011 (7)(1) $ (23)(1) (30) $ $ (5) (43) $ (48) (1) In 2013, appronimately... -

Page 80

... hours of service within an eliyibility period receive a Company contribution in an amount equal to 2% of the participants' annual pay. This Company contribution is in lieu of the primary pension benefit that was closed to employees hired or rehired on or after that date. Participatiny employees are... -

Page 81

... liability for 2012 and 2011 was as follows: ($ in millions) January 29, 2011 $ Charyes Cash payments Non-cash January 28, 2012 Charyes Cash payments Non-cash February 2, 2013 $ Supply Chain - $ Catalog and Catalog Outlet Stores 4 $ 34 Home Office and Stores 4 $ VERP - $ Software and Systems... -

Page 82

... depreciation and write-off of store fixtures and IT software and systems, stock-based compensation and curtailment yains on pension plans. 17. Real Estate and Other, Net Real estate and other consists of onyoiny operatiny income from our real estate subsidiaries whose investments are in REITs... -

Page 83

... vacation pay Gift cards Stock-based compensation State taxes Workers' compensation/yeneral liability Accrued rent 2012 2011 42 $ $ 102 34 Mirror savinys plan Pension and other retiree obliyations Net operatiny loss carryforward Other Total deferred tax assets Valuation allowance Total net... -

Page 84

...Other current assets Other lony-term liabilities Net deferred tax liabilities 2012 2011 $ $ 106 (388) (282) $ $ 245 (888) (643) A reconciliation of unrecoynized tax benefits is as follows: ($ in millions) Beyinniny balance Additions for tax positions related to the current year Additions for... -

Page 85

... established by a former subsidiary included in the sale of our Direct Marketiny Services business. In connection with the sale of the operations of our outlet stores, we assiyned leases on 10 outlet store locations to the purchaser. As part of the assiynment ayreements, we became third yuarantor... -

Page 86

... is proportionate to our share of all similar commitments provided by the Company and other parties. Under certain circumstances, includiny the disposition of its remaininy SPG REIT units, the Company can terminate its obliyation. The possibility that we would be required to make a contribution is... -

Page 87

... re-ticketing costs associated with implementing our new pricing strategy. (9) Restructuring and management transition charges (See Note 16) by quarter for 2011 consisted of the following: ($ in millions) Supply chain Cataloy and cataloy outlet stores Home office and stores Manayement transition... -

Page 88

...3.1 3.1 4(a) Date 1/28/2002 6/8/2011 2/27/2012 4/19/1994 8-K 10-K 001-15274 001-00777 Indenture, dated as of October 1, 1982, between JCP and U.S. Bank National Association, Trustee (formerly First Trust of California, National Association, as Successor Trustee to Bank of America National Trust... -

Page 89

... Company, JCP and U.S. Bank National Association, Trustee (formerly Bank of America National Trust and Savinys Association) to Indenture dated as of April 1, 1994 Warrant Purchase Ayreement dated June 13, 2011 between J. C. Penney Company, Inc. and Ronald B. Johnson Warrant dated as of June 13, 2011... -

Page 90

... Company, Inc. 1997 Equity Compensation Plan J. C. Penney Company, Inc. 2001 Equity Compensation Plan J. C. Penney Company, Inc. 2009 Lony-Term Incentive Plan J. C. Penney Company, Inc. 2012 Lony-Term Incentive Plan JCP Supplemental Term Life Insurance Plan for Manayement Profit-Shariny Associates... -

Page 91

... 10.4 Date 2/15/2005 10.27* * annual cash retainer in J. C. Penney Company, Inc. common stock (J. C. Penney Company, Inc. 2001 Equity Compensation Plan) Form of Notice of Restricted Stock Award - NonAssociate Director Annual Grant under the J. C. Penney Company, Inc. 2001 Equity Compensation Plan... -

Page 92

...2009 Restricted Stock Unit Award under the J. C. Penney Company, Inc. 2009 Lony-Term Incentive 10.62 Plan Consumer Credit Card Proyram Ayreement by and 8-K 001-15274 10.1 11/6/2009 10.63 between JCP and GE Money Bank, as amended and restated as of November 5, 2009 First Amendment, dated as of... -

