Goldman Sachs 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2000

Table of contents

-

Page 1

ANNUAL REPORT 2000 -

Page 2

...2 Letter to Shareholders 4 Our Core Businesses 5 Financial Highlights 6 Culture 1 2 Innovation 18 Execution 24 The Goldman Sachs Foundation 2 5 Financial Information 7 6 Board Members, Officers and Directors 82 International Advisors and Offices 8 3 Shareholder Information 84 Our Business Principles -

Page 3

...formidable global competitors. For others, our commitment to the superior execution of complex deals reinforced their trust in us and contributed to their continued success. As a firm, we pride ourselves on our high level of client service. The people of Goldman Sachs remain committed to our culture... -

Page 4

... Investments) and Asset Management and Securities Services. Our goal is for Goldman Sachs to be the financial advisor of choice for the most important and influential corporations, institutions and individuals worldwide. It is critical that we capture - and keep - a leading share of the high... -

Page 5

... the mortgage-backed securities market in the 1980s. As co-head of our FICC Division from 1994 to 2000 and, from May 2000, president and CEO of GS Ventures, the firm's financial services incubator, Mike was one of the most respected and beloved members of the Goldman Sachs family. Looking ahead, the... -

Page 6

OUR CORE BUSINESSES Goldman Sachs is a leading global investment banking and securities firm that provides a wide range of services worldwide to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals. Our activities ... -

Page 7

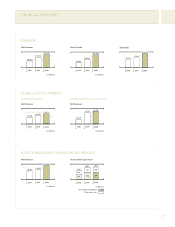

... 1998 1999 2000 GLOBAL CAPITAL MARKETS Investment Banking Net Revenues Trading and Principal Investments Net Revenues $5,773 $6,627 $5,371 $3,368 $4,359 $2,379 1998 1999 2000 ( in millions ) 1998 1999 2000 ( in millions ) ASSET MANAGEMENT AND SECURITIES SERVICES Net Revenues $4,592 $485... -

Page 8

... Events such as the first annual Goldman Sachs outing set the foundation for the firm's distinctive culture. Our culture's success is based on its ability to grow and adapt to its new environments without losing its sense of cohesion or compromising its principles. As global demand for our services... -

Page 9

2000 Goldman Sachs continues to value teamwork, integrity, excellence and entrepreneurship. The culture has allowed us to strengthen our position as the employer of choice in our industry. -

Page 10

.... 1922 Goldman Sachs is committed to hiring the best people and is one of the first investment banks to annually recruit MBAs from Harvard Business School. 1978 Goldman Sachs creates its original business principles. 1869 Marcus Goldman establishes M. Goldman, banker and broker, on Pine Street in... -

Page 11

... Community Service Department . 2000 Goldman Sachs continues its commitment to training, offering its people an average of 60 hours of professional development and setting up Pine Street, a training and development initiative for its managing directors. 1999 Goldman Sachs becomes a public company... -

Page 12

... in investment banking, sales and trading, or software design and systems implementation, our search for talent knows no bounds. This process is aided by robust programs to identify undergraduates, graduates and experienced hires who are team- and goal-oriented, and who thrive on challenges. Our... -

Page 13

... by initiatives focused on more universal aspects of our business and on such vital issues as diversity, our culture and leadership. Pine Street, our newest leadership development program, concentrates on training the current and future leaders of our firm. The effectiveness of this global learning... -

Page 14

... change. he people of Goldman Sachs have inherited a tradition of innovation that stretches back to our founders. Innovation across all aspects of our products, services and operations continues to be a requirement of success in one of the world's most dynamic industries. Our clients have benefited... -

Page 15

2000 We see the impact of technological change in almost every aspect of business worldwide. Our goal is to have technology that matches - and helps manage - the web of relationships we have around the world. -

Page 16

... and investment in ideas. 1982 In recognition of the special needs of a growing group of small and medium-sized companies with exceptional promise, the firm establishes a high technology group. 1927 Goldman Sachs introduces automated client statements that detail trades . 1950s Goldman Sachs... -

