FairPoint Communications 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

service as of December 31, 2003.

Since 1993, we have acquired 30 such businesses, 26 of which we continue to own and operate. Many of our telephone companies

have served their respective communities for over 75 years. The majority of the rural communities we serve have fewer than 2,500

residents. All of our telephone company subsidiaries qualify as RLECs under the Telecommunications Act.

RLECs generally are characterized by stable operating results and strong cash flow margins and operate in supportive regulatory

environments. In particular, existing state and federal regulations permit us to charge rates that enable us to recover our operating costs, plus

a reasonable rate of return on our invested capital (as determined by relevant regulatory authorities). Competition is typically limited because

RLECs primarily serve sparsely populated rural communities with predominantly

21

residential customers, and the cost of operations and capital investment requirements for new entrants is high. As a result, in our markets,

we have experienced virtually no wireline competition and limited competition from cable providers. While most of our markets are served by

wireless service providers, their impact on our business has been limited.

We derive our revenues from:

•. We receive revenues from providing local exchange telephone services, including monthly recurring

charges for basic service, usage charges for local calls and service charges for special calling features.

• . We receive payments from the USF to support the high cost of our

operations in rural markets. This revenue stream is based upon our average cost per loop compared to the national average

cost per loop. This support fluctuates based upon the historical costs of our operating companies.

•. These revenues are primarily based on a regulated return on rate base and recovery of allowable

expenses associated with the origination and termination of toll calls both to and from our customers. Interstate access charges

to long distance carriers and other customers are based on access rates filed with the FCC. These revenues also include USF

payments for local switching support, long term support and interstate common line support.

•. These revenues consist primarily of charges paid by long distance companies and other

customers for access to our networks in connection with the origination and termination of long distance telephone calls both to

and from our customers. Intrastate access charges to long distance carriers and other customers are based on access rates filed

with the state regulatory agencies.

•. We receive revenues from long distance services we provide to our residential and business

customers. In addition, our subsidiary Carrier Services provides our RLECs and other non-affiliated communications providers

with wholesale long distance services.

•. We receive revenues from monthly recurring charges for services, including digital subscriber

line, special access, private lines, Internet and other services.

•. We receive revenues from other services, including billing and collection, directory services and sale and

maintenance of customer premise equipment.

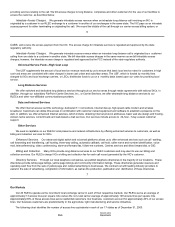

The following summarizes our revenues and percentage of revenues from continuing operations from these sources:

Local calling services $50,629 $54,000 $56,078 22%23%24%

Universal service fund—high cost loop support 19,019 22,429 18,903 8 10 8

Interstate access revenues 66,002 65,769 66,564 29 29 29

Intrastate access revenues 48,671 43,848 43,969 21 19 19

Long distance services 19,459 16,763 15,440 9 7 7

Data and Internet services 7,684 10,257 13,431 3 4 6

Other services 18,712 17,753 17,047 8 8 7

Total $230,176 $230,819 $231,432 100%100%100%

22