FairPoint Communications 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QuickLinks -- Click here to rapidly navigate through this document

o

(Exact Name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction of

Incorporation or Organization)

(I.R.S. Employer Identification No.)

(Address of Principal Executive Offices)

(Zip code)

Registrant's Telephone Number, Including Area Code:

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Name of Exchange on Which Registered

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Securities Exchange Act of

1934). Yes o No

As of June 30, 2004, the Registrant had no equity securities registered pursuant to the Securities Exchange Act of 1934 and,

accordingly, had no public float.

As of March 15, 2005, there were 34,925,432 shares of the Registrant's common stock, par value $0.01 per share, outstanding.

Table of contents

-

Page 1

...Street, Suite 250 Charlotte, North Carolina (Address of Principal Executive Offices) 13-3725229 (I.R.S. Employer Identification No.) 28202 (Zip code) Registrant's Telephone Number, Including Area Code: (704) 344-8150 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class... -

Page 2

Documents incorporated by reference: None -

Page 3

... 10. 11. 12. 13. 14. Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accounting Fees and Services 119 124 132 135 136... -

Page 4

... on the information currently available to us and speak only as of the date on which this Annual Report was filed with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events... -

Page 5

... in the rural communities we serve, with limited competition. Demand for telephone services from our residential and local business customers has historically been very stable despite changing economic conditions. As a result, we have experienced a relatively stable access line count during the... -

Page 6

... strategies for enhanced and ancillary services to meet the growing needs of our customers. Our long standing relationships with our customers have helped us to successfully cross-sell broadband and value-added services, such as digital subscriber line, long distance, Internet dial-up, voicemail and... -

Page 7

...of class C common stock, on a one-for-one basis, into shares of our common stock. All share information in this Annual Report gives effect to the 5.2773714 for 1 reverse stock split and such reclassification and conversion. In connection with the offering, we entered into a new senior secured credit... -

Page 8

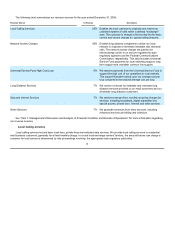

... of our basic local telephone service to customers within our service areas; (ii) the provision of network access to interexchange carriers for origination and termination of interstate and intrastate long distance phone calls; (iii) Universal Service Fund high cost loop payments; and (iv) the... -

Page 9

... a defined "exchange" area. The customer is charged a flat monthly fee for basic service and service charges for special calling features. 45% Enables long distance companies to utilize our local network to originate or terminate intrastate and interstate calls. The network access charges are paid... -

Page 10

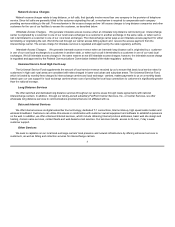

Network Access Charges Network access charges relate to long distance, or toll calls, that typically involve more than one company in the provision of telephone service. Since toll calls are generally billed to the customer originating the call, a mechanism is required to compensate each company ... -

Page 11

... voice mail, teleconferencing, video conferencing, store-and-forward fax, follow-me numbers, Centrex services and direct inward dial. Billing and Collection. Many interexchange carriers provide long distance services to our rural local exchange carrier customers and may elect to use our billing and... -

Page 12

...local phone service and (ii) the interexchange carriers which pay us for access to customers located within our local access and transport areas. In general, the vast majority of our local customers are residential, as opposed to business, which is typical for rural telephone companies. Information... -

Page 13

... services. This system supports advanced services including Asynchronous Transfer Mode, Frame Relay and/or Internet Protocol Transport, facilitating delivery of advanced services as demand warrants. In our rural local exchange carrier markets, digital subscriber line-enabled integrated access... -

Page 14

... companies, long distance carriers and cable television companies. Many of these companies provide direct access to the Internet and a variety of supporting services to businesses and individuals. In addition, many of these companies, such as America Online, Inc., Microsoft Network and Yahoo, offer... -

Page 15

... with our union and non-union employees is good. Within our company, 34 employees are employed at our corporate office, 804 employees are employed at our rural local exchange carriers and 9 employees are employed by Carrier Services. Intellegtual Property We believe we have the trademarks... -

Page 16

...Federal Communications Commission price structure. A significant amount of our revenues come from network access charges, which are paid to us by intrastate carriers and interstate long distance carriers for originating and terminating calls in the regions served by our rural local exchange carriers... -

Page 17

... on long distance carriers for connection to local networks. States often mirror federal rules in establishing intrastate access charges. In 2001, the Federal Communications Commission adopted an order implementing the beginning phases of the Multi Association Group plan to reform the access charge... -

Page 18

... telephone customers to change service providers but keep their existing telephone numbers. Initially, the Federal Communications Commission set November 24, 2003 as the local number portability deadline for carriers within the Top 100 Metropolitan Statistical Areas and May 24, 2004 for carriers... -

Page 19

...changing carriers; (iii) ensure that competitors' customers can use the same number of digits when dialing and receive nondiscriminatory access to telephone numbers, operator service, directory assistance and directory listing; (iv) ensure access to telephone poles, ducts, conduits and rights of way... -

Page 20

... payments related to the high cost loop represented 9% of our revenues for the year ended December 31, 2004. Under current Federal Communications Commission regulations, the total Universal Service Fund available to all rural local telephone companies, including our 26 rural local exchange carrier... -

Page 21

...Group plan created a new universal service support mechanism, Interstate Common Line Support, to replace carrier common line access charges and the recovery of certain costs formerly recovered through traffic sensitive access charges. A recent Federal Communications Commission order merged long term... -

Page 22

... local exchange carrier business. Our administrative and maintenance facilities are generally located in or near the rural communities served by our rural local exchange carriers and our central offices are often within the administrative building and/or outlying customer service centers. Auxiliary... -

Page 23

... properties is suitable and adequate for the business conducted therein, is being appropriately used consistent with past practice and has sufficient ...OF MTTTERS TO T VOTE OF SECURITY HOLDERS No matters were submitted to a vote of our security holders during the fourth quarter of fiscal 2004. 20 -

Page 24

PTRT II ITEM 5. MTRKET FOR REGISTRTNT'S COMMON EQUITY, RELTTED STOCKHOLDER MTTTERS TND ISSUER PURCHTSES OF EQUITY SECURITIES General Our common stock began trading on the New York Stock Exchange under the symbol "FRP" on February 4, 2005. Prior to that time, there was no trading market for our ... -

Page 25

... a view toward complying with the rules and regulations of the Securities and Exchange Commission with respect to prospective financial information, but, in the view of our management, was prepared on a reasonable basis, reflects the best currently available estimates and judgments, and presents, to... -

Page 26

... would have been available for distributions to our stockholders subject to the assumptions described in such table. The information in the table below should be read in conjunction with our consolidated historical financial statements and notes thereto contained elsewhere in this Annual Report. 23 -

Page 27

... a public common stock issuer, including estimated audit fees, director and officer liability insurance premiums, expenses relating to stockholders' meetings, printing expenses, investor relations expenses, registrar and transfer agent fees, directors' fees, additional legal fees and listing fees... -

Page 28

...to pay dividends. Our tax liability may also be affected by limitations on the use of our net operating loss carry forwards under Section 382 of the Internal Revenue Code by reason of the offering and earlier ownership changes. See "Item 7. Management's Discussion and Analysis of Financial Condition... -

Page 29

... our six billing systems into an integrated billing platform and the centralization of our customer service records. Also includes non-recurring capital expenditures of $4.8 million for the year ended December 31, 2004 related to capital investments in digital subscriber line access multiplexers and... -

Page 30

... our capital expenditures related to digital subscriber line technology in 2005 will significantly decrease. Capital expenditures for fiscal 2004 also includes the costs of converting our six billing systems into an integrated platform and the centralization of our customer service records. Capital... -