Page 17

...Goldman Sachs enhances client service by creating a proprietary Web site, the GS Financial WorkbenchSM, helping clients plan and execute investment strategies. Global e-mail boxes 1998 Goldman Sachs leads the bulge bracket by structuring its equity research around global teams. 1998 Despite market... -

Page 18

... is a product of this strategic relationship." The World Bank Group Gumersindo Oliveros, Director, Treasury Finance "Goldman Sachs was our lead manager of choice for many reasons. An electronic bond issue requires e-preparedness for book building, distribution and trading. Goldman Sachs was way... -

Page 19

... Sachs was financial advisor to Infineon Technologies AG on its approximately â,¬6.1 billion initial public offering, the largest corporate IPO in Germany and the largest European high-tech offering ever. AES Corporation Joseph Brandt "We felt that Goldman Sachs was one of the very few investment... -

Page 20

...businesses. SLK is a leading stock and options clearing firm in the United States, employing technology developed over years of serving highly demanding professional trading organizations. SLK also has a leadership position in providing liquidity in all major U.S. equities markets, with an important... -

Page 21

2000 By combining with Spear, Leeds & Kellogg, Goldman Sachs offers a suite of integrated services that include market making, trading and execution capabilities. -

Page 22

... dedicated mergers and acquisitions services and becomes one of the first investment banks to create a separate department solely for this purpose. 1981 Goldman Sachs acquires J. Aron & Co. to establish a stronger global presence in the currency and commodities markets. FTSE 100 1970s Recognizing... -

Page 23

... global coordinator and bookrunner for NTT DoCoMo's IPO, the largest corporate IPO in history . Goldman Sachs combines with Spear, Leeds & Kellogg to become one of the leading market makers of equities and options in the U.S. marketplace. 1990 In order to shorten trade execution time, Goldman Sachs... -

Page 24

...." • Goldman Sachs was the sole global coordinator and bookrunner on TSMC's $1.2 billion offering of American Depositary Shares, which was one of the largest corporate equity issues in non-Japan Asia at the time. GS Capital Partners 2000 Fund (GSCP 2000) The firm's Principal Investment Area (PIA... -

Page 25

... Banking Corporation / United Financial of Japan The Goldman Sachs advisory team worked closely with the banks to assess their position in an increasingly competitive environment and identify opportunities for structural changes and increased efficiencies. China Mobile (Hong Kong) Limited Wang... -

Page 26

... of $1 million with infusions of "social capital," in the form of professional services, volunteer time and the business expertise of Goldman Sachs executives. The Foundation allocated $20.4 million in grants to education and youth-serving institutions worldwide in its first year of operation. 24 -

Page 27

...-Term Debt Regulated Subsidiaries Risk Management Risk Management Structure Risk Limits Market Risk Trading Net Revenues Distribution Nontrading Risk Credit Risk Derivative Contracts Operational Risks Accounting Developments 46 REPORT OF INDEPENDENT ACCOUNTANTS 47 CONSOLIDATED FINANCIAL STATEMENTS... -

Page 28

... of private consumption and concerns about corporate and government debt led to declines in the Japanese equity market during the year. The Bank of Japan's zero-interest-rate policy was terminated and interest rates were raised for the first time in a decade. 26 Goldman Sachs Annual Report 2000 -

Page 29

..., Goldman Sachs' conversion to corporate form in 1999 has affected, and will continue to affect, our operating results in several significant ways. As a corporation, payments for services rendered by managing directors who, prior to our conversion to corporate form, were profit participating limited... -

Page 30

... increasing over the past several years. In addition, we have also experienced, due to competitive factors, pressure to extend credit against less liquid collateral and price more aggressively the credit risks we take. As a clearing member firm, we finance our customer positions and we could be held... -

