Hamilton Beach 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

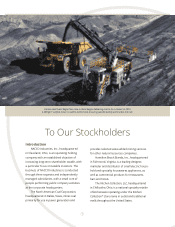

North American Coal

North American Coal’s mines operate

under contracts to supply coal to an individual

customer’s power plant or coal processing

facility for a long period of time, often for

decades. The mines and the customer facilities

are in close proximity, often adjacent to one

another. NACoal also provides value-added

services, such as operating and maintaining

draglines for limerock producers, and operating

and maintaining a coal processing system for

a customer’s power plant.

Unconsolidated Mines

NACoal employs a business model that

differs from most other coal industry participants.

All but one of NACoal’s contracts include “cost-

plus” pricing terms under which NACoal’s compen-

sation includes reimbursement of all operating

costs, plus a comparatively small but consistent

amount of agreed profit on coal tons or heating

units (btu) delivered. Each contract specifies the

indices and mechanics by which agreed profits

change over time, generally in line with broad

measures of inflation. Financing for these mines

is supported by, or in some instances actually

provided by, their respective customers in order

to minimize costs and are without recourse to

NACoal or NACCO.

These mines are referred to as “unconsoli-

dated mines” because they are not consolidated

in the Company’s financial statements. The pre-

tax profits generated from these mines are shown

separately in the Company’s income statement as

“Earnings of unconsolidated mines.” NACoal and

its customers believe strongly that the structure

of these long-term contracts fully aligns long-term

interests of the mine and the customer in a way

that assures low costs for the customer over the

long term. NACoal’s analysis of historical data

supports that conclusion.

NACoal entered into a new 15-year agree-

ment in 2015 to operate a mine for the Navajo

Transitional Energy Company (NTEC). Under this

agreement NACoal, through a new wholly owned

subsidiary named Bisti Fuels, will act as NTEC’s

contract miner at NTEC’s Navajo Mine, a surface

coal mine located within the Navajo Nation near

Fruitland, New Mexico. Similar to most of NACoal’s

other mining agreements, the agreement with

NTEC is a cost-plus arrangement, under which

NTEC will reimburse Bisti for all operating costs

of the mine, provide the capital required to

operate the mine and pay NACoal an agreed fee

per btu of heating value delivered. Production

is expected to be 5 million to 6 million tons of

coal per year. NTEC will deliver that coal to the

third-party owners of the nearby Four Corners

Generating Station.

Consolidated Mines

NACoal has a coal mine located in Mississippi

that operates pursuant to a more traditional

business model in which NACoal pays all operating

costs and provides the capital for the mine.

This mine is referred to as a “consolidated mine”

because its results are consolidated in the

Company’s financial statements. Mississippi

Lignite Mining Company (MLMC) delivers coal

to a single power plant adjacent to the mine.

MLMC’s sales prices are not subject to spot coal

market fluctuations since MLMC sells coal to

its customer at a contractually agreed-upon

price which adjusts monthly, primarily based on

changes in the level of established indices over

time. The indices include cost components such

as labor and diesel fuel. The price of diesel fuel is

heavily weighted among these indices. The recent

substantial decline in diesel fuel prices is expected

to reduce 2016 earnings as a moderate increase

in tons sold and the beneficial effect of lower

diesel prices on production costs will only partially