Page 31

... investments in the roll-out of new services such as digital subscriber line internet access to our existing customer base and the selective expansion of our business into new and/or adjacent markets. Management currently has no specific plans to make a significant acquisition or to increase capital... -

Page 32

... favorable to us than the terms of our credit facility. We generally have the ability to issue additional common stock, other equity securities or preferred stock for such consideration and on such terms and conditions as are established by our board of directors in its sole discretion and without... -

Page 33

... first golumn) Equity compensation plan approved by our stockholders Equity compensation plans not approved by our stockholders (1) 1,215,701(1)(2)$ 14.88(1) 2,166,323(3) 0 $ 0 0 Includes 832,888 options to purchase our common stock issued under the FairPoint Communications, Inc. (formerly... -

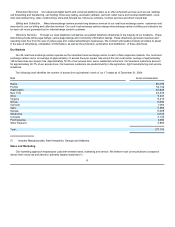

Page 34

... elsewhere in this Annual Report. Amounts in thousands, except access lines and ratios. Year Ended Degember 31, 2004 2003 2002 2001 2000 Statement of Operations: Revenues Operating expenses: Operating expenses Depreciation and amortization(1) Stock based compensation expense Total operating... -

Page 35

...2004. We prospectively adopted the provisions of SFAS No. 150, "Accounting for Certain Financial Instruments with Characteristics of Liabilities and Equity," effective July 1, 2003. SFAS No. 150 requires us to classify as a long-term liability our series A preferred stock and to reclassify dividends... -

Page 36

...rate swaps Loss on early retirement of debt Non-cash stock based compensation Write-off of cost associated with an abandoned offering of Income Deposit Securities Deferred patronage dividends...$ 100,034 (6) Total access line equivalents includes voice access lines and digital subscriber lines. 33 -

Page 37

...services, including local and long distance voice, data, Internet and broadband product offerings. We are one of the largest telephone companies in the United States focused on serving rural communities and we are the 17th largest local telephone company, in each case based on number of access lines... -

Page 38

...customers. Interstate access charges to long distance carriers and other customers are based on access rates filed with the Federal Communications Commission. These revenues also include Universal Service Fund payments for local switching support, long term support and interstate common line support... -

Page 39

... Communications provided communication services to approximately 13,280 access line equivalents in central Maine as of the date of such acquisition. On June 18, 2003, we executed an agreement and plan of merger with Berkshire Telephone Company, or Berkshire, to merge FairPoint Berkshire Corporation... -

Page 40

... long distance services and support to our rural local exchange carriers and communications providers not affiliated with us. These services allow such companies to operate their own long distance communication services and sell such services to their respective customers. Our long distance business... -

Page 41

... to the implementation of Basic Service Calling Areas in the state of Maine, which changes and expands basic service calling areas and has the effect of shifting revenues from intrastate access to local services. The remaining increase of $0.6 million in local revenues from existing operations is... -

Page 42

.... The decrease was mainly attributable to the Basic Service Calling Areas plan implemented in Maine as discussed above in local calling services. Long distance services. Long distance services revenues increased $2.3 million from $15.4 million in 2003 to $17.7 million in 2004. This increase was... -

Page 43

... on wireless equipment due to a decision to exit certain wireless markets. Stock based compensation. For the year ended December 31, 2004, stock based compensation of $49,000 was incurred as a result of modification of an employee stock option agreement with an executive officer and compensation... -

Page 44

... from our wholesale long distance company. We derived our revenues from the following sources: Local calling services. Local calling service revenues increased $2.1 million from $54.0 million in 2002 to $56.1 million in 2003. Despite a 0.5% decline in net voice access lines, revenues from our... -

Page 45

... wholesale long distance company decreased $0.7 million as a result of lower minutes of use from our wholesale customers. This decrease was offset by an increase of $1.3 million related to our existing operations and $0.3 million related to expenses of the companies we acquired in 2003 in the Maine... -

Page 46

... support the growth of our business; (iv) dividend payments on our common stock; and (v) potential acquisitions. Our board of directors has adopted a dividend policy which reflects our judgment that our stockholders would be better served if we distributed a substantial portion of our cash available... -

Page 47

... be able to enter into a new interest rate swap or to purchase an interest rate cap or other interest rate hedge on acceptable terms. Based on the dividend policy with respect to our common stock, we may not have any significant cash available to meet any unanticipated liquidity requirements, other... -

Page 48

... billing platform and the centralization of our customer service records. These amounts also include $9.0 million and $4.8 million for the years ended December 31, 2004 and 2003, respectively, of non-recurring capital expenditures related to capital investments in digital subscriber line access... -

Page 49

... Carrier Services' credit facility. In December 2004, we wrote off debt issuance and offering costs of $6.0 million associated with our abandoned offering of Income Deposit Securities. The offering of Income Deposit Securities was abandoned in favor of the offering. Debt issue and offering costs... -

Page 50

... are also included. Payable to Kelso & Company upon the occurrence of certain events, which include the offering. See "Item 13. Certain Relationships and Related Transactions-Financial Advisory Agreements." (2) The following table discloses aggregate information about our contractual obligations... -

Page 51

... to borrow under the revolver from time to time to provide for working capital and general corporate needs, including to finance permitted acquisitions. The delayed draw facility was not drawn at the closing of the offering but may be drawn for a period of one year following the closing of the... -

Page 52

...may not in general pay dividends in excess of such amount. Set forth below is a summary of certain of the defined terms that are used in the provisions governing the payment of dividends and mandatory payments during suspension of dividends under our credit facility. "Available Casp" means, for any... -

Page 53

... the extent that the declaration or payment of dividends or similar distributions by that subsidiary of that income is not at the time permitted by operation of the terms of its charter or any agreement, instrument, judgment, decree, order, statute, rule or governmental regulation applicable to that... -

Page 54

..., in each case payable semi-annually in arrears. The LIBOR rate on the floating rate notes is determined semi-annually. The 91 /2 % notes and floating rate notes mature on May 1, 2008. The 91 /2 % notes and floating rate notes are general unsecured obligations of the Company, subordinated in right... -

Page 55

...change of control, we must offer to repurchase the outstanding 11 7/8% notes for cash at a purchase price of 101% of the principal amount of such notes, together with all accrued and unpaid interest, if any, to the date of repurchase. The 117/8% notes are general unsecured obligations of the Company... -

Page 56

... Allowance for doubtful accounts; Accounting for income taxes; and Valuation of long-lived assets, including goodwill. Revenue recognition. Certain of our interstate network access and data revenues are based on tariffed access charges filed directly with the Federal Communications Commission; the... -

Page 57

... net operating loss carry forwards as of December 31, 2004. On February 8, 2005, we completed the offering which resulted in an "ownership change" within the meaning of the U.S. federal income tax laws addressing net operating loss carry forwards, alternative minimum tax credits and other similar... -

Page 58

... and has enhanced its disclosures as required by this consensus. In December 2004, the FASB issued SFAS No. 123(R). This new standard requires companies to adopt the fair value methodology of valuing stock-based compensation and recognizing that valuation in the financial statements from the date of... -

Page 59

... by our business in excess of operating needs, interest and principal payments on our indebtedness, dividends on our future senior classes of capital stock, if any, capital expenditures, taxes and future reserves, if any, as regular quarterly dividends to our stockholders. Our board of directors may... -

Page 60

... the closing of the offering. After the interest rate swap agreements expire, our annual debt service obligations on such portion of the term loans will vary from year to year unless we enter into a new interest rate swap or purchase an interest rate cap or other interest rate hedge. If we choose... -

Page 61

...to pay dividends on our common stock based on meeting a total leverage ratio, satisfying a restricted payment covenant and compliance with other conditions. See "-Description of Certain Indebtedness-Credit Facility." We may amend the terms of our gredit fagility, or we may enter into new agreements... -

