Expedia 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Expedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our stockholders:

2007 was a very good year for Expedia, Inc., as our 7,000+ worldwide employees delivered accelerating

growth in nearly every key financial metric:

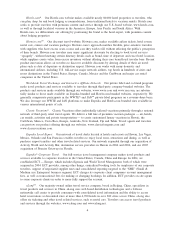

2007 (MM)

2007 Y/Y

Growth

2006 Y/Y

Growth

Transactions ........................................ 45.1 13% 4%

Gross bookings ...................................... $19,632 16% 10%

Revenue . . . ........................................ $ 2,665 19% 6%

Operating income before amortization (“OIBA”)(1) ........... $ 669 12% (5%)

Operating income .................................... $ 529 51% (12%)

Net cash provided by operating activities ................... $ 712 15% (28%)

Free cash flow(2) .................................... $ 625 19% (35%)

As impressive as these growth rates are for a company of Expedia’s scale, we are even more pleased with

how broad-based our progress was. Our flagship Expedia.com»rebounded from declining transaction growth

in 2006 to post mid-single digit growth in 2007 despite a fiercely competitive market. Our Hotwire»brand,

focused on providing travelers great air, hotel & car deals they won’t find anywhere else, overcame a

diminishing top-line in 2006 to grow its revenue over 60% in 2007.

International markets continue to be an increasingly important part of the Expedia»story, with gross

bookings outside the U.S. growing nearly 40% in 2007. By the fourth quarter our international websites

accounted for 33% of Expedia’s bookings, up from 22% just two years ago. In 2007 alone our brands

expanded into Austria, the Czech Republic, Greece, Hungary, Iceland, Ireland, New Zealand and Turkey.

These markets will take some time to scale and achieve profitability; however, we believe that establishing a

broad global presence can build lasting moats around our businesses.

While international diversification is important for any business, it is even more so for travel companies.

Why is that? Well, for starters, the amount of travel spend outside the U.S. is enormous — Europeans alone

spent over $300 billion on travel in 2007, nearly 20% more than United States travelers. International

expansion also allows Expedia to enhance the breadth and depth of our supply base while bringing ever more

travelers to our travel marketplace. We now offer hoteliers demand from dozens of countries, and we offer

travelers their choice of nearly 80,000 hotel properties spanning the globe.

A key driver of growth in 2007 was removing barriers to purchase for our travelers. There were many

examples of this, but some of the most important were removing change & cancel fees at Hotels.com»,

reducing or eliminating air booking fees and improving hotel pricing on our European websites, eliminating

air booking fees at Hotwire and expanding our ThankYou loyalty program, now serving 1.5 million members.

We’ll continue to rigorously evaluate our traveler value proposition, remaining open to changes in our business

model to enhance that value and build long-term loyalty.

In last year’s Annual Letter to Stockholders we introduced Expedia’s new mission statement: We get the

world going...by building the world’s largest and most intelligent travel marketplace.

To our way of thinking, being a “marketplace” goes beyond our core role of intelligently matching

disaggregated supply and demand to drive profitable travel transactions. It also means providing global

platforms for both travel and non-travel advertisers to reach our traveler audience.

The most obvious example of our advertising strategy at work is the TripAdvisor»Media Network. The

core of the Network is TripAdvisor.com

TM

and its six European websites, which leverage over 15 million

reviews and opinions contributed from millions of real travelers across the world. We meaningfully expanded

the Network in 2007 and early 2008 through the acquisition of several leading content sites, including

airfarewatchdog.com

TM

, bookingbuddy.com

TM

, cruisecritic.com

TM

, holidaywatchdog.com

TM

, seatguru.com

TM

,

smartertravel.com

TM

, travel-library.com

TM

and travelpod.com

TM

.

These media properties are first and foremost about compelling expert and user-generated content. But

these sites also provide airlines, hoteliers, car rental companies, cruiselines, package providers, travel bureaus,