Page 31

...in 1998 are not comparable with 2000 or 1999. On May 7, 1999, we converted from a partnership to a corporation and completed our initial public offering. Pro forma net earnings reflect the results of Goldman Sachs as if our conversion to corporate form and related transactions had taken place at the... -

Page 32

... daily and, therefore, its value and our net revenues are subject Global Capital Markets The components of the Global Capital Markets segment are set forth below: Investment Banking. Goldman Sachs provides a broad range of investment banking services to a diverse group of corporations, financial... -

Page 33

... our leadership position in the mergers and acquisitions and new issues markets, and benefited from increased levels of activity worldwide. Net revenue growth was strong in all major regions, particularly in the high technology and communications, media and entertainment sectors. Net revenues in... -

Page 34

... in the communications, media and entertainment, high technology, energy and power, and healthcare sectors. Financial Advisory revenues increased 28% compared with 1998. Goldman Sachs maintained its leading position in the advisory business and benefited from an increase in mergers and acquisitions... -

Page 35

... contributed to the net revenue growth in 1999. Operating expenses increased, principally due to the inclusion of compensation expense related to services rendered by managing directors who, prior to our conversion to corporate form, were profit participating limited partners and increased costs... -

Page 36

... all of the costs of these employees are reimbursed to Goldman Sachs by the real estate investment funds to which these companies provide property management services. Includes 2,600 employees related to the combination with SLK. (2) 2000 versus 1999. Operating expenses in 2000 were $11.57 billion... -

Page 37

... associated with Goldman Sachs' conversion to corporate form and related transactions, the inclusion of compensation expense related to services rendered by managing directors who were profit participating limited partners, higher levels of compensation commensurate with higher net revenues and... -

Page 38

... our risk management process. The Finance Committee meets monthly, and more often when necessary, to evaluate our liquidity position and funding requirements. Our Corporate Treasury Department manages the capital structure, funding, liquidity, and relationships with creditors and rating agencies on... -

Page 39

... permit us to fund our positions on a fully secured basis in the event that we were unable to replace our unsecured debt maturing within one year. Intercompany Funding. Most of the liquidity of Goldman Sachs is raised by the parent company, The Goldman Sachs Group, Inc. The parent company then lends... -

Page 40

...with short-term floating rates of interest in order to minimize our exposure to interest rates and foreign exchange movements. See Note 6 to the consolidated financial statements for further information regarding our long-term borrowings. Risk Management Structure Goldman Sachs seeks to monitor and... -

Page 41

... models and the pricing of positions determined by individual business units. Risk Limits Business unit risk limits are established by the various risk committees and may be further allocated by the business unit managers to individual trading desks. Market risk limits are monitored on a daily... -

Page 42

... management and security services activities as well as our trading revenues. VaR. VaR is the potential loss in value of Goldman Sachs' trading positions due to adverse market movements over a defined time horizon with a specified confidence level. For the VaR numbers reported below, a one-day time... -

Page 43

... table sets forth the daily VaR for substantially all of our trading positions: Daily VaR (in millions) Risk Categories As of November 2000 1999 Year Ended November 2000 Average High Low Interest rates Currency rates Equity prices Commodity prices Diversification effect(1) Firmwide (1) $ 11... -

Page 44

... for the year ended November 2000: Daily Trading Net Revenues 70 60 Number of Days 50 40 30 20 10 0 (30)-(20) (10)-0 (20)-(10) 30-40 20-30 0-10 10-20 Daily Trading Net Revenues ($ in millions) As part of our overall risk control process, daily trading net revenues are compared with VaR... -

Page 45

...part of a broader trading strategy. Accordingly, the market risk of derivative positions is managed with all of our other nonderivative risk. Derivative contracts are reported on a net-by-counterparty basis on our consolidated statements of financial condition where management believes a legal right... -

Page 46

... of an agent acting on our behalf. The Global Operations Department is responsible for establishing, maintaining and approving policies and controls with respect to the accurate inputting and processing of transactions, clearance and settlement of transactions, Operational Risks Goldman Sachs may... -

