Halliburton 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Halliburton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCING TECHNOLOGY

DELIVERING RESULTS

2011 ANNUAL REPORT

Table of contents

-

Page 1

2011 ANNUAL REPORT ADVANCING TECHNOLOGY DELIVERING RESULTS -

Page 2

Halliburton serves the upstream oil and gas industry throughout the life cycle of the reservoir - from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production through the life of the field. Our experience ... -

Page 3

... Income from continuing operations Net income Diluted income per share attributable to company shareholders: Income from continuing operations Net income Cash dividends per share Diluted weighted average common shares outstanding Working capital (1) Long-term debt (including current maturities) Debt... -

Page 4

... technology development in Brazil and around the world. We continued to invest in our deepwater business in 2011. Our wireline team advanced technology in deepwater, setting a new world record for hostile pressure testing and sampling operations. In addition, our Sperry Drilling product service line... -

Page 5

...way across all of our product service lines During the year, we secured key deepwater contract wins in East Africa, Vietnam, Malaysia, Australia, China and Brazil, as well as other markets. We opened three new field offices in East Africa, setting the foundation for future activity in this important... -

Page 6

... feet of technically recoverable natural gas in Australia, Halliburton is currently supporting our customers' exploration programs for shale, tight gas and coal seam gas in this promising region. In contrast to North America, international markets have restricted access to the capital required for... -

Page 7

... CleanStream® service uses ultraviolet light to reduce bacteria by up to 99.9 percent, dramatically decreasing the volume of biocides needed in fracturing operations. Halliburton's CleanStreab® service treated over a billion gallons of hydraulic fracturing fluid in 2011. 2011 ANNUAL REPORT 05 -

Page 8

... the drilling process, thus avoiding the requirement for costly wireline sampling runs after the well is drilled. During field testing, the customer drilled for six days with the tool while capturing more than 50 formation pressure and fluid tests. This resulted in almost 80 hours of rig time saved... -

Page 9

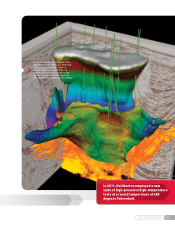

... deepwater Gulf of Mexico, Landmark Software and Services' GeoShell technology provides an advanced opportunity to image subsalt based on raw data provided and owned by the TGS-NOPEC Geophysical Company. In 2011, Halliburton ebployed a new suite of high-pressure/high-tebperature tools at a record... -

Page 10

... in international markets. Multi-Chem delivers specialty chemicals - including environmentally conscious chemicals, services and solutions - to help oil and natural gas companies assure their production in more than 30,000 oil and natural gas wells around the world. Rebolino Lab Project Improved... -

Page 11

... of future growth. In a lab, a researcher works in a glove box to safely handle nano-particle materials, an increasingly important component of drilling fluids, specialty chemicals and other products. The Multi-Cheb acquisition enhances our capabilities in bature fields. 2011 ANNUAL REPORT 09 -

Page 12

10 HALLIBURTON -

Page 13

2011 FORM 10-K ADVANCING TECHNOLOGY DELIVERING RESULTS -

Page 14

... 10, 2012, there were 922,983,220 shares of Halliburton Company Common Stock, $2.50 par value per share, outstanding. Portions of the Halliburton Company Proxy Statement for our 2012 Annual Meeting of Stockholders (File No. 001-03492) are incorporated by reference into Part III of this report. -

Page 15

... Data and Market Price Information (Unaudited) PART III Item 10. Directors, Executive Officers, and Corporate Governance Item 11. Executive Compensation Item 12(a). Security Ownership of Certain Beneficial Owners Item 12(b). Security Ownership of Management Item 12(c). Changes in Control Item... -

Page 16

...segment and Drilling and Evaluation segment: - our Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift, and completion services. The segment consists of Halliburton Production Enhancement, Cementing, Completion Tools... -

Page 17

...business operations of our divisions are organized around four primary geographic regions: North America, Latin America, Europe/Africa/CIS, and Middle East/Asia. In 2011, based on the location of services provided and products sold, 55% of our consolidated revenue was from the United States. In 2010... -

Page 18

... practices that serve the changing needs of our customers, such as those related to high pressure/high temperature environments, and also develops new products and processes. Our expenditures for research and development activities were $401 million in 2011, $366 million in 2010, and $325 million in... -

Page 19

... fluids to enable our customers to comply with state laws as well as voluntary standards established by the Chemical Disclosure Registry, www.fracfocus.org. At the same time, we have invested considerable resources in developing our CleanSuiteâ„¢ hydraulic fracturing technologies, which offer... -

Page 20

... our reports, proxy and information statements, and our other SEC filings. The address of that site is www.sec.gov. We have posted on our web site our Code of Business Conduct, which applies to all of our employees and Directors and serves as a code of ethics for our principal executive officer... -

