Groupon 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Groupon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

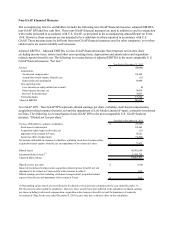

Non-GAAP Financial Measures

The accompanying letter to stockholders includes the following non-GAAP financial measures: adjusted EBITDA,

non-GAAP EPS and free cash flow. These non-GAAP financial measures are used in addition to and in conjunction

with results presented in accordance with U.S. GAAP, as presented in the accompanying Annual Report on Form

10-K. However, these measures are not intended to be a substitute for those reported in accordance with U.S.

GAAP. These measures may be different from non-GAAP financial measures used by other companies, even when

similar terms are used to identify such measures.

Adjusted EBITDA – Adjusted EBITDA is a non-GAAP financial measure that comprises net income (loss)

excluding income taxes, interest and other non-operating items, depreciation and amortization and acquisition-

related expense (benefit), net. The following is a reconciliation of adjusted EBITDA to the most comparable U.S.

GAAP financial measure, "Net loss."

Year Ended December 31, 2013

Net loss (88,946)$

Adjustments:

Stock-based compensation 121,462

Acquisition-related expense (benefit), net (11)

Depreciation and amortization 89,449

Non-operating items:

Loss (income) on equity method investments 44

Other expense (income), net 94,619

Provision for income taxes 70,037

Total adjustments 375,600

Adjusted EBITDA 286,654$

Non-GAAP EPS – Non-GAAP EPS represents diluted earnings per share excluding stock-based compensation,

acquisition-related expense (benefit), net and the impairment of Life Media Limited (F-tuan), a minority investment

in China. The following is a reconciliation of non-GAAP EPS to the most comparable U.S. GAAP financial

measure, “Diluted net loss per share.”

Year Ended December 31, 2013

Net loss attributable to common stockholders (95,393)$

Stock-based compensation 121,462

Acquisition-related expense (benefit), net (11)

Impairment of investment in F-tuan 85,521

Income tax effect of adjustments (38,504)

Net income attributable to common stockholders, excluding stock-based compensation,

acquisition-related expense (benefit), net and impairment of investment in F-tuan 73,075$

Diluted shares 663,910,194

Incremental diluted shares(1) 15,501,759

Ad jus ted d iluted s hares 679,411,953

Diluted net loss per share (0.14)$

Impact of stock-based compensation, acquisition-related expense (benefit), net and

impairment of investment in F-tuan and the related income tax effects 0.25

Diluted earnings per share excluding stock-based compensation, acquisition-related

expense (benefit), net and impairment of investment in F-tuan 0.11$

(1) Outstanding equity awards are not reflected in the diluted net loss per share calculation for the year ended December 31,

2013 because the effect would be antidilutive. However, those awards have been reflected in the calculation of diluted earnings

per share excluding stock-based compensation, acquisition-related expense (benefit), net and the impairment of a minority

investment in China for the year ended December 31, 2013 because they have a dilutive effect on that calculation.