Hamilton Beach 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

c c c 3c c c

Introduction

In 2010, as global markets and consumer

confidence improved, NACCO Industries, Inc. and its

subsidiaries realized the benefits of its existing long-

term programs and the aggressive cost containment

actions put in place to combat the global recession

of 2008-09. These programs and actions–along with

improvements in volumes at the materials handling

and housewares subsidiaries resulting from the

improved markets, and

increased deliveries at

the Company’s mining

operations–led to 2010

financial results which

were significantly better

than in 2009.

Markets improved at

all of our subsidiaries. At

the end of 2009, NACCO

Materials Handling Group

(“NMHG”) was concerned

that lift truck markets

served by NMHG would

recover only gradually from

the recession. In fact, beginning early in the second

quarter of 2010, those markets improved more rapidly.

Consumer markets, which showed improvement at

the end of 2009, continued to improve during 2010.

However, the recovery in the mass consumer market,

where Hamilton Beach Brands (“HBB”) and Kitchen

Collection are primarily focused, was not as strong

as in the high-end consumer market. Mass-market

consumers continued to struggle with high unemploy-

ment rates and financial concerns. Demand for lignite

from customers served by The North American Coal

Corporation (“NACoal”) remained steady, and the

limerock mining market in southern Florida improved

as mining permits, which had been suspended during

2009, were reinstated in early 2010, resulting in a

significant improvement in limerock yards delivered.

However, during the year, particularly the second half

of 2010, market improvements in all of NACCO’s busi-

nesses were accompanied by increasing commodity

costs and, for NMHG and HBB, adverse changes in

foreign currency exchange rates.

Overall, in the context of these general economic

conditions, NACCO’s subsidiaries returned to more

normal operating levels in 2010 after the deep market

declines of 2008 and 2009. Given 2010 market levels,

strong results were achieved at NMHG, HBB and

NACoal in 2010 and significant strides were made

at Kitchen Collection, where improvement is still

necessary at the Le Gourmet Chef®store format.

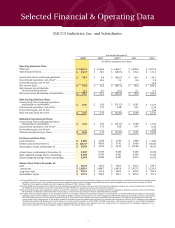

Consolidated revenues for NACCO increased to

$2.7 billion in 2010 from $2.3 billion in 2009, with the

increase primarily driven by volume improvements

at NMHG. Net income(1) increased substantially to

$79.5 million, or $9.53 per diluted share, compared

with net income of $31.1 million, or $3.75 per diluted

share, in 2009, which included income from discon-

tinued operations of $22.6 million from the sale of

NACoal’s Red River Mining Company. Income from

continuing operations(1) was $8.5 million, or $1.03

per diluted share, in 2009.

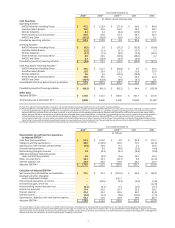

Offsetting these favorable subsidiary results in

2010 were costs of $18.8 million ($12.2 million after

tax of $6.6 million) at NACCO for litigation initiated

in 2006 against Applica Incorporated (“Applica”) and

individuals and entities affiliated with Applica’s share-

holder, Harbinger Capital Partners Master Fund I Ltd.,

related to NACCO’s failed transaction with Applica in

2006. On February 14, 2011, the parties to the Applica

litigation entered into a settlement agreement. The

settlement agreement provides for, among other

things, the payment of $60 million ($39.0 million after

taxes of $21.0 million) to NACCO and dismissal of

the lawsuit with prejudice. NACCO expects to incur

additional litigation costs for the first two months of

To Our Stockholders

Subsidiary Financial Objectives:

• NMHG: Achieve an operating profit

margin of 9 percent at the peak of

the market cycle.

• HBB: Achieve a minimum operating

profit margin of 10 percent.

• Kitchen Collection: Achieve a

minimum operating profit margin

of 5 percent.

• NACoal: Earn a minimum return

on capital employed of 13 percent

and attain positive Economic

Value Income from all existing

consolidated mining operations and

any new projects while maintaining

or increasing the profitability of all

existing unconsolidated mining

operations

• All subsidiaries: Generate substantial

cash flow before financing activities.

(1) For purposes of this annual report, discussions about income/loss from continuing operations and net income/loss refer to income/loss from continuing

operations attributable to stockholders and net income/loss attributable to stockholders.