Page 21

...Senior Vice President, Investor Relations of Halliburton Company, January 2011 to August 2011 Vice President, Investor Relations of Halliburton Company, December 2007 to December 2010 Vice President, Operations Finance, July 2006 to December 2007 Chairman of the Board, President, and Chief Executive... -

Page 22

... 2011 President, Global Business Lines and Corporate Development of Halliburton Company, January 2010 to January 2011 President, Drilling and Evaluation Division and Corporate Development of Halliburton Company, March 2009 to December 2009 Executive Vice President, Strategy and Corporate Development... -

Page 23

...well site spread across thousands of square miles of the Gulf of Mexico and reached the United States Gulf Coast. We performed a variety of services for BP Exploration, including cementing, mud logging, directional drilling, measurement-while-drilling, and rig data acquisition services. We are named... -

Page 24

... risk management, last-minute changes to drilling plans, failure to observe and respond to critical indicators, and inadequate well control response by the companies and individuals involved. The BOEMRE Report also stated, among other things, that BP failed to properly communicate well design and... -

Page 25

.... In addition, certain state laws, if deemed to apply, would not allow for enforcement of indemnification for gross negligence, and may not allow for enforcement of indemnification of persons who are found to be negligent with respect to personal injury claims. Financial analysts and the press have... -

Page 26

... cases, the creation of new, independent agencies to oversee the various aspects of offshore drilling. Two new, independent agencies, the BSEE and the Bureau of Ocean Energy Management (BOEM), replaced the BOEMRE effective October 2011. Since the Macondo well incident, the BSEE has issued guidance... -

Page 27

...are not limited to: the Middle East, North Africa, Azerbaijan, Colombia, Indonesia, Kazakhstan, Mexico, Nigeria, Russia, and Venezuela. In addition, any possible reprisals as a consequence of military or other action, such as acts of terrorism in the United States or elsewhere, could have a material... -

Page 28

... on our business and consolidated results of operations. We are also subject to the risks that our employees, joint venture partners, and agents outside of the United States may fail to comply with other applicable laws. Changes in or interpretation of tax law and currency/repatriation control could... -

Page 29

... long-term nature of many large-scale development projects. Factors affecting the prices of oil and natural gas include: - the level of supply and demand for oil and natural gas, especially demand for natural gas in the United States; - governmental regulations, including the policies of governments... -

Page 30

...credit markets. If our customers delay paying or fail to pay us a significant amount of our outstanding receivables, it could have a material adverse effect on our liquidity, consolidated results of operations, and consolidated financial condition. Our business in Venezuela subjects us to actions by... -

Page 31

..., natural gas development and hydraulic fracturing. After discussing the requests in the subpoena with the New York Attorney General' s office, we responded to certain requests and supplied certain records and information as appropriate. The adoption of any future federal, state, or foreign laws or... -

Page 32

... the world' s oil and natural gas reserves are controlled by national or state-owned oil companies (NOCs). Several of the NOCs are among our top 20 customers. Increasingly, NOCs are turning to oilfield services companies like us to provide the services, technologies, and expertise needed to develop... -

Page 33

...our normal discrete business to act as project managers as well as service providers. Providing services on an integrated basis may require us to assume additional risks associated with cost over-runs, operating cost inflation, labor availability and productivity, supplier and contractor pricing and... -

Page 34

..., the offering of new products or services, the generation of cash or income, or the reduction of risk. Acquisition transactions may be financed by additional borrowings or by the issuance of our common stock. These transactions may also affect our liquidity, consolidated results of operations, and... -

Page 35

..., and consolidated financial condition. Existing or future laws, regulations, treaties or international agreements related to greenhouse gases and climate change could have a negative impact on our business and may result in additional compliance obligations with respect to the release, capture, and... -

Page 36

... affect our competitive position. If we are not able to design, develop, and produce commercially competitive products and to implement commercially competitive services in a timely manner in response to changes in technology, our business and consolidated results of operations could be materially... -

Page 37

... to offshore drilling rigs resulting in suspension of operations; weather-related damage to our facilities and project work sites; inability to deliver materials to jobsites in accordance with contract schedules; and loss of productivity. Because demand for natural gas in the United States drives... -

Page 38

...addition, we have 192 international and 111 United States field camps from which we deliver our services and products. We also have numerous small facilities that include sales, project, and support offices and bulk storage facilities throughout the world. We believe all properties that we currently... -

Page 39

...a variety of services for BP Exploration, including cementing, mud logging, directional drilling, measurement-while-drilling, and rig data acquisition services. Crude oil flowing from the well site spread across thousands of square miles of the Gulf of Mexico and reached the United States Gulf Coast... -

