Famous Footwear 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Famous Footwear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BROWN SHOE COMPANY, INC. 2003 FORM 10-K

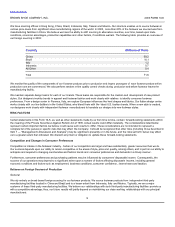

Gross Profit

Gross profit increased $17.9 million, or 2.4%, to $758.7 million in fiscal year 2003 and increased $74.5 million, or 11.2%, to $740.8 million

in fiscal year 2002. As a percentage of sales, gross profit increased to 41.4% in fiscal year 2003 compared to 40.2% in fiscal year 2002 and

37.9% in fiscal year 2001. We record warehousing, distribution, sourcing and other inventory procurement costs in selling and

administrative expenses. Accordingly, our gross profit and selling and administrative expense rates, as a percentage of sales, may not be

comparable to other companies.

The increase in gross profit and the gross profit percentage in 2003 are due primarily to higher markups at Famous Footwear generated from

a fresher mix of merchandise. Modest gross profit improvements within the Wholesale division were offset by declines in gross profit at the

Naturalizer Retail division. Cost of goods sold for 2003 includes a special charge of $1.6 million (out of a total charge of $4.5 million) to

liquidate inventory as we close our last Canadian factory in 2004.

The increase in the gross profit and gross profit percentage in 2002 primarily reflected improved gross profits at Famous Footwear as a result

of improved inventory freshness and $20.1 million of special charges in 2001 related to closing Naturalizer stores and inventory reductions at

Famous Footwear as described in Note 3 to the consolidated financial statements.

Selling and Administrative Expenses

Selling and administrative expenses, which include warehousing and distribution costs of $50.0 million in 2003, $51.1 million in 2002 and

$53.1 million in 2001, increased $14.1 million, or 2.1%, to $681.6 million in fiscal year 2003 and increased $14.4 million, or 2.2%, to

$667.5 million in fiscal year 2002. As a percent of net sales, selling and administrative expenses were 37.2%, 36.2% and 37.1% in fiscal

years 2003, 2002 and 2001, respectively.

The increase in selling and administrative expenses in 2003 is primarily a result of a special charge of $2.9 million (out of a total charge of

$4.5 million) to close the last Canadian factory, $9.9 million higher retail facilities costs and a $5.0 million increase in buying, merchandising

and administrative costs.

The increase in selling and administrative expenses in 2002 is a result of increased costs at the new, larger Famous Footwear stores and

higher incentive plan costs throughout the Company. Offsetting this increase were savings from the adoption of the shared-services

platforms in the information systems, human resources and finance functions. Selling and administrative costs were also offset in 2002 by

$1.2 million in recoveries of special charges, including those related to an excess severance reserve related to our new shared-services

platform, and an excess reserve established to close Naturalizer retail stores, both of which we originally recorded during fiscal year 2001. As

a percent of net sales, selling and administrative costs declined as 2002 sales growth outpaced growth in selling and administrative costs.

Selling and administrative expenses in 2001 include $21.3 million of special charges as described in Note 3 to the consolidated financial

statements.

Provision for Environmental Litigation Costs

We recorded a $3.1 million charge in 2003 related to our class action litigation related to the Redfield site in Denver, Colorado, and related

costs, including the verdict, anticipated pretrial interest and sanction costs.

Interest Expense

Interest expense decreased $2.4 million to $9.8 million in fiscal year 2003 and decreased $8.0 million to $12.2 million in fiscal year 2002.

The decreases reflect a reduction in debt obligations of $33.0 million during fiscal year 2003 and $63.8 million in 2002 and lower interest

rates in both periods. Increased earnings and lower inventory levels have contributed to strong cash flows and lower average borrowings

during both periods.

Income Tax Provision

Our consolidated effective tax rate in 2003 and 2002 was 27.5% and 26.5%, respectively, compared to a 70.1% tax benefit rate in 2001. We

do not provide deferred taxes on unremitted foreign earnings, as it is our intention to reinvest these earnings indefinitely or to repatriate the

earnings only when it is tax-advantageous to do so. The 2003 and 2002 effective tax rate is below the federal statutory rate of 35%, because

foreign earnings are subject to lower statutory tax rates. The 2001 effective tax rate reflects domestic losses tax-affected at the federal statutory

rate and foreign earnings tax-affected at rates lower than the federal statutory rate. See Note 5 to the consolidated financial statements for

further discussion.

18