Harman Kardon 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Harman Kardon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The page numbers in this Table of Contents reflect actual page numbers, not EDGAR page tag numbers.

References to “

Harman International,

”

“

Harman,

”

the

“company,

”

“

we,

”

“us

”

and “our

”

in this Form 10

-

K refer to Harman

International Industries, Incorporated and its subsidiaries unless the context requires otherwise.

Forward–Looking Statements

This report contains forward

-

looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). You should not place undue reliance on these statements.

Forward

-

looking statements include information concerning possible or assumed future results of operations, capital

expenditures, the outcome of pending legal proceedings and claims, including environmental matters, goals and objectives for

future operations, including descriptions of our business strategies and purchase commitments from customers. These statements

are typically identified by words such as “

believe,

” “anticipate,” “

expect,

” “plan,” “intend,” “

estimate

” and similar

expressions. We base these statements on particular assumptions that we have made in light of our industry experience, as well

as our perception of historical trends, current conditions, expected future developments and other factors that we believe are

appropriate under the circumstances. As you read and consider the information in this report, you should understand that these

statements are not guarantees of performance or results. They involve risks, uncertainties and assumptions. In light of these risks

and uncertainties, there can be no assurance that the results and events contemplated by the forward

-

looking statements

contained in, or incorporated by reference into, this report will in fact transpire.

You should carefully consider the risks described below and the other information in this report. Our operating results may

fluctuate significantly and may not meet our expectations or those of securities analysts or investors. The price of our stock

would likely decline if this occurs. In addition, the proposed acquisition of our company by KHI Parent Inc. (“Parent”), a

company formed by investment funds affiliated with Kohlberg, Kravis Roberts & Co. L.P. (“KKR”) and GS Capital Partners

VI Fund, L.P. and its related funds, which are sponsored by Goldman, Sachs & Co. (“GSCP”), as reported on our current

report on Form 8

-

K filed with the Securities and Exchange Commission on April 26, 2007, may cause the price of our stock to

fluctuate significantly.

INDEX

Page

Forward–

Looking Statements

i

Part I

Item

1.

Business

1

Item

1A.

Risk Factors

9

Item

1B.

Unresolved Staff Comments

15

Item

2.

Properties

16

Item

3.

Legal Proceedings

17

Item

4.

Submission of Matters to a Vote of Security Holders

18

Executive Officers of the Registrant

18

Part II

Item

5.

Market for Registrant

’

s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity

Securities

19

Item

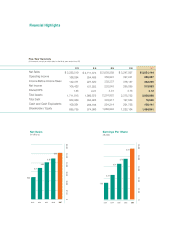

6.

Selected Financial Data

20

Item

7.

Management

’

s Discussion and Analysis of Financial Condition and

Results of Operations

21

Item

7A.

Quantitative and Qualitative Disclosures About Market Risk

35

Item

8.

Financial Statements and Supplementary Data

37

Item

9.

Changes in and Disagreements With Accountants on Accounting and

Financial Disclosure

72

Item

9A.

Controls and Procedures

72

Item

9B.

Other Information

72

Part III

Item

10.

Directors, Executive Officers and Corporate Governance

72

Item

11.

Executive Compensation

74

Item

12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

74

Item

13.

Certain Relationships and Related Transactions, and Director Independence

74

Item

14.

Principal Accounting Fees and Services

74

Part IV

Item

15.

Exhibits and Financial Statement Schedules

75

Signatures

79

i