Entergy 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

and $1.7 million in 2012, $2.0 million in 2011, and $2.3 million in

2010 for Entergy Gulf States Louisiana. Oil tank facilities lease pay-

ments for Entergy Mississippi were $3.4 million in 2012, $3.4 million

in 2011, and $3.4 million in 2010.

Sale and Leaseback Transactions

WATERFORD 3 LEASE OBLIGATIONS

In 1989, in three separate but substantially identical transactions,

Entergy Louisiana sold and leased back undivided interests in Water-

ford 3 for the aggregate sum of $353.6 million. The leases expire in

July 2017. At the end of the lease terms, Entergy Louisiana has the

option to repurchase the leased interests in Waterford 3 at fair mar-

ket value or to renew the leases for either fair market value or, under

certain conditions, a fixed rate. In the event that Entergy Louisiana

does not renew or purchase the interests, Entergy Louisiana would

surrender such interests and their associated entitlement of Waterford

3’s capacity and energy.

Entergy Louisiana issued $208.2 million of non-interest bearing

first mortgage bonds as collateral for the equity portion of certain

amounts payable under the leases.

Upon the occurrence of certain events, Entergy Louisiana may

be obligated to assume the outstanding bonds used to finance the

purchase of the interests in the unit and to pay an amount sufficient

to withdraw from the lease transaction. Such events include lease

events of default, events of loss, deemed loss events, or certain

adverse “Financial Events.” “Financial Events” include, among other

things, failure by Entergy Louisiana, following the expiration of any

applicable grace or cure period, to maintain (i) total equity capital

(including preferred membership interests) at least equal to 30% of

adjusted capitalization, or (ii) a fixed charge coverage ratio of at least

1.50 computed on a rolling 12 month basis. As of December 31,

2012, Entergy Louisiana was in compliance with these provisions.

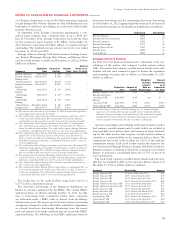

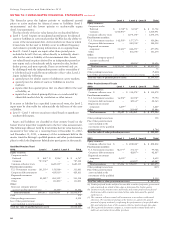

As of December 31, 2012, Entergy Louisiana had future minimum

lease payments (reflecting an overall implicit rate of 7.45%) in con-

nection with the Waterford 3 sale and leaseback transactions, which

are recorded as long-term debt, as follows (in thousands):

2013 $ 26,301

2014 31,036

2015 28,827

2016 16,938

2017 106,335

Years thereafter –

Total 209,437

Less: Amount representing interest 46,488

Present value of net minimum lease payments $162,949

GRAND GULF LEASE OBLIGATIONS

In 1988, in two separate but substantially identical transactions, Sys-

tem Energy sold and leased back undivided ownership interests in

Grand Gulf for the aggregate sum of $500 million. The leases expire

in July 2015. At the end of the lease terms, System Energy has the

option to repurchase the leased interests in Grand Gulf at fair market

value or to renew the leases for either fair market value or, under

certain conditions, a fixed rate. In the event that System Energy does

not renew or purchase the interests, System Energy would surrender

such interests and their associated entitlement of Grand Gulf’s capac-

ity and energy.

System Energy is required to report the sale-leaseback as a financ-

ing transaction in its financial statements. For financial reporting

purposes, System Energy expenses the interest portion of the lease

obligation and the plant depreciation. However, operating revenues

include the recovery of the lease payments because the transactions

are accounted for as a sale and leaseback for ratemaking purposes.

Consistent with a recommendation contained in a FERC audit report,

System Energy initially recorded as a net regulatory asset the differ-

ence between the recovery of the lease payments and the amounts

expensed for interest and depreciation and continues to record this

difference as a regulatory asset or liability on an ongoing basis, result-

ing in a zero net balance for the regulatory asset at the end of the lease

term. The amount was a net regulatory liability of $27.8 million and

$2.0 million as of December 31, 2012 and 2011, respectively.

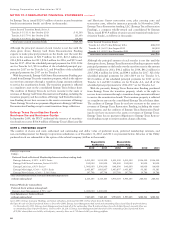

As of December 31, 2012, System Energy had future minimum

lease payments (reflecting an implicit rate of 5.13%), which are

recorded as long-term debt, as follows (in thousands):

2013 $ 50,546

2014 51,637

2015 52,253

2016 –

2017 –

Years thereafter –

Total 154,436

Less: Amount representing interest 15,543

Present value of net minimum lease payments $138,893

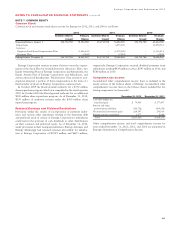

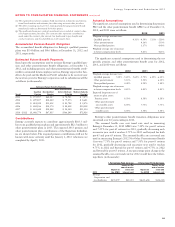

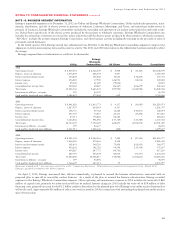

NOTE 11. RETIREMENT, OTHER POSTRETIREMENT

BENEFITS AND DEFINED CONTRIBUTION PLANS

Qualified Pension Plans

Entergy has seven qualified pension plans covering substantially

all employees: “Entergy Corporation Retirement Plan for Non-Bar-

gaining Employees,” “Entergy Corporation Retirement Plan for

Bargaining Employees,” “Entergy Corporation Retirement Plan II

for Non-Bargaining Employees,” “Entergy Corporation Retirement

Plan II for Bargaining Employees,” “Entergy Corporation Retire-

ment Plan III,” “Entergy Corporation Retirement Plan IV for Non-

Bargaining Employees,” and “Entergy Corporation Retirement Plan

IV for Bargaining Employees.” The Registrant Subsidiaries partici-

pate in two of these plans: “Entergy Corporation Retirement Plan

for Non-Bargaining Employees” and “Entergy Corporation Retire-

ment Plan for Bargaining Employees.” Except for the Entergy Cor-

poration Retirement Plan III, the pension plans are noncontributory

and provide pension benefits that are based on employees’ credited

service and compensation during the final years before retirement.

The Entergy Corporation Retirement Plan III includes a mandatory

employee contribution of 3% of earnings during the first 10 years of

plan participation, and allows voluntary contributions from 1% to

10% of earnings for a limited group of employees.

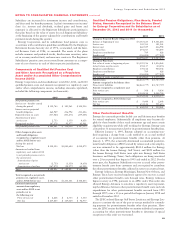

The assets of the seven qualified pension plans are held in a master

trust established by Entergy. Each pension plan has an undivided ben-

eficial interest in each of the investment accounts of the master trust

that is maintained by a trustee. Use of the master trust permits the

commingling of the trust assets of the pension plans of Entergy Cor-

poration and its Registrant Subsidiaries for investment and adminis-

trative purposes. Although assets are commingled in the master trust,

the trustee maintains supporting records for the purpose of allocating

the equity in net earnings (loss) and the administrative expenses of

the investment accounts to the various participating pension plans.

The fair value of the trust assets is determined by the trustee and

certain investment managers. The trustee calculates a daily earnings

factor, including realized and unrealized gains or losses, collected and

accrued income, and administrative expenses, and allocates earnings

to each plan in the master trust on a pro rata basis.

Further, within each pension plan, the record of each Registrant

Subsidiary’s beneficial interest in the plan assets is maintained by the

plan’s actuary and is updated quarterly. Assets for each Registrant

88