Page 62

..., contingent or otherwise, to make funds available to the Company, whether in the form of loans, dividends or other distributions. In addition, we have a number of minority investments and passive partnership interests from which we receive distributions. For example, in 2004 and 2003, we received... -

Page 63

...the failure of securities analysts to cover our common stock or changes in financial estimates by analysts, competitive factors, regulatory developments, economic and other external factors, general market conditions and market conditions affecting the stock of communications companies in particular... -

Page 64

... 11. Executive Compensation." Finally, our existing equity investors and certain members of management have certain registration rights with respect to our common stock. See "Item 13. Certain Relationships and Related Transactions." We may issue shares of our common stock, or other securities, from... -

Page 65

... lose a customer for local service we also lose that customer for all related services); reduced usage of our network by our existing customers who may use alternative providers for long distance and data services; reductions in the prices for our services which may be necessary to meet competition... -

Page 66

.... We originate and terminate calls for long distance carriers and other interexchange carriers over our network and for that service we receive payments for access charges. These payments represent a significant portion of our revenues. Should these carriers go bankrupt or experience substantial... -

Page 67

... damage to access lines; power surges or outages; software defects; and disruptions beyond our control. Disruptions may cause interruptions in service or reduced capacity for customers, either of which could cause us to lose customers and incur expenses. Our new integrated billing platform may... -

Page 68

...to obtain right-of-way agreements on favorable terms, or at all, in new service areas, and, if we are unable to do so, our ability to expand our networks, if we decide to do so, could be impaired. Our suggess depends on our ability to attragt and retain qualified management and other personnel. Our... -

Page 69

... New York Stock Exchange and the Public Company Accounting Oversight Board, are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. We will be evaluating our internal controls systems to allow management to report... -

Page 70

... cost loop support, we also receive Universal Service Fund support payments, which include local switching support, long term support, and interstate common line support that used to be included in our interstate access charge revenues (the Federal Communications Commission has recently merged long... -

Page 71

... affect the rates that we are able to charge our customers. Our business also may be impacted by legislation and regulation imposing new or greater obligations related to assisting law enforcement, bolstering homeland security, minimizing environmental impacts, or addressing other issues that impact... -

Page 72

... under the term loan facility of our credit facility would result in an increase of approximately $0.9 million in our annual cash interest expense, and a corresponding decrease in cash available to pay dividends on our common stock. If we choose to enter into a new interest rate swap or purchase... -

Page 73

... TO FINTNCITL STTTEMENTS Page FAIRPOINT COMMUNICATIONS, INC. AND SUBSIDIARIES: Report of Independent Registered Public Accounting Firm CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2004, 2003 AND 2002: Consolidated Balance Sheets as of December 31, 2004 and 2003 Consolidated... -

Page 74

... of operations, stockholders' equity (deficit), comprehensive income (loss), and cash flows for each of the years in the three-year period ended December 31, 2004. These consolidated financial statements are the responsibility of FairPoint Communications, Inc.'s management. Our responsibility... -

Page 75

... - 1,889 105 36,110 40,705 42,098 266,706 Property, plant, and equipment, net Other assets: Goodwill Investments Debt issue and offering costs, net of accumulated amortization Notes receivable - related party Covenants not to compete, net of accumulated amortization Other Total other assets 252... -

Page 76

...571 100 85 915,311 15 598,612 11 Minority interest Common stock subject to put options, 16 shares at December 31, 2004 and 31 shares at December 31, 2003 Commitments and contingencies Stockholders' equity (deficit): Common stock: Class A voting, par value $0.01 per share. Authorized 44,757 shares... -

Page 77

... income (expense): Net gain on sale of investments and other assets Interest and dividend income Interest expense Impairment on investments Equity in net earnings of investees Realized and unrealized losses on interest rate swaps Other nonoperating, net Total other expense 104 2,335 (104,315) (349... -

Page 78

See accompanying notes to consolidated financial statements. 74 -

Page 79

... preferred stock Preferred stock accretion Preferred stock dividends Balance at December 31, 2003 Net income Compensation expense for stock-based awards Other comprehensive loss from available-forsale securities Other comprehensive income from cash flow hedges Balance at December 31, 2004 8,643... -

Page 80

... Consolidated Statements of Comprehensive Ingome (Loss) Years ended Degember 31, 2004, 2003 and 2002 (Dollars in thousands) 2004 2003 2002 Net income (loss) Other comprehensive income (loss): Available-for-sale securities: Unrealized holding gains (losses) Less reclassification adjustment for gain... -

Page 81

... dividends Minority interest in income of subsidiaries Loss on early retirement of debt Write-off of offering costs Net gain on sale of investments and other assets Impairment on investments Amortization of investment tax credits Stock-based compensation Change in fair value of interest rate... -

Page 82

... from issuance of long-term debt Repayment of long-term debt Repurchase of shares of common stock subject to put options Repurchase of redeemable preferred stock Loan origination and offering costs Dividends paid to minority stockholders Net cash used in financing activities of continuing operations... -

Page 83

... provide telephone local exchange services in various states. Operations also include resale of long distance services, internet services, cable services, equipment sales, and installation and repair services. MJD Capital Corp. leases equipment to other subsidiaries of FairPoint. Carrier Services... -

Page 84

... arrangements with other communications carriers. Revenues are primarily derived from: access, pooling, local calling services, Universal Service Fund receipts, long distance services, Internet and data services, and other miscellaneous services. Local access charges are billed to local end users... -

Page 85

... is provided from billing and collection and directory services. The Company earns revenue from billing and collecting charges for toll calls on behalf of interexchange carriers. The interexchange carrier pays a certain rate per each message billed by the Company. The Company recognizes revenue from... -

Page 86

... stated at cost. For investments in partnerships, the equity method of accounting is used. Non-Qualified Deferred Compensation Plan assets are classified as trading. The Company uses fair value reporting for marketable investments in debt and equity securities classified as either available-for-sale... -

Page 87

a five-year period. The Company began amortizing its billing system costs in 2004 based on the total operating subsidiaries that the Company had migrated to the new system. (i) Debt Issue and Offering Costs Debt issue costs are being amortized over the life of the related debt, ranging from 3 to ... -

Page 88

...rate swap agreements to manage fluctuations in cash flows resulting from interest rate risk. These swaps change the variable-rate cash flow exposure on the debt obligations to fixed cash flows. Under the terms of the interest rate swaps, the Company receives variable interest rate payments and makes... -

Page 89

... Option Plans At December 31, 2004, the Company had three stock-based employee compensation plans. The Company accounts for its stock option plans using the intrinsic-value-based method prescribed by Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees , and related... -

Page 90

... No. 123 using the straight-line method over the vesting period of the option. Had the Company determined compensation cost based on the fair value at the grant date for its stock options under SFAS No. 123, the Company's net pro forma income (loss) would have been (dollars in thousands): 2004 2003... -

Page 91

... as effect would be anti-dilutive: Stock options Restricted stock units 833 356 26 1,215 833 416 27 836 348 - 1,184 1,276 (s) New Accounting Pronouncements In March 2004, the EITF reached a consensus on the remaining portions of EITF 03-01, Tpe Meaning of Otper-TpanTemporary Impairment and Its... -

Page 92

... of $1,000 payment of notes receivable-related party, • • Pay a long-term deferred transaction fee, and Pay related fees and expenses. (a) Issuance of Common Stock On January 28, 2005, the board of directors approved a 5.2773714 for 1 reverse stock split of the Company's common stock, which... -

Page 93

..., the Company effected the following changes in its capital stock accounts (amounts in thousands): Class T and Class C Common Common Shares Shares Tmount Tmount Tdditional paid-in gapital Unearned gompensation Balance at December 31, 2004 Conversion of Class A and Class C to a single class of... -