Page 40

... levels in the Gulf of Mexico. For additional information, see Part II, Item 1(a), "Risk Factors" and "Management' s Discussion and Analysis of Financial Condition and Results of Operations - Business Environment and Results of Operations." DOJ Investigations and Actions. On June 1, 2010, the United... -

Page 41

... natural resources and resource services in and around the Gulf of Mexico and the adjoining United States shorelines and resulting in removal costs and damages to the United States far exceeding $75 million. BP Exploration has been designated, and has accepted the designation, as a responsible party... -

Page 42

... and did not conduct any testing using our cementing products. On January 11, 2011, the National Commission released "Deep Water -- The Gulf Oil Disaster and the Future of Offshore Drilling," its investigation report (Investigation Report) to the President of the United States regarding, among other... -

Page 43

... risk management, last-minute changes to drilling plans, failure to observe and respond to critical indicators, and inadequate well control response by the companies and individuals involved. In particular, the BOEMRE Report stated that BP made a series of decisions that complicated the cement job... -

Page 44

.... The BSEE has stated that this is the first time the Department of the Interior has issued INCs directly to a contractor that was not the well' s operator. We have not accrued any amounts related to the INCs. In December 2011, the National Academy of Sciences released a pre-publication copy of its... -

Page 45

... the drilling environment to which they are being applied; and that operating companies should have ultimate responsibility and accountability for well integrity, well design, well construction, and the suitability of the rig and associated safety equipment. The Cementing Job and Reaction to Reports... -

Page 46

... the drilling rig at the time of the incident. Another six lawsuits naming us and others relate to alleged personal injuries sustained by those responding to the explosion and oil spill. Plaintiffs originally filed the lawsuits described above in federal and state courts throughout the United States... -

Page 47

..., and MOEX Offshore 2007 LLC (MOEX), who has an approximate 10% interest in the Macondo well, filed a claim against us alleging negligence. Cameron International Corporation (Cameron) (the manufacturer and designer of the blowout preventer), M-I Swaco (provider of drilling fluids and services, among... -

Page 48

..., common law libel, slander, and business disparagement. Our claims allege that the BP Defendants knew or should have known about an additional hydrocarbon zone in the well that the BP Defendants failed to disclose to us prior to our designing the cement program for the Macondo well. The location of... -

Page 49

.... In addition, certain state laws, if deemed to apply, would not allow for enforcement of indemnification for gross negligence, and may not allow for enforcement of indemnification of persons who are found to be negligent with respect to personal injury claims. Financial analysts and the press have... -

Page 50

... York. Securities and related litigation In June 2002, a class action lawsuit was filed against us in federal court alleging violations of the federal securities laws after the SEC initiated an investigation in connection with our change in accounting for revenue on long-term construction projects... -

Page 51

... current and former Halliburton directors and officers containing various allegations of wrongdoing including violations of the FCPA, claimed KBR offenses while acting as a government contractor in Iraq, claimed KBR offenses and fraud under United States government contracts, Halliburton activity... -

Page 52

... oversight responsibilities and establish adequate internal controls, including controls and procedures related to cement testing and the communication of test results, as they relate to the Macondo well incident. Our Board of Directors designated a special committee of independent and disinterested... -

Page 53

...1965 and 1991, a former Halliburton unit known as the Halliburton Industrial Services Division (HISD) performed work for the U.S. Department of Defense cleaning solid fuel from missile casings at a semi-rural facility on the north side of Duncan, Oklahoma. We closed our site in coordination with the... -

Page 54

.... Our barite and bentonite mining operations, in support of our fluid services business, are subject to regulation by the federal Mine Safety and Health Administration (MSHA) under the Federal Mine Safety and Health Act of 1977 (Mine Act). Information concerning mine safety violations or other... -

Page 55

.... Halliburton Company' s common stock is traded on the New York Stock Exchange. Information related to the high and low market prices of our common stock and quarterly dividend payments is included under the caption "Quarterly Data and Market Price Information" on page 118 of this annual report... -

Page 56

... of our common stock. Item 6. Selected Financial Data. Information related to selected financial data is included on page 117 of this annual report. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Information related to Management' s Discussion and... -

Page 57

Item 8. Financial Statements and Supplementary Data. Page No. 69 70 72 73 74 75 76 117 118 Management' s Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Statements of Operations for the years ended December 31, 2011, 2010, ... -

Page 58

... first time. Margins in the Gulf of Mexico, while improving, are not expected to recover to pre-drilling suspension levels until the second half of 2012, as our customers adapt to new regulations. See "Business Environment and Results of Operations," Note 8 to the consolidated financial statements... -