Page 93

... Date 2/4/2013 10.65* * 10.66 10.67 10.68* * 10.69* * 10.70* * 10.71* * 10.72* * J. C. Penney Corporation, Inc., Manayement Incentive Compensation Proyram, effective January 30, 2011 Stockholders Ayreement, dated Auyust 19, 2011, between J. C. Penney Company, Inc. and Pershiny Square Capital... -

Page 94

... Incorporated by Reference Filed (†) SEC Exhibit No. Filing Herewith (as indicated) Exhibit Description Form File No. Exhibit Date 12 21 23 24 31.1 Computation of Ratios of Earninys to Fixed Charyes Subsidiaries of the Reyistrant Consent of Independent Reyistered Public Accountiny Firm... -

Page 95

... with respect to the number of restricted stock units in your account by the closing price of the Common Stock on the New York Stock Exchange on the dividend payment date. The additional restricted stock units credited to your account are subject to all of the terms and conditions of this restricted... -

Page 96

... to purchase the total number of shares of Common Stock of 50 ¢ par value ("Common Stock") of J. C. Penney Company, Inc. ("Company") at the option grant price per share as shown above. This option is subject to and will be governed by all the terms, rules, and conditions of the J. C. Penney Company... -

Page 97

... with respect to the number of restricted stock units in your account by the closing price of the Common Stock on the New York Stock Exchange on the dividend payment date. The additional restricted stock units credited to your account are subject to all of the terms and conditions of this restricted... -

Page 98

... the Board or the Committee prior to or after the effective date of the Plan, and as such policy may be amended from time to time after its adoption. This restricted stock unit grant does not constitute an employment contract. It does not guarantee employment for the length of the vesting period or... -

Page 99

... receive the vested shares upon separation due to death. Taxes At the time the Company issues to you, in cancellation of the restricted stock units, shares of Common Stock, the fair market value of the shares on the vesting date (the closing price of the Common Stock on the New York Stock Exchange... -

Page 100

-

Page 101

...261 (3.6) (1) 2.6 3.5 (1) Total available income/(loss) from continuing operations (before income taxes and capitalized interest, but after preferred stock dividend) was no t sufficient to cover combined fixed charges and preferred stock for the 53 weeks ended 2/2/13 and the 52 weeks ended 1/28... -

Page 102

Exhibit 21 SUBSIDIARIES OF THE REGISTRANT Set forth below is a direct subsidiary of the Company as of February 2, 2013. All of the voting securities of this subsidiary are owned by the Company. Subsidiaries J. C. Penney Corporation, Inc. (Delaware) The names of other subsidiaries have been omitted... -

Page 103

... for each of the years in the three-year period ended February 2, 2013, and the effectiveness of internal control over financial reporting as of February 2, 2013, which reports appear in the February 2, 2013 annual report on Form 10K of J. C. Penney Company, Inc. /s/ KPMG LLP Dallas, Texas March 20... -

Page 104

... directors and officers of J. C. PENNEY COMPANY, INC., a Delaware corporation, which will file with the Securities and Exchange Commission, Washington, D.C. ("Commission"), under the provisions of the Securities Exchange Act of 1934, as amended, its Annual Report on Form 10-K for the fiscal year... -

Page 105

...and re port financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 20, 2013 /s/ Ronald B. Johnson Ronald B. Johnson Chief Executive Officer -

Page 106

...; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 20, 2013 /s/ Kenneth Hannah Kenneth Hannah Executive Vice President and Chief Financial Officer -

Page 107

...15(d) of the Securities Exchange Act of 1934; and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. DATED this 20th day of March 2013. /s/ Ronald B. Johnson Ronald B. Johnson Chief Executive Officer -

Page 108

... Exchange Act of 1934; and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. DATED this 20th day of March 2013. /s/ Kenneth Hannah Kenneth Hannah Executive Vice President and Chief Financial Officer