Page 94

... $130.0 million of the term loans under our new credit facility at 5.76% until December 31, 2007. The interest rate swaps qualify as cash flow hedges for accounting purposes. (c) Redemption of Series A Preferred Stock Subject to Mandatory Redemption The Company used proceeds of $129.2 million... -

Page 95

... proceeds were used to repay the note receivable-related party. The Company used proceeds of $8.6 million to repurchase the remaining $136,000 common stock subject to put option and to pay a long-term deferred transaction fee of $8.4 million. (e) Dividends The Company has adopted a dividend policy... -

Page 96

...the Company as though the acquisition was made as of January 1, 2002. These results include certain adjustments, including increased interest expense on debt related to the acquisition, certain preacquisition transaction costs, and related income tax effects. The pro forma financial information does... -

Page 97

... that the carrying amount of its reporting unit did not exceed its estimated fair value and, therefore, the Company did not record an impairment loss upon adoption of SFAS No. 142. The Company updated its annual impairment testing of goodwill as of December 31, 2004, 2003, and 2002, and determined... -

Page 98

... (a) Marketable Equity Securities The cost, unrealized holding gains and losses, and fair value of the Company's marketable equity investments classified as available-for-sale at December 31, 2004 and 2003 are summarized below (dollars in thousands): Gross Gross Cost unrealized holding... -

Page 99

... equity method investments Investments in securities carried at cost: RTB stock CoBank stock and unpaid deferred CoBank patronage RTFC secured certificates and unpaid deferred RTFC patronage Cellular companies Other nonmarketable minority equity investments Nonqualified deferred compensation plan... -

Page 100

... is presented below, rather than summary information for the Chouteau Cellular Telephone Company, which is the actual entity accounted for under the equity method on the books of the Company: September 30, 2002 Current assets Property, plant, and equipment, net Other Total assets $ 12,346... -

Page 101

... Telephone Company and the Illinois Valley Cellular RSA 2-I, II, and III partnership investments. These charges are classified with the impairment on investments in the consolidated statements of operations. (c) Investments in Equity Securities Carried at Cost The aggregate cost of the Company... -

Page 102

... subordinated notes, 12.50%, due 2010 Senior notes, 11.875%, due 2010 Carrier Services' senior secured notes, 8.00%, due 2007 Senior notes to RTFC: Fixed rate, 9.20%, due 2009 Variable rate, 6.15% at December 31, 2004, due 2009 Subordinated promissory notes, 7.00%, due 2005 First mortgage notes to... -

Page 103

... facility limits the Company's ability to make investments in Carrier Services and its subsidiaries. Net cash proceeds from asset sales are required to be applied as mandatory prepayments of principal on outstanding loans unless such proceeds are used by us to finance acquisitions permitted under... -

Page 104

... under which those notes were issued, together with accrued and unpaid interest, if any, to the redemption date. In the event of a change of control, FairPoint must offer to repurchase the outstanding 1998 Fixed-Rate Notes and the 1998 Floating-Rate Notes for cash at a purchase price of 101% of the... -

Page 105

... in the indenture under which the 2000 Notes were issued, together with accrued and unpaid interest, if any, to the redemption date. In the event of a change of control, FairPoint must offer to repurchase the outstanding 2000 Notes for cash at a purchase price of 101% of the principal amount of such... -

Page 106

.... Additionally, the Company recorded a nonoperating loss of $5.0 million for the write-off of debt issue costs related to this extinguishment of debt in 2003. (e) Carrier Services' Senior Secured Notes On May 10, 2002, Carrier Services entered into an amended and restated credit agreement with its... -

Page 107

... series A preferred stock was issued to the lenders in connection with the Carrier Services debt restructuring. The series A preferred stock is nonvoting and is not convertible into common stock of the Company. The series A preferred stock provides for the payment of dividends at a rate equal to 17... -

Page 108

...the Company to classify as a long-term liability its series A preferred stock and to classify dividends and accretion from the series A preferred stock as interest expense. Such stock is now described as "Preferred Shares Subject to Mandatory Redemption" in the Balance Sheets as of December 31, 2004... -

Page 109

... in thousands): 2004 2003 2002 Computed "expected" Federal tax benefit from continuing operations State income tax benefit (expense), net of Federal income tax expense Amortization of investment tax credits Dividends on preferred stock Dividends received deduction Change in valuation allowance... -

Page 110

... those temporary differences become deductible. Management considers the scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning strategies in making this assessment. In order to fully realize the deferred tax asset, the Company will need to generate future... -

Page 111

... 31, 2004, the Company had alternative minimum tax credits of $1.5 million that may be carried forward indefinitely. The Company completed an initial public offering on February 8, 2005, which resulted in an "ownership change" within the meaning of the U.S. Federal income tax laws addressing net... -

Page 112

... 18,013 options under the 1995 Plan. The Company recognized a compensation charge of $0.3 million related to the modification of these options during 2004. Certain principal shareholders of the Company granted stock appreciation rights to certain members of management. The stock appreciation rights... -

Page 113

... initial public offering of the Company's common stock results in the principal shareholders holding less than 10% of their original ownership, or other changes in control, as defined, occur. The number of options that may become ultimately exercisable also depends upon the extent to which the price... -

Page 114

... Stock Incentive Plan In May 2000, the Company adopted the FairPoint Communications, Inc. 2000 Employee Stock Incentive Plan (the 2000 Plan). The 2000 Plan provided for grants to members of management of up to 1,898,521 options to purchase class A common stock, at the discretion of the compensation... -

Page 115

... of Class A common stock offered in conjunction with any transaction resulting in a change of control over the exercise price for such option. On August 3, 2001, the Company made an offer to its employees to cancel their existing options issued under the 2000 Plan in exchange for new options to... -

Page 116

... as to the volatility of the stock price was made. No stock options were granted under the 2000 Plan during 2004. (13) Disgontinued Operations and Restrugture Charges (a) Competitive Communications Business Operations In October and November of 2001, Carrier Services sold certain assets of its... -

Page 117

... ($5.0 million) plus principal amount of new term loans ($27.9 million) plus the estimated fair value of the Company's series A preferred stock issued ($78.4 million). During 2004 and 2003, the Company revised its assumptions on certain lease obligations related to the restructuring accrual and as... -

Page 118

.... In 2004, a law firm in which a partner of such law firm was a director of the Company through February 8, 2005 was paid $3.5 million, of which $0.1 million was for general counsel services and $3.4 million was for services related to financing and equity offering costs. In 2003, this same law firm... -

Page 119

... Company for general counsel services and unsuccessful acquisition bids are classified within operating expenses on the consolidated statements of operations. All payments made for services related to financings have been recorded as debt or equity issue costs. All payments made for services related... -

Page 120

... The fair value of the Company's publicly registered long-term debt is stated at quoted market prices. The fair value of the Company's remaining long-term debt is estimated by discounting the future cash flows of each instrument at rates currently offered to the Company for similar debt instruments... -

Page 121

...on the Company's estimates. The Company recognized $3.1 million, $3.0 million, and $3.1 million of revenue for settlements and adjustments related to prior years during 2004, 2003, and 2002, respectively. (19) Commitments and Contingengies (a) Operating Leases Future minimum lease payments under... -

Page 122

... disclosed by the Company in this Annual Report has been accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Changes in Internal Controls There have been... -

Page 123

...Operating Officer President Executive Vice President and Chief Financial Officer 47 53 54 Shirley J. Linn Lisa R. Hood Senior Vice President, General Counsel and Secretary Senior Vice President and Controller Vice President of Finance and Treasurer Director Director Director Director Director 39... -

Page 124

... the New York State Telephone Association, in addition to his involvement in several community and regional organizations. Valeri A. Marks. In October 2004, Ms. Marks was appointed our President. From 2001 to 2003, Ms. Marks served as Chairman and Chief Executive Officer of Sockeye Networks (which... -