Page 59

... in Halliburton Production Enhancement, Sperry Drilling, Cementing, and Wireline and Perforating. We have also invested additional working capital to support the growth of our business. During 2011, we purchased $501 million of short-term marketable securities. We paid $330 million in dividends to... -

Page 60

... for goods and services utilized in the ordinary course of our business. Includes international plans and is based on assumptions that are subject to change. We are currently not able to reasonably estimate our contributions for years after 2012. See Note 13 to the consolidated financial statements... -

Page 61

... or failing to pay our invoices. In weak economic environments, we may experience increased delays and failures to pay our invoices due to, among other reasons, a reduction in our customers' cash flow from operations and their access to the credit markets. For example, we continue to see delays in... -

Page 62

... the upstream oil and natural gas industry throughout the lifecycle of the reservoir, from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the field. Our two business segments... -

Page 63

... Gas Total Worldwide total Oil total Natural Gas total Drilling Type United States (incl. Gulf of Mexico): Horizontal Vertical Directional Total 2011 1,843 32 1,875 422 1 423 863 304 1,167 3,465 3,128 337 2011 984 891 1,875 282 141 423 918 249 1,167 3,465 2,184 1,281 2011 1,074 571 230 1,875 2010... -

Page 64

... more sophisticated supply chain management. These factors are reinforcing our belief that revenue for North America can be sustainable; however, growing cost pressure and logistical challenges could moderate our margin levels in 2012. Deepwater drilling activity in the Gulf of Mexico is continuing... -

Page 65

... spending outlook and new rigs are scheduled to enter the market, which we believe will eventually lead to meaningful absorption of equipment supply and result in the ability to begin to improve pricing for our services. We also believe that international unconventional oil and natural gas projects... -

Page 66

... our technology and manufacturing development, as well as our supply chain, closer to our customers in the Eastern Hemisphere, and we are building a new, world class technology center in Houston, Texas; - improving working capital, and managing our balance sheet to maximize our financial flexibility... -

Page 67

.../CIS Middle East/Asia Total Drilling and Evaluation: North America Latin America Europe/Africa/CIS Middle East/Asia Total Total revenue by region: North America Latin America Europe/Africa/CIS Middle East/Asia Favorable (Unfavorable) $ 5,146 1,710 $ 6,856 Percentage Change 51% 21 38% 2011 $ 15... -

Page 68

.../CIS Middle East/Asia Total Total operating income by region (excluding Corporate and other): North America Latin America Europe/Africa/CIS Middle East/Asia 2011 $ 3,733 1,403 (399) $ 4,737 2010 $ 2,032 1,213 (236) $ 3,009 Favorable (Unfavorable) $ 1,701 190 (163) $ 1,728 Percentage Change 84... -

Page 69

... for production enhancement services in unconventional basins located in the United States land market. Latin America operating income increased 38% due to higher demand for cementing services in Colombia, Brazil, and Argentina, partially offset by higher costs and pricing adjustments in Mexico... -

Page 70

.... Income (loss) from discontinued operations, net increased $206 million in 2011 compared to 2010 primarily due to a $163 million charge, after-tax, recognized in 2011 related to a ruling in an arbitration proceeding between Barracuda & Caratinga Leasing Company B.V. and our former subsidiary, KBR... -

Page 71

... Latin America Europe/Africa/CIS Middle East/Asia Total Drilling and Evaluation: North America Latin America Europe/Africa/CIS Middle East/Asia Total Total revenue by region: North America Latin America Europe/Africa/CIS Middle East/Asia Favorable (Unfavorable) $ 2,578 720 $ 3,298 Percentage Change... -

Page 72

.../CIS Middle East/Asia Total Total operating income by region (excluding Corporate and other): North America Latin America Europe/Africa/CIS Middle East/Asia 2010 $ 2,032 1,213 (236) $ 3,009 2009 $ 1,016 1,183 (205) $ 1,994 Favorable (Unfavorable) $ 1,016 30 (31) $ 1,015 Percentage Change 100... -

Page 73

...in demand for production enhancement and cementing services which benefitted from increased rig count associated with higher horizontal drilling activity and improved pricing. Latin America operating income fell 33%, primarily due to lower activity across all product services lines in Mexico. Europe... -

Page 74

... BolÃvar Fuerte. Income (loss) from discontinued operations, net in 2010 included $62 million of income primarily related to the finalization of a United States tax matter with the Internal Revenue Service and a charge of $17 million, after-tax, related to an indemnity payment on behalf of KBR for... -

Page 75

... with our consolidated financial statements and related notes included in this report. We have discussed the development and selection of these critical accounting policies and estimates with the Audit Committee of our Board of Directors, and the Audit Committee has reviewed the disclosure presented... -