Page 47

... areas of Goldman Sachs, including the Legal and Compliance departments, for ensuring compliance with applicable regulations with respect to the clearance and settlement of transactions and the margining of positions. The Network Management Department oversees our relationships with our clearance... -

Page 48

REPORT OF INDEPENDENT ACCOUNTANTS To the Board of Directors and Shareholders, The Goldman Sachs Group, Inc.: In our opinion, the accompanying consolidated statements of financial condition and the related consolidated statements of earnings, changes in shareholders' equity and partners' capital, ... -

Page 49

...) 2000 1999 1998 Revenues Global capital markets Investment banking Trading and principal investments Asset management and securities services Interest income Total revenues Interest expense Revenues, net of interest expense Operating expenses Compensation and benefits Nonrecurring employee initial... -

Page 50

... under agreements to resell Right to receive securities Financial instruments owned, at fair value Commercial paper, certificates of deposit and time deposits U.S. government, federal agency and sovereign obligations Corporate debt Equities and convertible debentures State, municipal and provincial... -

Page 51

... per share amounts) 2000 1999 1998 Partners' capital Balance, beginning of year Transfer of beginning partners' capital allocated for income taxes and potential withdrawals Net earnings Capital contributions Return on capital and certain distributions to partners Termination of profit participation... -

Page 52

...firm's conversion to corporate form in 1999, junior subordinated debentures of $371 million were issued to retired limited partners in exchange for their partnership interests. The accompanying notes are an integral part of these consolidated financial statements. 50 Goldman Sachs Annual Report 2000 -

Page 53

... INCOME Year Ended November (in millions) 2000 1999 1998 Net earnings Currency translation adjustment, net of tax Comprehensive income $3,067 (167) $2,900 $2,708 37 $2,745 $2,428 (31) $2,397 The accompanying notes are an integral part of these consolidated financial statements. 51 -

Page 54

...FINANCIAL STATEMENTS Note 1/Description of Business The Goldman Sachs Group, Inc. (Group Inc.), a Delaware corporation, together with its consolidated subsidiaries (collectively, the firm), is a global investment banking and securities firm that provides a wide range of financial services worldwide... -

Page 55

... basis on the consolidated statements of financial condition where management believes a legal right of setoff exists under an enforceable netting agreement. Principal Investments Principal investments are carried at fair value, generally based upon quoted market prices or comparable substantial... -

Page 56

... Foreign Currency Translation Assets and liabilities denominated in non-U.S. currencies are translated at rates of exchange prevailing on the date of the statement of financial condition, and revenues and expenses are translated at average rates of exchange for 54 Goldman Sachs Annual Report 2000 -

Page 57

...except per share amounts) 2000 1999 Revenues, net of interest expense Net earnings Basic EPS Diluted EPS $18,630 3,459 6.66 6.32 $14,652 2,595 5.06 4.97 Note 4/Financial Instruments Financial instruments, including both cash instruments and derivatives, are used to manage market risk, facilitate... -

Page 58

... performed by groups that are independent from revenue-producing departments. Market Risk. The potential for changes in the market value of the firm's trading positions is referred to as "market risk." The firm's trading positions result from underwriting, market making, specialist and proprietary... -

Page 59

... rate Equity Currency and commodity $427,176 123,645 212,583 $484,104 114,680 210,421 The firm utilizes replacement cost as its measure of derivative credit risk. Replacement cost, as reported in "Financial instruments owned, at fair value" on the consolidated statements of financial condition... -

Page 60

... 1999, weighted average interest rates for short-term borrowings, including commercial paper, were 6.43% and 5.66%, respectively. (2) The firm maintains unencumbered securities with a market value in excess of all uncollateralized short-term borrowings. 58 Goldman Sachs Annual Report 2000 -

Page 61

... the federal funds rate. Certain equity-linked and indexed instruments are included in floating rate obligations. Long-term borrowings have maturities that range from one to 30 years from the date of issue. (2) (3) Long-term borrowings by maturity date are set forth below: As of November 2000 (in... -