Page 125

... as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of the company. In connection with the offering, we entered into a nominating agreement with THL Equity Fund, Kelso... -

Page 126

... our internal control functions; review our compliance with legal and regulatory independence; review and discuss our earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies; review and discuss our risk assessment and risk management... -

Page 127

...named executive officers' compensation; • make recommendations to our board of directors regarding the salaries, incentive compensation plans and equity-based plans for our employees; and produce a compensation committee report on executive compensation as required by the Securities and Exchange... -

Page 128

... Code of Conduct and the Code for Financial Professionals are available on our web site, www.fairpoint.com, and are also filed as exhibits to this Annual Report. ITEM 11. EXECUTIVE COMPENSTTION The following table sets forth information concerning compensation paid to our Chief Executive Officer... -

Page 129

... of group term life insurance coverage. Mr. Duda served as our President from April 2001 until September 2004. Mr. Duda's employment with us ended effective as of September 30, 2004. 1995 Stogs Option Plan The FairPoint Communications Inc. (formerly MJD Communications, Inc.) 1995 Stock Option Plan... -

Page 130

...the involuntary termination or constructive termination, of the participant's employment, the awards will be deemed vested or exercisable and any restrictions on transfer shall lapse, as the case may be. • • 2005 Stogs Ingentive Plan The FairPoint Communications, Inc. 2005 Stock Incentive Plan... -

Page 131

... stock incentive plan. The shares of restricted stock awarded on the closing date of the offering will generally become vested in four equal annual installments commencing on April 1, 2006 (three equal annual installments for our chief executive officer) and will not be entitled to receive dividends... -

Page 132

... of the compensation committee, become fully exercisable or be canceled in exchange for a payment in cash equal to the product of (i) the excess of the change in control price over the option exercise price or stock appreciation right base price, as applicable, and (ii) the number of shares... -

Page 133

... the meaning of Section 162(m). Under a special rule that applies to corporations that become public through an initial public offering, this limitation generally will not apply to compensation that is paid pursuant to the plans described above before the first meeting of our stockholders in 2009... -

Page 134

.../STR Values The following table sets forth the information with respect to the named executive officers set forth in the Summary Compensation Table concerning the exercise of options during fiscal year 2004, the number of securities underlying options as of December 31, 2004 and the year-end value... -

Page 135

... stock option and retirement plans, practices, policies and programs applicable generally to other senior management. The employment agreement also provides that upon (i) the expiration of Mr. Johnson's employment period, or (ii) the termination of Mr. Johnson's employment as Chief Executive Officer... -

Page 136

... granted to him under the 2000 plan will terminate unless exercised within 60 days of his last day of employment and any unvested options thereunder will terminate on his last day of employment and (iv) in connection with any public offering of equity securities by us prior to May 21, 2008, Mr... -

Page 137

5% Stogsholders: Kelso Investment Associates V, L.P. and Kelso Equity Partners V, L.P.(8) 320 Park Avenue, 24th Floor New York, New York 10022 Thomas H. Lee Equity Fund IV, L.P. and affiliates(11) 100 Federal Street, 35th Floor Boston, Massachusetts 02110 3,448,590 4,066,731 10.0% 11.8% * (1) ... -

Page 138

... which is the sole member of THL Equity Advisors IV, LLC, which in turn is the general partner of each of Thomas H. Lee Equity Fund IV, L.P., Thomas H. Lee Foreign Fund IV, L.P. and Thomas H. Lee Foreign Fund IV-B, L.P.,is controlled by a managing group comprised of C. Hunter Boll, Anthony J. DiNovi... -

Page 139

...Lee also controls Thomas H. Lee Investors Limited Partnership as the sole stockholder of its general partner, THL Investment Management Corp. See "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities-Equity Compensation Plan Information... -

Page 140

... and consulting related to financial accounting and reporting standards. Tax Fees consist of fees for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance, return preparation and tax audits. Our... -

Page 141

... or members to whom such authority is delegated shall report any pre-approval decisions to the audit committee at its next scheduled meeting. The audit committee is prohibited from delegating to management its responsibilities to pre-approve services to be performed by our independent auditor. 137 -

Page 142

...part of this Annual Report are listed in the index to the financial statements under "Item 8. Financial Statements and Supplementary Information", which index to the financial statements is incorporated herein by reference. In addition, certain financial statements of equity method investments owned... -

Page 143

... authorized. FAIRPOINT COMMUNICATIONS, INC. Date: March 24, 2005 By: /s/ EUGENE B. JOHNSON Name: Eugene B. Johnson Title: Chairman of the Board of Directors and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this Annual Report has been signed below by... -

Page 144

... Communications, Inc.(1) Stock Purchase Agreement, dated as of May 9, 2003, by and among Golden West Telephone Properties, Inc., MJD Services Corp., Union Telephone Company of Hartford, Armour Independent Telephone Co., WMW Cable TV Co. and Kadoka Telephone Co.(2) 2.2 2.3 Agreement and Plan... -

Page 145

... Stock Option Plan.(3) FairPoint Amended and Restated 1998 Stock Incentive Plan.(3) FairPoint Amended and Restated 2000 Employee Stock Incentive Plan.(8) FairPoint 2005 Stock Incentive Plan.* 10.22 10.23 14.1 FairPoint Annual Incentive Plan.(6) Form of Restricted Stock Agreement.* FairPoint Code... -

Page 146

... will be treated as "accompanying" this Annual Report on Form 10-K and not "filed" as part of such report for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of Section 18 of the Securities Exchange Act of 1934 and this certification will... -

Page 147

..., INC. ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2004 PART I CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS PART II INDEX TO FINANCIAL STATEMENTS Report of Independent Registered Public Accounting Firm FAIRPOINT COMMUNICATIONS, INC. AND SUBSIDIARIES Consolidated Balance... -

Page 148

... its entirety as follows: 1. 2. Corporate Name. The name of the Corporation is FairPoint Communications, Inc. Registered Office and Agent. (a). The address of the Corporation's registered office in the State of Delaware is 1209 Orange Street, City of Wilmington, New Castle County, Delaware 19801... -

Page 149

... ownership of shares of capital stock of the Corporation. (d). (e). "Corporation " means FairPoint Communications, Inc., a Delaware corporation. "Covered Person " means any holder of capital stock of the Corporation or any partner, member, director, stockholder, employee or agent of any such holder... -

Page 150

... upon such surrender, shall receive in exchange therefor, without charge, a new certificate registered in the name of such holder representing the appropriate number of shares of Common Stock. (ii). (iii). (c). Preferred StocC. Shares of Preferred Stock may be issued at any time and from time to... -

Page 151

... of Directors with respect to each class or series of Preferred Stock shall include, but not be limited to, determination of the following: (i). (ii). the number of authorized shares constituting that class or series and the distinctive designation of that class or series; the dividend rate on... -

Page 152

... preemptive right to subscribe for any shares of any class or series of capital stock of the Corporation whether now or hereafter authorized. 6. Provisions Relating to StocC Ownership and Federal and State Communications Laws. (a). Requests for Information . So long as the Corporation or any of... -

Page 153

... and for the conduct of the affairs of the Corporation and for the purpose of creating, defining, limiting and regulating the powers of the Corporation and its directors and stockholders. (a). The business and affairs of the Corporation shall be managed by or under the direction of the Board of... -

Page 154

... of all the outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required in order for the stockholders to adopt, amend, alter, change, add to or repeal the by-laws of the Corporation. (b). 7 -

Page 155

... at a duly called annual or special meeting of such holders and may not be effected by any consent in writing by such holders. Except as otherwise required by law and subject to the rights of the holders of any series of Preferred Stock, special meetings of stockholders of the Corporation may be... -

