Epson 2016 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2016 Epson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

environmental management systems. Thanks to these efforts, we have not had any serious environmental issues to

date. In the future, however, it is possible that an environmental problem could arise that would require us to pay

damages and/or fines, bear costs for cleanup, or force a halt of production. Moreover, new regulations could be

enacted that would require major expenditures, and, if such a situation should occur, Epson’s operating results

could be adversely affected.

10. Epson faces risks concerning the hiring and retention of personnel.

We must hire and retain talented personnel both in Japan and overseas to develop advanced new technologies and

manufacture advanced new products, but the competition for such personnel is becoming increasingly intense. We

must hire and retain talented personnel by, for example, introducing compensation and benefit packages that are

commensurate with roles and by proactively promoting people with the right skills overseas. If we are unable to

continue to hire and keep enough of such employees, or if we are unable to pass along technologies and skills, we

could find it difficult or impossible to execute our business plans.

11. Fluctuations in foreign currency exchanges create risks for Epson.

A significant portion of our revenue is denominated in U.S. dollars or the euro. We expanded our overseas

procurement and moved our production sites overseas, so our dollar-denominated expenses currently exceed our

dollar-denominated revenue. On the other hand, our euro-denominated revenue is still significantly greater than our

euro-denominated expenses. On the whole, our revenues in other foreign currencies also significantly exceed our

expenses in those currencies. Also, although we use currency forwards and other means to hedge against the risks

inherent in foreign currency exchanges, unfavorable movements in the exchange rates of foreign currencies such as

the U.S. dollar, euro, or other foreign currencies against the yen could adversely affect our financial situation and

financial results.

12. There are risks inherent in pension systems.

We have a defined-benefit pension plan and a lump-sum payment on retirement as defined-benefit plans.

We revised the defined-benefit retirement pension plan in April 2014 in response to a drop in the rate of return on

pension assets and an increase in the number of beneficiaries. The revisions are designed to enable us to adapt to

future market changes and maintain stable operations into the future. However, if there is a change in the operating

results of the pension assets or in the ratio used as the basis for calculating retirement allowance liabilities, our

financial position and operating results could be adversely affected.

13. Epson is vulnerable to proceedings relating to antitrust laws and regulations.

With business operations that span the globe, Epson is subject in Japan and overseas to proceedings relating to

antitrust laws and regulations, such as those prohibiting private monopolies and those protecting fair trade.

Overseas authorities sometimes investigate or gather information on certain industries and, in conjunction with this,

Epson’s market conditions and sales methods may come under investigation. Such investigations and proceedings,

or violations of applicable statutes, could interfere with our sales activities. They could also potentially damage

Epson’s credibility or result in a large civil fine. Any of these could adversely affect our operating results.

Seiko Epson and certain of its consolidated subsidiaries are currently under investigation by some competition

authorities regarding allegations of involvement in a liquid crystal display price-fixing cartel. It is difficult at this

time to predict the outcome of these investigations and when they may be settled.

14. Epson is at risk of material legal actions being brought against it.

Epson conducts businesses internationally. We are engaged primarily in the development, manufacture and sales of

printing solutions, visual communications equipment, and wearable and industrial products, as well as the

provision of services related thereto. Given the nature of these businesses, there is a possibility that an action could

be brought or legal proceedings could be started against Epson regarding, for example, intellectual property rights,

product liability, antitrust laws or environmental regulations.

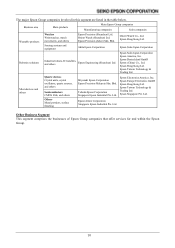

As of the date we submitted our Annual Securities Report, Epson was contending with the following material

actions.

In June 2010, Epson Europe B.V. (“EEB”), a consolidated subsidiary of Seiko Epson, brought a civil suit against

La SCRL Reprobel (“Reprobel”), a Belgium-based group that collects copyright royalties, seeking restitution for

copyright royalties for multifunction printers. With Reprobel subsequently filing a suit against EEB, the two

lawsuits were adjoined. EEB’s claims were rejected at the first trial, but EEB, dissatisfied with the decision, intends

to appeal.