Hamilton Beach 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Above from top: Yale’s MPE060-080VG

motorized hand truck has a lifting capacity of

6,000 to 8,000 pounds. NMHG’s new range

of UTILEV®brand forklift trucks, which are

basic forklift trucks that meet the needs of

low-intensity users. The new Hyster®S50CT

internal combustion engine, cushion tire lift

truck has a lifting capacity of 5,000 pounds

and is targeted at the medium-duty segment.

At right, from top: The new European Hyster®

2.5CT internal combustion engine, pneumatic

tire lift truck, with lifting capacities of 2,000

to 2,500 kilograms, targeted for low-intensity

or medium-duty operations. The European

Hyster®H4.0FT Fortens®lift truck, upgraded

with new Hyster technologies, has a lifting

capacity of 4,000 kilograms.

normal lead times. NMHG continued to

strengthen its distribution network by

adding strong independent dealers in

Eastern Europe, adding more dual brand

representation by dealers and replacing

underperforming dealerships. In addition,

the company entered into agreements with

two dealers in India to enhance distribution

by permitting certain Hyster®and Yale®

lift trucks to be manufactured in India

under license. Major enhancements were

also made to many of NMHG’s product

lines, and a new brand of forklift truck

was offered to a market sector NMHG

had not effectively competed in previously.

In addition, to strengthen innovation

and execution of advanced product

development programs, NMHG opened

a new Engineering Concept Centre near

NMHG’s European headquarters in the

United Kingdom.

Five

NACCO Materials

Handling Group

2011 Results

NMHG has engineering, manufac-

turing, sales and distribution operations

throughout the world serving a global

customer base. The company is continually

seeking to expand its reach by enhancing

its dealer network in individual markets

and sourcing components from all over

the globe, while executing its strategy

of manufacturing in the market of sale.

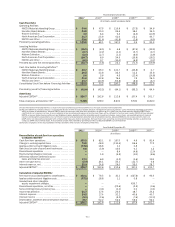

However, while the business benefits

from this global reach, the company is also

susceptible to fluctuating currencies and

market conditions in the countries in which

it operates. The global market recovery

in the materials handling industry, which

began in 2010, continued into 2011. These

improvements resulted in a 41 percent

increase in revenues from $1.8 billion in

2010 to $2.5 billion in 2011, driven by a

33 percent increase in new unit shipments,

as well as increased part sales. Improved

volumes, combined with price increases

implemented in late 2010 and early 2011

that more than offset material cost

increases, manufacturing efficiencies

obtained from increased volumes and tight

control of expenses and the company’s

lean and cautious attitude in running the

business, helped drive the substantial

improvement in net income from $32.4

million in 2010 to $82.6 million in 2011.

Operating profit margins improved from 2.6

percent in 2010 to 4.3 percent in 2011, a

significant improvement but still well below

NMHG’s operating profit margin target of a

7 percent average operating profit margin

at the mid-point of the market cycle. This

substantial improvement occurred despite

the full restoration of compensation and

benefits at the beginning of 2011. NMHG

also generated strong cash flow before

financing activities of $38.7 million in

2011, comparable to the $39.0 million

generated in 2010.

Continued market improvement in

2011 resulted in a number of other positive

developments during the year. A strong,

stable backlog developed and supplier

constraints dissipated, resulting in more