Hamilton Beach 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

North American Coal

Unconsolidated Mines

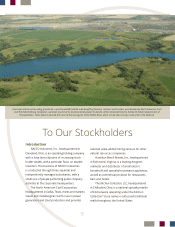

North American Coal (“NACoal”) employs a

different business model than most other coal

industry participants. A large majority of NACoal’s

mines operate under contracts to supply coal to

an individual customer’s power plant for a long

period of time, often for decades. The mines

and the customer facilities are in close proximity,

often adjacent to one another. These contracts

include “cost-plus” pricing terms under which

NACoal’s compensation includes all operating

costs, plus a comparatively small but consistent

amount of agreed profit on tons or heating

units (btu) delivered. All but two of NACoal’s coal

mining operations operate pursuant to cost-plus

contracts. This contractual approach also applies

to NACoal’s value-added service operations, such

as its Florida dragline mining operations, where

NACoal personnel operate and maintain draglines

for extraction of limerock at customer-owned

limerock mines.

While the pre-tax profits generated from

these mines are included in NACoal’s income

statement, these mines, which are referred to as

the “unconsolidated mines,” are not consolidated

in the Company’s financial statements. Financing

for these mines is supported by, or in some

instances, actually provided by customers to

minimize costs. NACoal and its customers believe

strongly that these long-term contracts fully align

the long-term interests of the mine and the

customer facility in a way that assures low costs

for the customer over the long term. NACoal’s

analysis of historical data supports that conclusion.

Consolidated Mines

Two of NACoal’s coal mines, one in Mississippi

and one in Alabama, operate pursuant to a

more traditional business model, where NACoal

provides the capital for the mine and sells coal

produced to customers. These mines are referred

to as the “consolidated mines” because they are

consolidated in the Company’s financial state-

ments. At Mississippi Lignite Mining Company

(“MLMC”), coal is delivered to a single power plant

which is adjacent to the mine. MLMC’s coal

prices are fixed, but they escalate pursuant

to established indices over time and are not

subject to spot coal market fluctuations. MLMC’s

contract expires in 2032.

The Centennial Natural Resources coal

mining business in Alabama, formerly known as

Reed Minerals until the beginning of 2015, was

acquired in August 2012 as the foundation of

what was expected to become a metallurgical

coal platform for NACoal. Key to this acquisition

was an existing multi-year contract to sell a

majority of the coal produced as steam coal for

use by a significant U.S.-based public utility.

NACoal viewed this contract as providing stability

against the recognized volatility in the market for

metallurgical coal, which accounted for the balance

of Centennial’s coal production. Centennial is

the only part of NACoal’s business that has any

exposure to fluctuations in spot coal prices.

When this business was acquired in 2012, the

Company believed the metallurgical coal market

was at a relative low point. Market analysis at the

time of the acquisition indicated that the metal-

lurgical coal market was close to bottom and

suggested that improvements in both price and

demand were on the horizon. That analysis was

proven to be incorrect as global demand for

metallurgical coal has fallen significantly, including

in important export markets such as China, and

the price for metallurgical coal has deteriorated

far beyond what NACoal expected. Customer