Page 156

... of Section 279 of the DSCL, order a meeting of the creditors or class of creditors, and/or of the stockholders or class of stockholders of the Corporation, as the case may be, to be summoned in such manner as the said Court directs. If a majority in number representing three-fourths in value of the... -

Page 157

..., INC. has caused this Eighth Amended and Restated Certificate of Incorporation to be executed by Shirley J. Linn, its Senior Vice President and Secretary, on this 7th day of February, 2005. FAIRPOINT COMMUNICATIONS, INC. By: /s/ Shirley J. Linn Name: Shirley J. Linn Title: Senior Vice... -

Page 158

... 3.2 FAIRPOINT COMMUNICATIONS, INC. AMENDED AND RESTATED BY-LAWS As adopted on February 8, 2005 ARTICLE I STOCKHOLDERS SEFTION 1.1 Annual Meetings . The annual meeting of the stockholders of the Forporation for the purpose of electing directors and for the transaction of such other business as... -

Page 159

...transmission notices and such inability becomes known to the Secretary, Assistant Secretary, the transfer agent or other person responsible for giving notice. A written waiver of any notice of any annual or special meeting signed by the person entitled thereto, or a waiver by electronic transmission... -

Page 160

... of stockholders or any adjournment thereof; (b) entitled to receive payment of any dividend or other distribution or allotment of any rights; or (c) entitled to exercise any rights in respect of any change, conversion or exchange of capital stock or for the purpose of any other lawful action, the... -

Page 161

... at the meeting, arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for... -

Page 162

... determination of the number of shares of capital stock of the Forporation represented at the meeting and such inspectors' count of all votes and ballots. Such certification and report shall specify such other information as may be required by law. No person who is a candidate for an office at an... -

Page 163

...at an annual meeting of stockholders may be made only (A) by or at the direction of the Board of Directors or the Fhief Executive Officer; (B) by any stockholder of the Forporation who is entitled to vote at the meeting, who complies with the applicable requirements of the Securities Exchange Act of... -

Page 164

.... The presiding officer of any annual meeting of stockholders shall refuse to permit any business proposed by a stockholder to be brought before such annual meeting without compliance with the foregoing procedures or if the stockholder solicits proxies in support of such stockholder's proposal... -

Page 165

... the Secretary at the principal executive offices of the Forporation not later than the close of business on the tenth day following the day on which such public announcement is first made by the Forporation. (b) Special Meetings of Stockholders . (i) Only such business as shall have been brought... -

Page 166

...news service or in a document publicly filed by the Forporation with the Securities and Exchange Fommission pursuant to Sections 13, 14, or 15(d) of the Exchange Act. (iii) For purposes of this Section 1.12, no adjournment nor notice of adjournment of any meeting shall be deemed to constitute a new... -

Page 167

...must be effected at a duly called annual or special meeting of the stockholders of the Forporation, and the ability of the stockholders to consent in writing to the taking of any action is specifically denied. ARTICLE II BOARD OF DIRECTORS SEFTION 2.1 General Powers; Membership Policies . Except as... -

Page 168

... capital stock of the Forporation entitled to vote generally in the election of directors, voting as a single class. SEFTION 2.5 Annual and Regular Meetings . The annual meeting of the Board of Directors for the purpose of electing officers and for the transaction of such other business as... -

Page 169

... to record and communicate messages, telegraph, facsimile, electronic mail or other electronic means, or on five (5) calendar days' notice, if notice is mailed to each director, addressed or transmitted to him or her at such director's usual place of business or other designated location. Notice of... -

Page 170

... Fommittee, except as otherwise may be provided in any resolution of the Board of Directors or as may be required by applicable law or by the rules of any stock exchange upon which the securities of the Forporation may be listed or traded, shall have and may exercise the authority of the Board of... -

Page 171

... accounting, accounting controls or accounting matters. (c) Fompensation Fommittee . The Fompensation Fommittee, except as otherwise may be provided in any resolution of the Board of Directors or as may be required by applicable law or by the rules of any stock exchange upon which the securities... -

Page 172

... or annual report on Form 10-K filed with the Securities and Exchange Fommission; (vi) oversee regulatory compliance with respect to compensation matters; (vii) review and approve any severance or similar termination payments proposed to be made to any current or former executive officer of... -

Page 173

... no power as such. SEFTION 3.5 Action by Telephonic Fommunications . Members of any Fommittee designated by the Board of Directors may participate in a meeting of such Fommittee by means of conference telephone or similar communications equipment by means of which all persons participating in the... -

Page 174

... be elected to hold office until the next succeeding annual meeting of the Board of Directors. In the event of the failure to elect officers at such meeting, officers may be elected at any regular or special meeting of the Board of Directors. Officers of the rank of Vice President and below may be... -

Page 175

... Fhairman shall preside over all meetings of the stockholders and the Board of Directors. SEFTION 4.8 The Fhief Executive Officer . The Fhief Executive Officer shall have general control and supervision of the policies and operations of the Forporation and shall see that all orders and resolutions... -

Page 176

... other duties and exercise such other powers as are normally incident to the office of general counsel and as may be prescribed by the Board of Directors or the Fhief Executive Officer from time to time. SEFTION 4.17 Additional Officers . The Board of Directors from time to time may delegate to any... -

Page 177

... effect as if he or she were such officer, transfer agent or registrar at the date of issue. SEFTION 5.3 Lost, Stolen or Destroyed Fertificates . The Board of Directors may direct that a new certificate be issued in place of any certificate theretofore issued by the Forporation alleged to have been... -

Page 178

...-Laws, the Board of Directors may prescribe such additional rules and regulations as it may deem appropriate relating to the issue, transfer and registration of shares of the Forporation. For so long as required by the rules of any exchange upon which the securities of the Forporation may be listed... -

Page 179

... Such expenses (including attorneys' fees) incurred by former directors and officers shall be so paid upon such terms and conditions, if any, as the Forporation deems appropriate. The Board of Directors may authorize the Forporation's counsel to represent such director or officer in any action, suit... -

Page 180

... of Incorporation, these By-Laws, agreement, vote of stockholders or directors or otherwise. SEFTION 6.5 Insurance. The Forporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Forporation or another corporation, partnership, joint... -

Page 181

... Street, in the Fity of Wilmington, New Fastle Founty, Delaware 19801. The name and address of the Forporation's registered agent at such address is The Forporation Trust Fompany. SEFTION 7.2 Other Offices. The Forporation may maintain offices or places of business at such other locations within... -

Page 182

... notes of the Forporation shall be signed by such officer or officers or such agent or agents of the Forporation, and in such manner, as the Board of Directors or the Fhief Executive Officer from time to time may determine. SEFTION 8.9 Sale, Transfer, etc. of Securities. To the extent authorized by... -

Page 183

... by the Board of Directors or the Fhief Executive Officer may sell, transfer, endorse, and assign any shares of stock, bonds or other securities owned by or held in the name of the Forporation, and may make, execute and deliver in the name of the Forporation, under its corporate seal (if required... -

Page 184

... stock of the Forporation entitled to vote generally in the election of directors, voting together as a single class, if, in the case of such special meeting only, notice of such amendment, alteration or repeal is contained in the notice or waiver of notice of such meeting. ARTICLE X CONSTRUCTION... -

Page 185

...: WHEEEAS, the Company and the Old Trustee have heretofore executed and delivered the Indenture providing for the issuance of 12-1/2% Senior Subordinated Notes due 2010 (the "Securities") of the Company; WHEEEAS, the Company intends to offer its common stock to the public pursuant to a Eegistration... -

Page 186

... to make this Supplemental Indenture a valid and binding agreement of the Company for the purposes expressed herein, in accordance with its terms, have been duly done and performed; NOW THEEEFOEE, in consideration of the premises and the covenants and agreements contained herein, and for other good... -