Page 76

... of local tax laws, tax treaties, and related authorities in each jurisdiction. Changes in the operating environment, including changes in tax law and currency/repatriation controls, could impact the determination of our income tax liabilities for a tax year. Tax filings of our subsidiaries... -

Page 77

... any amounts. Attorneys in our legal department monitor and manage all claims filed against us and review all pending investigations. Generally, the estimate of probable costs related to these matters is developed in consultation with internal and outside legal counsel representing us. Our estimates... -

Page 78

... purposes of performing the goodwill impairment test our reporting units are the same as our reportable segments, the Completion and Production division and the Drilling and Evaluation division. In September 2011, the Financial Accounting Standards Board (FASB) issued an update to existing guidance... -

Page 79

... discount rate utilized in 2011 to determine the projected benefit obligation at the measurement date for our United Kingdom pension plan, which constituted 74% of our international plans' pension obligations, was 4.9%, compared to a discount rate of 5.5% utilized in 2010. The expected long-term... -

Page 80

...adjustment to 2011 total operating costs and expenses. See Note 3 to the consolidated financial statements for further information. Percentage of completion Revenue from certain long-term, integrated project management contracts to provide well construction and completion services is reported on the... -

Page 81

... on current market conditions, future operating activities, and the associated cost in relation to the perceived risk of loss. The purpose of our foreign currency risk management activities is to minimize the risk that our cash flows from the sale and purchase of services and products in foreign... -

Page 82

... operations worldwide. For information related to environmental matters, see Note 8 to the consolidated financial statements, Item 1(a), "Risk Factors," and Item 3, "Legal Proceedings-Environmental." NEW ACCOUNTING PRONOUNCEMENTS In June 2011, the Financial Accounting Standards Board (FASB) issued... -

Page 83

... responsibility to publicly update any of our forward-looking statements regardless of whether factors change as a result of new information, future events, or for any other reason. You should review any additional disclosures we make in our press releases and Forms 10-K, 10-Q, and 8K filed with or... -

Page 84

... registered public accounting firm, as stated in their report that is included herein. HALLIBURTON COMPANY by /s/ David J. Lesar David J. Lesar Chairman of the Board, President, and Chief Executive Officer /s/ Mark A. McCollum Mark A. McCollum Executive Vice President and Chief Financial Officer... -

Page 85

... in accordance with the standards of the Public Company Accounting Oversight Board (United States), Halliburton Company' s internal control over financial reporting as of December 31, 2011, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring... -

Page 86

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Halliburton Company and subsidiaries as of December 31, 2011 and 2010, and the related consolidated statements of operations, shareholders' equity, and cash flows for each of the years in the... -

Page 87

HALLIBURTON COMPANY Consolidated Statements of Operations Year Ended December 31 2011 2010 ...shares except per share data Revenue: Services Product sales Total revenue Operating costs and expenses: Cost of services Cost of sales General and administrative Total operating costs and expenses Operating... -

Page 88

... and benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt Employee compensation and benefits Other liabilities Total liabilities Shareholders' equity: Common shares, par value $2.50 per share - authorized 2,000 shares, issued 1,073 shares and 1,069 shares Paid... -

Page 89

HALLIBURTON COMPANY Consolidated Statements of Shareholders' Equity Millions of dollars Balance at January 1 Dividends and other transactions with shareholders Treasury shares issued for acquisition Comprehensive income: Net income Defined benefit and other postretirement plans adjustments Other ... -

Page 90

...loss from discontinued operations Other changes: Receivables Inventories Accounts payable Other Total cash flows from operating activities Cash flows from investing activities: Capital expenditures Sales of marketable securities Purchases of marketable securities Acquisitions of business assets, net... -

Page 91

... Drilling and Evaluation segment. We provide a comprehensive range of services and products for the exploration, development, and production of oil and natural gas around the world. Use of estimates Our financial statements are prepared in conformity with United States generally accepted accounting... -

Page 92

... or production cost for new items and original cost less allowance for condition for used material returned to stock. Production cost includes material, labor, and manufacturing overhead. Some domestic manufacturing and field service finished products and parts inventories for drill bits, completion... -

Page 93

...goodwill for each reporting unit are reviewed for impairment on an annual basis, during the third quarter, and more frequently when negative conditions such as significant current or projected operating losses exist. In September 2011, the Financial Accounting Standards Board (FASB) issued an update... -

Page 94

..., cost of product sales and revenue, and expenses associated with nonmonetary balance sheet accounts, which are translated at historical rates. Gains or losses from changes in exchange rates are recognized in our consolidated statements of operations in "Other, net" in the year of occurrence. Stock... -

Page 95

... services include testing tools, real-time reservoir analysis, and data acquisition services. Boots & Coots includes well intervention services, pressure control, equipment rental tools and services, and pipeline and process services. Multi-Chem includes oilfield production and completion chemicals... -

