Ingram Micro 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

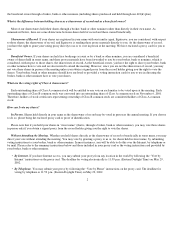

2) David B. Ingram, Robin Ingram Patton, Orrin H. Ingram II, John R. Ingram, and Martha R. Ingram are trustees of the E. Bronson

Ingram QTIP Marital Trust (the “QTIP Trust”), and accordingly each can be deemed to be the beneficial owner of the shares held

by the QTIP Trust.

3) The address for each of the indicated parties is c/o Ingram Industries Inc., One Belle Meade Place, 4400 Harding Road, Nashville,

Tennessee 37205. The address for David B. Ingram is c/o Ingram Entertainment Inc., Two Ingram Boulevard, La Vergne,

Tennessee 37089.

4) Includes vested options to purchase 73,007 shares of Class A common stock, and unvested options to purchase 2,478 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

5) Excludes 231,000 shares of common stock owned by Ingram Industries. As principal shareowners of Ingram Industries, the

indicated shareowners may be deemed to be beneficial owners of the shares held by Ingram Industries.

6) Includes 51,703,898, 50,906,318, 50,959,490, 51,859,490, 54,300,913, and 56,107,790 shares, for David B. In

g

ram, Robin In

g

ram

Patton, Orrin H. Ingram II, John R. Ingram, Martha R. Ingram, and all executive officers and Directors as a group, respectively,

which shares are held by various trusts or foundations of which these individuals are trustees. Such individuals could each be

deemed to be the beneficial owner of the shares held by trusts of which he or she is a trustee.

7) Excludes for John R. Ingram 185,312 shares held by one or more trusts of which he and/or his children are beneficiaries; for Orrin

H. Ingram II 188,815 shares held by one or more trusts of which he and/or his children are beneficiaries; for David B. Ingram

1,878,418 shares held by one or more trusts of which he and/or his children are beneficiaries; and for Robin Ingram Patton

2,517,755 shares held by one or more trusts of which she is a beneficiary. Each such individual disclaims beneficial ownership as

to such shares.

8) Includes 900,000 shares held in two grantor-retained annuity trusts.

9) Includes vested options to purchase 32,000 shares of Class A common stock, and unvested options to purchase 1,078 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002

10) Includes vested options to purchase 46,018 shares of Class A common stock, and unvested options to purchase 1,078 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

11) Includes vested options to purchase 10,274 shares of Class A common stock, and unvested options to purchase 4,947 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

12) Includes vested options to purchase 61,000 shares of Class A common stock, and unvested options to purchase 1,078 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

13) Includes vested options to purchase 8,630 shares of Class A common stock, and unvested options to purchase 3,595 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

14) Includes vested options to purchase 83,000 shares of Class A common stock, and unvested options to purchase 1,078 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

15) Includes vested options to purchase 625,557 shares of Class A common stock, and unvested options to purchase 12,000 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

16) Includes vested options to purchase 231,073 shares of Class A common stock, and unvested options to purchase 9,000 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

17) Includes vested options to purchase 188,545 shares of Class A common stock.

18) Includes vested options to purchase 513,282 shares of Class A common stock, and unvested options to purchase 7,600 shares of

Class A common stock, but which are exercisable within 60 days of February 1, 2002.

19) Includes options to purchase 4,128,368 shares of Class A common stock, of which 566,352 options are exercisable within 60 days

of the date of the table.

20) Includes 744,408 shares held in three grantor-retained annuity trusts.

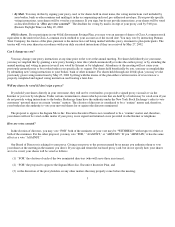

21) Based on information provided in a Schedule 13G (Amendment No. 2) filed on February 12, 2002 by AXA Assurances I.A.R.D.

Mutuelle (“I.A.R.D.”) and certain related entities (collectively, the “AXA entities”). Each of I.A.R.D., AXA Assurances Vie

Mutuelle (“Vie”), AXA Conseil Vie Assurance Mutuelle (“Conseil”), AXA Courtage Assurance Mutuelle (“Courtage”), AXA

(“AXA”), and AXA Financial, Inc. (“AXA Financial”) (through its subsidiary Alliance Capital Management L.P. (“Alliance”))

shares voting power with respect to 1,040,830 shares. Each of the AXA Entities has sole voting power with respect to 6,278,925

shares and sole dispositive power with respect to 11,398,664 shares. The addresses for the AXA Entities are as follows: I.A.R.D.,

Vie and Conseil: 370 rue Saint Honore 75001

12