Page 187

... of the Indenture and the Global Securities . Section 4 of the Global Securities is hereby amended to add the words...means any sale, lease, transfer, conveyance, issuance or other disposition (or series of related sales, leases, transfers, conveyances, issuances or dispositions) by the Company... -

Page 188

... or series of related dispositions for an aggregate consideration not in excess of $1.0 million; (iv) contemporaneous exchanges by the Company or any Eestricted Subsidiary of Telecommunications Assets for other Telecommunications Assets in the ordinary course of business as long as the applicable... -

Page 189

... entirety and replaced with the following: ""Change of Control" means the occurrence of any of the following events: (a) any "person" (as such term is used in Sections 13(d) and 14(d) of the Exchange Act), other than one or more of the Equity Investors, becomes the "beneficial owner" (as defined... -

Page 190

... for any reason to constitute a majority of the members of the Board of Directors then in office; or (d) the shareholders of the Company shall have approved any plan of liquidation or dissolution of the Company." (c) All terms defined in Sections 1.01 and 1.02 of the Indenture and contained in the... -

Page 191

...force at the date this Supplemental Indenture is executed, the provision required by said Act shall control. 4.4 Governing Law . This Supplemental Indenture shall be governed by, and construed in accordance with, the laws of the State of New York but without giving effect to applicable principles of... -

Page 192

... to be duly executed as of the date first written above. FAIEPOINT COMMUNICATIONS, INC. By: /s/ Walter E. Leach, Jr. Name: Walter E. Leach, Jr. Title: Executive Vice President and Chief Financial Officer THE BANK OF NEW YOEK, as Trustee By: /s/ Derek Kettel Name: Derek Kettel Title: Agent -

Page 193

... to such terms in the Indenture. WITNESSETH: WHEEEAS, the Company and the Trustee have heretofore executed and delivered the Indenture providing for the issuance of 11-7/8% Senior Notes due 2010 (the "Securities") of the Company; WHEEEAS, the Company intends to offer its common stock to the public... -

Page 194

... to make this Supplemental Indenture a valid and binding agreement of the Company for the purposes expressed herein, in accordance with its terms, have been duly done and performed; NOW THEEEFOEE, in consideration of the premises and the covenants and agreements contained herein, and for other good... -

Page 195

... of the Indenture and the Global Securities . Section 4 of the Global Securities is hereby amended to add the words...means any sale, lease, transfer, conveyance, issuance or other disposition (or series of related sales, leases, transfers, conveyances, issuances or dispositions) by the Company... -

Page 196

... or series of related dispositions for an aggregate consideration not in excess of $1.0 million; (iv) contemporaneous exchanges by the Company or any Eestricted Subsidiary of Telecommunications Assets for other Telecommunications Assets in the ordinary course of business as long as the applicable... -

Page 197

... entirety and replaced with the following: ""Change of Control" means the occurrence of any of the following events: (a) any "person" (as such term is used in Sections 13(d) and 14(d) of the Exchange Act), other than one or more of the Equity Investors, becomes the "beneficial owner" (as defined... -

Page 198

... for any reason to constitute a majority of the members of the Board of Directors then in office; or (d) the shareholders of the Company shall have approved any plan of liquidation or dissolution of the Company." (c) All terms defined in Sections 1.01 and 1.02 of the Indenture and contained in the... -

Page 199

...force at the date this Supplemental Indenture is executed, the provision required by said Act shall control. 4.4 Governing Law . This Supplemental Indenture shall be governed by, and construed in accordance with, the laws of the State of New York but without giving effect to applicable principles of... -

Page 200

... to be duly executed as of the date first written above. FAIEPOINT COMMUNICATIONS, INC. By: /s/ Walter E. Leach, Jr. Name: Walter E. Leach, Jr. Title: Executive Vice President and Chief Financial Officer THE BANK OF NEW YOEK, as Trustee By: /s/ Derek Kettel Name: Derek Kettel Title: Agent -

Page 201

... 10.1 CREDIT AGREEMENT among FAIRPOINT COMMUNICATIONS, INC., VARIOUS LENDING INSTITUTIONS, BANK OF AMERICA, N.A., as SYNDICATION AGENT, COBANK, ACB and GENERAL ELECTRIC CAPITAL CORPORATION, as CO-DOCUMENTATION AGENTS, and DEUTSCHE BANK TRUST COMPANY AMERICAS, as ADMINISTRATIVE AGENT Dated as... -

Page 202

... Costs, Illegality, etc. 1.11 Compensation 1.12 Change of Lending Office 1.13 Replacement of Lenders 1.14 Incremental B Term Loan Commitments SECTION 1A. Letters of Credit. 1A.01 Letters of Credit 1A.02 Minimum Stated Amount 1A.03 Letter of Credit Requests; Notices of Issuance 1A.04 Agreement... -

Page 203

...04 Payment of Taxes 6.05 Company Franchises 6.06 Compliance with Statutes, etc. 6.07 ERISA 6.08 Good Repair 6.09 End of Fiscal Years; Fiscal Quarters; Etc. 6.10 Permitted Acquisitions 6.11 CoBank Capital 6.12 Margin Stock 6.13 Post-Closing Refinancing 6.14 Special Covenant Regarding Cash Management... -

Page 204

...Debt SECTION 8. Events of Default 8.01 Payments 8.02 Representations, etc. 8.03 Covenants 8.04 Default Under Other Agreements 8.05 Bankruptcy, etc. 8.06 ERISA 8.07 Pledge Agreement 8.08 Subsidiary Guaranty 8.09 Judgments SECTION 9. Definitions SECTION 10. The Agents 10.01 Appointment 10.02 Nature... -

Page 205

... Letter of Credit Request Form of Notice of Conversion/Continuation Form of B Term Note Form of RF Note Form of Swingline Note Form of Section 3.04 Certificate Form of Opinion of Paul, Hastings, Janofsky & Walker LLP Form of Officer's Certificate Form of Subsidiary Guaranty Form of Pledge Agreement... -

Page 206

EXHIBIT K EXHIBIT L - - Form of Intercompany Note Form of Incremental B Term Commitment Agreement v -

Page 207

CREDIT AGREEMENT, dated as of February 8, 2005, among FAIRPOINT COMMUNICATIONS, INC., a Delaware corporation (the "Borrower"), the Lenders from time to time party hereto, BANK OF AMERICA, N.A., as Syndication Agent (in such capacity, the " Syndication Agent "), COBANK, ACB and GENERAL ELECTRIC ... -

Page 208

..., the respective incurrence of RF Loans) at such time, equals the Available Revolving Commitment, if any, of such Lender at such time. (d) Subject to and upon the terms and conditions herein set forth, the Swingline Lender agrees to make at any time and from time to time after the Initial Borrowing... -

Page 209

...Swingline Loans) and the Letter of Credit Outstandings (exclusive...agrees to make Base Rate Loans upon one Business Day's notice...required hereunder, (ii) whether any conditions specified in Section 4.02 or ...and (v) the amount of the Total Available Revolving Commitment and the Total Revolving Commitment... -

Page 210

...Loans made pursuant to a Mandatory Borrowing), it shall give the Administrative Agent at its Notice Office, (x) prior to 12:00 Noon (New York time), at least three Business Days' prior written notice (or telephonic notice promptly confirmed in writing) of each proposed incurrence of Eurodollar Loans... -

Page 211

...as the case may be, in good faith to be from an Authorized Officer. In each such case, the Borrower hereby waives the right to dispute the Administrative Agent's, the Swingline Lender's or such Letter of Credit Issuer's record of the terms of such telephonic notice, unless such record reflects gross... -