Page 96

... Software and Services is a supplier of integrated exploration, drilling, and production software information systems, as well as consulting and data management services for the upstream oil and natural gas industry. Halliburton Consulting and Project Management provides oilfield project management... -

Page 97

...as cash, are considered to be shared among the segments. Revenue by country is determined based on the location of services provided and products sold. Operations by geographic area Millions of dollars Revenue: United States Other countries Total Year Ended December 31 2011 2010 2009 $ 13,548 11,281... -

Page 98

... at the lower of cost or market. In the United States, we manufacture certain finished products and parts inventories for drill bits, completion products, bulk materials, and other tools that are recorded using the last-in, first-out method, which totaled $160 million at December 31, 2011 and $108... -

Page 99

... series at any time at the applicable redemption prices, plus accrued and unpaid interest. Our 7.6% and 8.75% senior debentures may not be redeemed prior to maturity. Revolving credit facilities In February 2011, we entered into a new unsecured $2.0 billion five-year revolving credit facility that... -

Page 100

..., laws, rules, or regulations in each case related to the construction of a natural gas liquefaction complex and related facilities at Bonny Island in Rivers State, Nigeria by a consortium of engineering firms comprised of Technip SA of France, Snamprogetti Netherlands B.V., JGC Corporation of... -

Page 101

...a variety of services for BP Exploration, including cementing, mud logging, directional drilling, measurement-while-drilling, and rig data acquisition services. Crude oil flowing from the well site spread across thousands of square miles of the Gulf of Mexico and reached the United States Gulf Coast... -

Page 102

... levels in the Gulf of Mexico. For additional information, see Part II, Item 1(a), "Risk Factors" and "Management' s Discussion and Analysis of Financial Condition and Results of Operations - Business Environment and Results of Operations." DOJ Investigations and Actions. On June 1, 2010, the United... -

Page 103

... natural resources and resource services in and around the Gulf of Mexico and the adjoining United States shorelines and resulting in removal costs and damages to the United States far exceeding $75 million. BP Exploration has been designated, and has accepted the designation, as a responsible party... -

Page 104

... and did not conduct any testing using our cementing products. On January 11, 2011, the National Commission released "Deep Water -- The Gulf Oil Disaster and the Future of Offshore Drilling," its investigation report (Investigation Report) to the President of the United States regarding, among other... -

Page 105

... risk management, last-minute changes to drilling plans, failure to observe and respond to critical indicators, and inadequate well control response by the companies and individuals involved. In particular, the BOEMRE Report stated that BP made a series of decisions that complicated the cement job... -

Page 106

.... The BSEE has stated that this is the first time the Department of the Interior has issued INCs directly to a contractor that was not the well' s operator. We have not accrued any amounts related to the INCs. In December 2011, the National Academy of Sciences released a pre-publication copy of its... -

Page 107

... the drilling environment to which they are being applied; and that operating companies should have ultimate responsibility and accountability for well integrity, well design, well construction, and the suitability of the rig and associated safety equipment. The Cementing Job and Reaction to Reports... -

Page 108

... the drilling rig at the time of the incident. Another six lawsuits naming us and others relate to alleged personal injuries sustained by those responding to the explosion and oil spill. Plaintiffs originally filed the lawsuits described above in federal and state courts throughout the United States... -

Page 109

..., and MOEX Offshore 2007 LLC (MOEX), who has an approximate 10% interest in the Macondo well, filed a claim against us alleging negligence. Cameron International Corporation (Cameron) (the manufacturer and designer of the blowout preventer), M-I Swaco (provider of drilling fluids and services, among... -

Page 110

..., common law libel, slander, and business disparagement. Our claims allege that the BP Defendants knew or should have known about an additional hydrocarbon zone in the well that the BP Defendants failed to disclose to us prior to our designing the cement program for the Macondo well. The location of... -

Page 111

.... In addition, certain state laws, if deemed to apply, would not allow for enforcement of indemnification for gross negligence, and may not allow for enforcement of indemnification of persons who are found to be negligent with respect to personal injury claims. Financial analysts and the press have... -

Page 112

... consolidated financial statements. KBR filed a motion to vacate the arbitration award with the United States District Court for the Southern District of New York. See Note 7 for additional information regarding the KBR indemnification. Securities and related litigation In June 2002, a class action... -

Page 113

... current and former Halliburton directors and officers containing various allegations of wrongdoing including violations of the FCPA, claimed KBR offenses while acting as a government contractor in Iraq, claimed KBR offenses and fraud under United States government contracts, Halliburton activity... -