Page 62

... and rent charged to operating expense for the last three years are set forth below: (in millions) Minimum Rental Commitments 2001 2002 2003 2004 2005 2006-Thereafter Total Net Rent Expense 2000 1999 1998 $ 355 334 335 391 374 2,524 $4,313 $ 240 154 104 60 Goldman Sachs Annual Report 2000 -

Page 63

... 2000, Sumitomo Bank Capital Markets, Inc. exchanged all 7.4 million shares of its nonvoting common stock, par value $0.01 per share, of Group Inc. for an equal number of shares of voting common stock. On March 20, 2000, the Board of Directors of Group Inc. approved a common stock repurchase program... -

Page 64

... 1999, respectively. For plans in which the accumulated benefit obligation exceeded the fair value of plan assets, the effect of recognizing this amount would not have been material to the consolidated statements of financial condition or comprehensive income. 62 Goldman Sachs Annual Report 2000 -

Page 65

...to develop net periodic pension cost and the actuarial present value of the projected benefit obligation are set forth below. The assumptions represent a weighted average of the assumptions used for the U.S. and international plans and are based on the economic environment of each applicable country... -

Page 66

... as of the last day of the immediately preceding fiscal year, increased by the number of shares available for awards in previous fiscal years but not covered by awards granted in such years. As of November 2000 and November 1999, 156.2 million shares and 183.4 million shares were available for... -

Page 67

...tions for terminations of employment due to death, retirement, extended absence or a change in control. Once service requirements have been met, these options will generally remain exercisable, subject to satisfaction of certain conditions, until the tenth anniversary of the date of grant. Pursuant... -

Page 68

... option pricing model using the following weighted average assumptions: Year Ended November 2000 1999 In the preceding table, pro forma compensation expense associated with option grants is recognized over the relevant vesting period. Note 12/Income Taxes Prior to its conversion to corporate form... -

Page 69

... in future years and are measured using the tax rates and laws that will be in effect when such differences are expected to reverse. In connection with the conversion from a partnership to a corporation, the firm recognized a deferred tax benefit related to the revaluation of net deferred tax... -

Page 70

... Markets The Global Capital Markets segment includes services related to the following: Investment Banking. The firm provides a broad range of investment banking services to a diverse group of corporations, financial institutions, governments and individuals. 68 Goldman Sachs Annual Report 2000 -

Page 71

...makes markets in, acts as a specialist for, and trades equities and equity-related products, structures and enters into equity derivative transactions, and engages in proprietary trading and equity arbitrage; and • Principal Investments. Principal Investments primarily represents net revenues from... -

Page 72

... of employee initial public offering awards of $268 million and (iii) the charitable contribution to The Goldman Sachs Foundation of $200 million made at the time of the firm's initial public offering. As a partnership, payments for services rendered by profit participating limited partners were... -

Page 73

... forth the net revenues of the firm's two segments: Year Ended November (in millions) 2000 1999 1998 Financial Advisory Underwriting Investment Banking FICC Equities Principal Investments Trading and Principal Investments Total Global Capital Markets Asset Management Securities Services Commissions... -

Page 74

... of employee initial public offering awards of $268 million and (iii) the charitable contribution to The Goldman Sachs Foundation of $200 million made at the time of the firm's initial public offering. As a partnership, payments for services rendered by profit participating limited partners were... -

Page 75

... Goldman Sachs Foundation of $200 million made at the time of the firm's initial public offering. Includes a net tax benefit of $825 million related to the firm's conversion to corporate form, a benefit of $880 million related to the granting of employee initial public offering awards and a benefit... -

Page 76

... commenced trading on the New York Stock Exchange under the symbol "GS." Prior to that date, there was no public market for the firm's common stock. The following table sets forth, for the fiscal quarters indicated, the high and low closing prices per share of the firm's common stock as reported by... -