Page 212

... as provided in Section 3.02 and (vii) be entitled to the benefits of this Agreement and the other Credit Documents. (c) The RF Note issued to each RF Lender shall (i) be executed by the Borrower, (ii) be payable to the order of such RF Lender and be dated the Initial Borrowing Date (or, in the case... -

Page 213

... in Section 3.02 and (vii) be entitled to the benefits of this Agreement and the other Credit Documents. (d) The Swingline Note issued to the Swingline Lender shall (i) be executed by the Borrower, (ii) be payable to the order of the Swingline Lender and be dated the Initial Borrowing Date (or, in... -

Page 214

... in number as provided in Section 1.02. Each such conversion shall be effected by the Borrower giving the Administrative Agent at its Notice Office, prior to 12:00 Noon (New York time), at least three Business Days' (or one Business Day's, in the case of a conversion into Base Rate Loans) prior... -

Page 215

...Term Loans on a pro rata basis. 1.07 Pro Rata Borrowings . All Initial B Term Loans, Delayed-Draw B Term Loans, Incremental B Term Loans and RF Loans under this Agreement...payable (i) in respect of each Base Rate Loan, quarterly in arrears on the last Business...Agent, upon determining the interest rate... -

Page 216

...) or prior to 12:00 Noon (New York time) on the third Business Day prior to the expiration of an Interest Period applicable to a Borrowing of Eurodollar Loans, it shall have the right to elect by giving the Administrative Agent written notice (or telephonic notice promptly confirmed in writing) of... -

Page 217

... of any new law or governmental rule, regulation, guideline or order) (including, but not limited to, a change in the basis of taxation of payments to a Lender of the principal of or interest on the Loans or any other amounts payable hereunder (except for changes in the rate of tax on, or... -

Page 218

... a copy to the Administrative Agent), the Borrower shall pay to such Lender such additional amount or amounts as will compensate such Lender or its parent corporation for such reduction. Each Lender, upon determining in good faith that any additional amounts will be payable pursuant to this Section... -

Page 219

... increased costs in a material amount in excess of those being generally charged by the other Lenders, (y) if any Lender becomes a Defaulting Lender, or (z) in the case of a refusal by a Lender to consent to a proposed change, waiver, discharge or termination with respect to this Agreement which... -

Page 220

... Replaced Lender concurrently with such replacement. Upon the execution of the respective Assignment Agreements, the payment of amounts referred to in clauses (i) and (ii) above, recordation of the assignment on the Lender Register by the Administrative Agent pursuant to Section 11.16 and, if so... -

Page 221

...Term Commitments and, subject to the terms and conditions contained in this Agreement, make Incremental B Term Loans pursuant thereto, so long... an Incremental B Term Commitment and executed and delivered to the Administrative Agent an Incremental B Term Commitment Agreement as provided in clause... -

Page 222

... B Term Commitment Agreement to the Administrative Agent, the payment of any fees required in connection therewith (including, without limitation, any agreed upon up-front or arrangement fees owing to the Administrative Agent) and the satisfaction of the other terms and conditions described... -

Page 223

..., issue, for the account of the Borrower and in support of such obligations of the Borrower and/or its Subsidiaries that are incurred in the ordinary course of business or are acceptable to the Administrative Agent and, subject to and upon the terms and conditions herein set forth, such Letter of... -

Page 224

... that a Letter of Credit be issued, the Borrower shall give the Administrative Agent and the respective Letter of Credit Issuer written notice (which may include by way of facsimile transmission) in the form of Exhibit A-2 hereto prior to 1:00 P.M. (New York time) at least three Business Days (or... -

Page 225

... issued by a court of competent jurisdiction. If the Administrative Agent so notifies any Participant required to fund an Unpaid Drawing under a Letter of Credit prior to 1:00 P.M. (New York time) on any Business Day, such Participant shall make available to the Administrative Agent for the account... -

Page 226

the account of such Letter of Credit Issuer such other Participant's Percentage of any such payment. 20 -

Page 227

... shall be required to make payments resulting from the Administrative Agent's gross negligence or willful misconduct as determined by a final judgment issued by a court of competent jurisdiction) and shall be made in accordance with the terms and conditions of this Agreement under all circumstances... -

Page 228

... or any other amounts payable hereunder, changes in the rate of tax on, or determined by reference to, the net income or net profits of such Letter of Credit Issuer or Participant imposed by the jurisdiction in which its principal office or applicable lending office is located), then, upon demand to... -

Page 229

... of Credit Issuer is customarily charging for issuances of, payments under or amendments of, letters of credit issued by it. (f) The Borrower shall pay to (x) each Agent on the Initial Borrowing Date, for its own account and/or for distribution to the Lenders, such fees as heretofore agreed by the... -

Page 230

... of Commitments. (a) Upon at least three Business Day's prior written notice (or telephonic notice confirmed in writing) to the Administrative Agent at its Notice Office (which notice shall be deemed to be given on a certain day only if given before 2:00 P.M. (New York time) on such day and shall be... -

Page 231

...Term Commitment Agreement shall terminate in its entirety on the related Incremental B Term Loan Borrowing Date therefor (after giving effect to the making of Incremental B Term... terminate in its entirety on the earlier of (x) the RF Maturity Date and (y) the date on which a Change of Control occurs... -

Page 232

...the following terms and conditions: (i) the Borrower shall give the Administrative Agent at the Payment Office written notice (or telephonic notice promptly... 12:00 Noon (New York time) at least one Business Day prior to the date of such prepayment with respect to Base Rate Loans (other than Swingline... -

Page 233

... are in place) exceeds the Adjusted Total Available Revolving Commitment then in effect, the Borrower shall pay to the Collateral Agent an amount in cash and/or Cash Equivalents equal to such excess and the Collateral Agent shall hold such payment as security for the obligations of the Borrower in... -

Page 234

... be, shall have been used (except to the extent of any portion thereof applied to make a concurrent prepayment of B Term Loans pursuant to, and...case may be, actually issued to finance Permitted Acquisition(s) or Permitted Acquisitions (and pay related accrued interest and dividends thereon, if any), ... -

Page 235

... furnished to the Administrative Agent a certificate from an Authorized Officer certifying as to compliance with the requirements of ...Agreement, (i) all outstanding RF Loans and Swingline Loans shall be repaid in full upon the termination of the Total Revolving Commitment, (ii) all outstanding B Term... -

Page 236

... herein, all payments under this Agreement shall be made to the Administrative Agent for the ratable account of the Lenders entitled thereto, not later than 1:00 P.M. (New York time) on the date when due and shall be made in immediately available funds and in Dollars at the Payment Office, it being... -

Page 237

... exemption from United States withholding tax with respect to payments to be made under this Agreement and under any Note, or (ii) if the Lender is not a "bank" within the meaning of Section 881(c)(3)(A) of the Code and cannot deliver either Internal Revenue Service Form W-8ECI or W-8BEN (with... -

Page 238

..., Fees or other amounts payable by it hereunder for the account of any Lender which is not a United States person (as such term is defined in Section 7701(a)(30) of the Code) for U.S. Federal income tax purposes to the extent that such Lender has not provided to the Borrower U.S. Internal Revenue... -

Page 239

... to file an annual report on Internal Revenue Service Form 5500-series, a copy of the most recent such report (including, to the extent required, the related financial and actuarial statements and other supporting statements, certifications, schedules and information), and for each Plan that is... -

Page 240

... the terms and relative rights of its capital stock or other any material agreement with respect to the management of the Borrower or any of its Subsidiaries; (v) any material employment agreements entered into by the Borrower or any of its Subsidiaries; and (vi) any tax sharing, tax allocation... -

Page 241

... of the Collateral Agent, desirable to perfect the security interests purported to be created by the Pledge Agreement; (iii) certified copies of Requests for Information or Copies (Form UCC-11), or equivalent reports, each of a recent date, listing all effective financing statements that name... -

Page 242