Exelon 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Exelon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

capacity based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to

market quotes for power, fuel, load following products, and options. Equivalent sales represent all hedging products, which include

economic hedges and certain non-derivative contracts, including sales to ComEd, PECO and BGE to serve their retail load. A

portion of Generation’s hedging strategy may be implemented through the use of fuel products based on assumed correlations

between power and fuel prices, which routinely change in the market. The corporate risk management group and Exelon’s RMC

monitor the financial risks of the wholesale and retail power marketing activities. Generation also uses financial and commodity

contracts for proprietary trading purposes, but this activity accounts for only a small portion of Generation’s efforts. The proprietary

trading portfolio is subject to a risk management policy that includes stringent risk management limits, including volume, stop-loss

and value-at-risk limits, to manage exposure to market risk. See QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK for additional information.

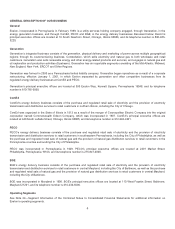

At December 31, 2014, Generation’s short and long-term commitments relating to the purchase of energy and capacity from and to

unaffiliated utilities and others were as follows:

(in millions)

Net Capacity

Purchases (a)

REC

Purchases (b)

Transmission Rights

Purchases (c) Total

2015 ....................................................... $ 418 $152 $ 20 $ 590

2016 ....................................................... 283 228 15 526

2017 ....................................................... 222 121 15 358

2018 ....................................................... 112 29 16 157

2019 ....................................................... 117 5 16 138

Thereafter .................................................. 279 1 35 315

Total ....................................................... $1,431 $536 $117 $2,084

(a) Net capacity purchases include PPAs and other capacity contracts including those that are accounted for as operating leases. Amounts presented in the

commitments represent Generation’s expected payments under these arrangements at December 31, 2014, net of fixed capacity payments expected to be received

(“Capacity offsets”) by Generation under contracts to resell such acquired capacity to third parties under long-term capacity sale contracts. As of December 31, 2014,

capacity offsets were $132 million, $133 million, $136 million, $137 million,$138 million, and $591 million for years 2015, 2016, 2017, 2018, 2019, and thereafter,

respectively. Expected payments include certain fixed capacity charges which may be reduced based on plant availability.

(b) The table excludes renewable energy purchases that are contingent in nature.

(c) Transmission rights purchases include estimated commitments for additional transmission rights that will be required to fulfill firm sales contracts.

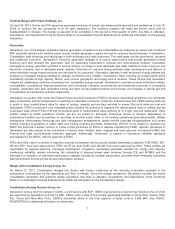

Capital Expenditures

Generation’s business is capital intensive and requires significant investments in nuclear fuel and energy generation assets and in

other internal infrastructure projects. Generation’s estimated capital expenditures for 2015 are as follows:

(in millions)

Nuclear fuel (a) ......................................................................... $1,250

Production plant ....................................................................... 1,800

Renewable energy projects .............................................................. 225

Maryland commitments ................................................................. 225

Other ................................................................................ 125

Total ................................................................................. $3,625

(a) Includes Generation’s share of the investment in nuclear fuel for the co-owned Salem plant.

ComEd

ComEd is engaged principally in the purchase and regulated retail sale of electricity and the provision of electricity distribution and

transmission services to a diverse base of residential, commercial and industrial customers in northern Illinois. ComEd is a public

utility under the Illinois Public Utilities Act subject to regulation by the ICC related to distribution rates and service, the issuance of

securities, and certain other aspects of ComEd’s business. ComEd is a public utility under the Federal Power Act subject to

regulation by FERC related to transmission rates and certain other aspects of ComEd’s business. Specific operations of ComEd are

also subject to the jurisdiction of various other Federal, state, regional and local agencies. Additionally, ComEd is subject to NERC

mandatory reliability standards.

16