Page 77

... of the costs of these employees are reimbursed to Goldman Sachs by the real estate investment funds to which these subsidiaries provide property management services. (4) Substantially all assets under supervision are valued as of calendar month-end. (5) In 2000, pre-tax earnings included a charge... -

Page 78

... of the Board of Sara Lee Corporation James A. Johnson Chairman and Chief Executive Officer of Johnson Capital Partners Dr. Ruth J. Simmons President of Smith College John L. Weinberg Former Senior Partner and Chairman of the Management Committee, Goldman, Sachs & Co. Management Committee Henry... -

Page 79

... Casati Andrew A. Chisholm Abby Joseph Cohen Frank T. Connor Claudio Costamagna...John R. Tormondsen Robert B. Tudor III John E. Urban A. Carver Wickman Susan A. Willetts Steven J. Wisch W. Thomas York, Jr. Jide J. Zeitlin Herbert E. Ehlers M. Roch Hillenbrand Simon M. Robertson* Malcolm B. Turnbull... -

Page 80

... John H. Taylor Greg W. Tebbe Daisuke Toki Harkanwar Uberoi John J. Vaske George H. Walker IV David R. Walton Hsueh-Ming Wang David M. Weil Mark S. Weiss Barbara A. White Tetsufumi Yamakawa James P. Ziperski Sofia Katzap Philip J. Pifer R. Douglas Henderson 78 Goldman Sachs Annual Report 2000 -

Page 81

... Karen R. Cook Alberto F. Ades Gregory A. Agran Raanan A. Agus Lay Pheng Ang Dean C. Backer Michiel J. Bakker Mark E. Bamford Carl-Georg BauerSchlichtegroll Patrick Y. Baune Stuart N. Bernstein Randall A. Blumenthal Alison L. Bott James K. Brown John J. Bu Mark J. Buisseret Andrew J. Burke-Smith... -

Page 82

...Y. Friedman Robert K. Frumkes Richard A. Genna Kenneth K. Gershenfeld Rajiv A. Ghatalia Robert R. Gheewalla Gary T. Giglio Pedro Gonzalez Grau Roger H.... John P. Rustum Neil I. Sarnak Atsuko Sato Masanori Sato Marc P. Savini Erich P. Schlaikjer Thomas M. Schwartz 80 Goldman Sachs Annual Report 2000 -

Page 83

... Gary J. Sveva Gary S. Tolchin Brian J. Toolan Lawrence F. Trainor George F. Varsam Thomas L. Williams Bryant M. Yunker, Jr. Alphonse Zenna Gregory Zenna Timothy G. Freshwater John L. Weinberg Peter M. Sacerdote Peter R. Coneway Eric S. Dobkin Peter K. Barker Joseph H. Wender Jonathan L. Cohen... -

Page 84

...Ambassador Kim Kihwan Klaus Luft Senator Michael J. Mansfield Jacques Mayoux C. Roger Moss O.B.E. Dr. Cherry Qingyuan Li Ambassador Arifin M. Siregar Martin ... Seoul Shanghai Singapore Stockholm Sydney Taipei Tampa Tokyo Toronto Vancouver Washington, D.C. Zurich 82 Goldman Sachs Annual Report 2000 -

Page 85

... Transfer Agent and Registrar for Common Stock Questions from registered shareholders of The Goldman Sachs Group, Inc. regarding lost or stolen stock certificates, dividends, changes of address and other issues related to registered share ownership should be addressed to: Mellon Investor Services... -

Page 86

... fair competitors and must never denigrate other firms. 14 Integrity and honesty are at the heart of our business. We expect our people to maintain high ethical standards in everything they do, both in their work for the firm and in their personal lives. 84 Goldman Sachs Annual Report 2000 -

Page 87

...this document may refer to The Goldman Sachs Group, Inc. and/or its subsidiaries and affiliates worldwide, or to one or more of them, depending on the context in each instance. All marks indicated by ®,™ or SM are trademarks or service marks or both of Goldman, Sachs & Co. New York Stock Exchange... -

Page 88

www.gs.com