FairPoint Communications 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

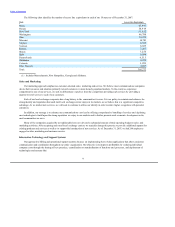

The following chart identifies the number of access line equivalents in each of our 18 states as of December 31, 2007:

Maine 65,947

Florida 54,919

New York 51,652

Washington 46,788

Ohio 14,928

Missouri 14,783

Virginia 8,538

Vermont 8,025

Kansas 7,287

Illinois 7,256

Idaho 6,884

Pennsylvania 6,515

Oklahoma 4,289

Colorado 3,899

Other States(1) 4,067

Total: 305,777

(1) Includes Massachusetts, New Hampshire, Georgia and Alabama.

Our marketing approach emphasizes customer-oriented sales, marketing and service. We believe most communications companies

devote their resources and attention primarily toward customers in more densely populated markets. To the extent we experience

competition for any of our services, we seek to differentiate ourselves from the competitors providing such services by providing a

superior level of service to each of our customers.

Each of our local exchange companies has a long history in the communities it serves. It is our policy to maintain and enhance the

strong identity and reputation that each rural local exchange carrier enjoys in its markets, as we believe this is a significant competitive

advantage. As we market new services, we will seek to continue to utilize our identity in order to attain higher recognition with potential

customers.

In addition, our strategy is to enhance our communications services by offering comprehensive bundling of services and deploying

new technologies to build upon the strong reputation we enjoy in our markets and to further promote rural economic development in the

rural communities we serve.

Many of the companies acquired by us traditionally have not devoted a substantial amount of their operating budget to sales and

marketing activities. After acquiring such rural local exchange carriers, we typically change this practice to provide additional support for

existing products and services as well as to support the introduction of new services. As of December 31, 2007, we had 244 employees

engaged in sales, marketing and customer service.

Our approach to billing and operational support systems focuses on implementing best-of-class applications that allow consistent

communication and coordination throughout our entire organization. Our objective is to improve profitability by reducing individual

company costs through the sharing of best practices, centralization or standardization of functions and processes, and deployment of

technologies and systems that

9