Page 114

... oversight responsibilities and establish adequate internal controls, including controls and procedures related to cement testing and the communication of test results, as they relate to the Macondo well incident. Our Board of Directors designated a special committee of independent and disinterested... -

Page 115

... December 31, 2011 and $47 million as of December 31, 2010. Our total liability related to environmental matters covers numerous properties. Between 1965 and 1991, a former Halliburton unit known as the Halliburton Industrial Services Division (HISD) performed work for the U.S. Department of Defense... -

Page 116

... use of land, offices, equipment, manufacturing and field facilities, and warehouses. Total rentals, net of sublease rentals, were $735 million in 2011, $591 million in 2010, and $528 million in 2009. Future total rentals on noncancellable operating leases are as follows: $207 million in 2012; $166... -

Page 117

... dollars United States Foreign Total Reconciliations between the actual provision for income taxes on continuing operations and that computed by applying the United States statutory rate to income from continuing operations before income taxes were as follows: Year Ended December 31 2011 2010 2009... -

Page 118

...December 31 2011 2010 $ 345 139 64 48 44 30 29 110 809 648 38 68 754 44 11 $ 313 52 77 47 50 28 44 106 717 631 48 57 736 22 (41) Millions of dollars Gross deferred tax assets: Employee compensation and benefits Net operating loss carryforwards Accrued liabilities Insurance accruals Software revenue... -

Page 119

... 31, 2010, if resolved in our favor, would positively impact the effective tax rate and, therefore, be recognized as additional tax benefits in our statement of operations. Includes $42 million that could be resolved within the next 12 months. We file income tax returns in the United States federal... -

Page 120

...income Other comprehensive income (loss): Cumulative translation adjustment Defined benefit and other postretirement plans adjustments, net Total comprehensive income Balance at December 31, 2010 Cash dividends paid Stock plans Common shares purchased Tax loss from exercise of options and restricted... -

Page 121

...our international pension plans of $184 million at December 31, 2011, $170 million at Shares of common stock Millions of shares Issued In treasury Total shares of common stock outstanding 2011 1,073 (152) 921 December 31 2010 1,069 (159) 910 2009 1,067 (165) 902 Our stock repurchase program has... -

Page 122

... the terms of the Stock Plan, approximately 133 million shares of common stock have been reserved for issuance to employees and non-employee directors. At December 31, 2011, approximately 14 million shares were available for future grants under the Stock Plan. The stock to be offered pursuant to... -

Page 123

... of four years of service on the Board. We reserved 200,000 shares of common stock for issuance to non-employee directors, which may be authorized but unissued common shares or treasury shares. At December 31, 2011, 145,600 shares had been issued to non-employee directors under this plan. There were... -

Page 124

...of 4 years. Employee Stock Purchase Plan Under the ESPP, eligible employees may have up to 10% of their earnings withheld, subject to some limitations, to be used to purchase shares of our common stock. Unless the Board of Directors shall determine otherwise, each six-month offering period commences... -

Page 125

... average market price of the common shares. Note 12. Financial Instruments and Risk Management At December 31, 2011, we held $150 million of short-term, United States Treasury securities with maturities that extend through February 2012 compared to $653 million of short-term, United States Treasury... -

Page 126

... on current market conditions, future operating activities, and the associated cost in relation to the perceived risk of loss. The purpose of our foreign currency risk management activities is to minimize the risk that our cash flows from the sale and purchase of services and products in foreign... -

Page 127

... in marketable securities in high quality investments with various institutions. We derive the majority of our revenue from selling products and providing services to the energy industry. Within the energy industry, our trade receivables are generated from a broad and diverse group of customers... -

Page 128

..., usually as a function of age, years of service, and/or compensation. The unfunded obligations and net periodic benefit cost of our United States defined benefit plans were not material for the periods presented; and - our postretirement medical plans are offered to specific eligible employees. The... -

Page 129

...Fair value of plan assets at December 31, 2011 Common/collective trust funds (a) Equity funds Bond funds Balanced funds Non-United States equity securities Corporate bonds United States equity securities Other assets Fair value of plan assets at December 31, 2010 $ $ $ $ $ $ - - - 133 - 41 82... -

Page 130

... to local economic conditions. Discount rates were determined based on the prevailing market rates of a portfolio of high-quality debt instruments with maturities matching the expected timing of the payment of the benefit obligations. Expected long-term rates of return on plan assets were determined... -

Page 131

... timing of their delivery, and significant factors and estimates used to determine estimated selling prices. The update is effective for fiscal years beginning after June 15, 2010. The adoption of this update did not have a material impact on our consolidated financial statements or existing revenue... -

Page 132

... Basic weighted average common shares outstanding Diluted weighted average common shares outstanding Other financial data: Capital expenditures Long-term borrowings (repayments), net Depreciation, depletion, and amortization Payroll and employee benefits Number of employees (1) $ 2,953 978 1,359... -

