Graco 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 Graco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Newell Rubbermaid 3 2014 Annual Report

our Rubbermaid Consumer storage business.

Normalized gross margin increased 90 basis points

to 38.8 percent, enabling a 70 basis point increase in

advertising and promotion investment as a percentage

of sales. Even with this increased investment,

normalized operating margins expanded 40 basis

points to 13.8 percent. Normalized earnings per share

grew 9.9 percent to $2.00, an all-time high for Newell

Rubbermaid, and operating cash flow increased to

$634 million.

Our Win Bigger businesses — Writing, Tools and

Commercial Products — led our performance with

combined core sales growth of 7.3 percent. These

segments, which are the major drivers of future

company growth and our first priority for expansion

in faster-growing emerging markets, have benefited

from significantly increased investment behind our

brands and stronger innovation. Writing segment

core sales increased 7.8 percent, led by double-digit

core growth in Latin America and mid-single digit

core sales growth in North America. These results

were fueled by strong innovation, expanded

distribution and increased advertising support with

activity across all our major brands, including the

launch of Sharpie Clear View® Highlighter, the

relaunch of Mr Sketch® scented markers and ongoing

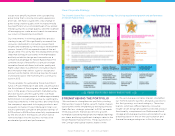

Three-stage transformation

2014

DELIVERY STRATEGIC ACCELERATION

consistently do

what we say

2013 2015 2016/20172012

shape the

future

accelerate

performance

support of our Paper Mate® InkJoy® platform. Tools

segment core sales improved 6.3 percent, driven by

solid growth across all geographic regions, including

double-digit core growth in Latin America due to

the ongoing success of our expanded product

oerings under the Irwin® brand and a year of

strong growth for the Lenox® brand. Commercial

Products’ core sales grew 7.2 percent, reflecting

pricing and strong volume growth in North

America as we supported key product lines such

as Brute® trash cans and Rubbermaid® HYGEN™

microfiber, as well as distribution gains in

emerging markets such as Brazil and China.

OUR BUSINESS MODEL

IS GAINING MOMENTUM

The success of our Win Bigger businesses gives us

increasing confidence that our new business model

is working. Newell Rubbermaid is in the midst of

transforming from a holding company to an operating

company, from a loose federation of independent

businesses to a single, coherent organization that

harnesses the scale of a $6 billion company. This enables

us to place more strategic bets and allocate resources

more dynamically to those businesses, brands and

initiatives with the greatest right to win. Our unwavering

focus on reducing structural and overhead costs

and reinvesting those savings into brand building

and enhanced capabilities have already contributed

to improved performance, and that trend should

continue to accelerate as we move through 2015

and into the Acceleration phase of the Growth

Game Plan in 2016 and beyond.

Strengthened investment in our brands coupled

with stronger innovation will be key to that outcome.

In 2014, we significantly increased our brand-building

investment, nearly doubling our advertising spend

versus the prior year. This step up in spending

helped drive market share gains and increased

point-of-sale growth across our portfolio, including

key brands such as Sharpie®, Paper Mate®, Expo,®

Mr Sketch®, Irwin®, Lenox®, Rubbermaid® Commercial

Products and Graco®. With the consolidation

of multiple creative agencies into one and a more

disciplined marketing approach, the quality of

our advertising has improved significantly, testing

amongst the best across all industries. Of the

14 major advertising campaigns executed in 2014,

over 85 percent garnered the top box test scores

for both consumer persuasion and awareness,

two key predictive metrics of success. That rate

is double the industry norm. So not only are we

winning on the quality of our innovation ideas,

In the Strategic phase, we are investing in

core activity systems critical to our business

success and establishing an operating company

structure that releases the full potential of our

$6 billion business.