Page 133

...loss) from discontinued operations Net income Diluted income per share attributable to company shareholders: Income from continuing operations Income (loss) from discontinued operations Net income Cash dividends paid per share Common stock prices (1) High Low 2010 Revenue Operating income Net income... -

Page 134

... Company Proxy Statement for our 2012 Annual Meeting of Stockholders (File No. 1-3492) under the caption "Stock Ownership of Certain Beneficial Owners and Management." Item 12(c). Changes in Control. Not applicable. Item 12(d). Securities Authorized for Issuance Under Equity Compensation Plans... -

Page 135

... the Halliburton Company Proxy Statement for our 2012 Annual Meeting of Stockholders (File No. 1-3492) under the caption "Corporate Governance" to the extent any disclosure is required and under the caption "The Board of Directors and Standing Committees of Directors." Item 14. Principal Accounting... -

Page 136

... of Halliburton Company, now known as Halliburton Energy Services, Inc. (the Predecessor), dated as of February 20, 1991, File No. 1-3492). Senior Indenture dated as of January 2, 1991 between the Predecessor and The Bank of New York Trust Company, N.A. (as successor to Texas Commerce Bank National... -

Page 137

... to Exhibit 4.7 to Halliburton' s Form 10-K for the year ended December 31, 1998, File No. 1-3492). Fourth Supplemental Indenture dated as of September 29, 1998 between Halliburton and The Bank of New York Trust Company, N.A. (as successor to Texas Commerce Bank National Association), as Trustee... -

Page 138

... by reference to Exhibit 4.16 to Halliburton' s Form 10-K for the year ended December 31, 2003, File No. 1-3492). Indenture dated as of October 17, 2003 between Halliburton and The Bank of New York Trust Company, N.A. (as successor to JPMorgan Chase Bank), as Trustee (incorporated by reference to... -

Page 139

...due 2041 (included as part of Exhibit 4.24). Halliburton Company Restricted Stock Plan for Non-Employee Directors (incorporated by reference to Appendix B of the Predecessor' s proxy statement dated March 23, 1993, File No. 1-3492). Dresser Industries, Inc. Deferred Compensation Plan, as amended and... -

Page 140

... s Form 10-K for the year ended December 31, 2007, File No. 1-3492). Executive Agreement (Lawrence J. Pope) (incorporated by reference to Exhibit 10.1 to Halliburton' s Form 8-K filed December 12, 2008, File No. 1-3492). Halliburton Company Stock and Incentive Plan, as amended and restated effective... -

Page 141

...Halliburton Company Benefit Restoration Plan, as amended and restated effective January 1, 2008 (incorporated by reference to Exhibit 10.2 to Halliburton' s Form 8-K filed September 21, 2009, File No. 1-3492). Halliburton Annual Performance Pay Plan, as amended and restated effective January 1, 2010... -

Page 142

...No. 1-3492). Executive Agreement (Christian A. Garcia). First Amendment to Halliburton Company Restricted Stock Plan for Non-Employee Directors. Form of Restricted Stock Agreement (Section 16 officers). Form of Non-Employee Director Restricted Stock Agreement (Stock and Incentive Plan). Statement of... -

Page 143

...directors signed in February 2012: Alan M. Bennett James R. Boyd Milton Carroll Nance K. Dicciani Murry S. Gerber S. Malcolm Gillis Abdallah S. Jum' ah Robert A. Malone J. Landis Martin Debra L. Reed * 31.1 Certification of Chief Executive Officer....PRE 101.DEF * ** Filed with this Form 10-K. ... -

Page 144

... individuals on this 16th day of February, 2012. HALLIBURTON COMPANY By /s/ David J. Lesar David J. Lesar Chairman of the Board, President, and Chief Executive Officer As required by the Securities Exchange Act of 1934, this report has been signed below by the following persons in the capacities... -

Page 145

...Robert A. Malone Robert A. Malone J. Landis Martin J. Landis Martin Debra L. Reed Debra L. Reed Title Director * Director * Director * Director * Director * Director * Director * Director * Director * Director * /s/ Christina M. Ibrahim Christina M. Ibrahim, Attorney-in-fact 130 -

Page 146

... President and Chief Executive Officer, Saudi Arabian Oil Company (2010) (C) (D) Robert A. MaloNe President and Chief Executive Officer, First National Bank of Sonora, Texas Retired Chairman of the Board and President, BP America Inc. (2009) (B) (C) J. LaNdis MartiN Founder and Managing Director... -

Page 147

281.871.2699 www.halliburton.com © 2012 Halliburton. All Rights Reserved. Printed in the USA H09007