Entergy 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

Entergy Corporation and Subsidiaries 2007

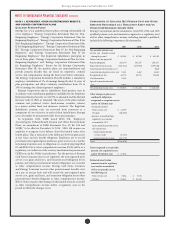

OT H E R T HAN T E M P O R A R Y IM P A I R M E N T S A N D

UN R E A L I Z E D GA I N S A N D LO S S E S

Entergy, Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, and System Energy evaluate these unrealized losses at the

end of each period to determine whether an other than temporary

impairment has occurred. e assessment of whether an investment

has suered an other than temporary impairment is based on a number

of factors including, rst, whether Entergy has the ability and intent to

hold the investment to recover its value, the duration and severity of any

losses, and, then, whether it is expected that the investment will recover

its value within a reasonable period of time. Entergy’s trusts are managed

by third parties who operate in accordance with agreements that dene

investment guidelines and place restrictions on the purchases and sales

of investments. Entergy did not record any signicant impairments in

2007 or 2006 on these assets.

Due to the regulatory treatment of decommissioning collections and

trust fund earnings, Entergy Arkansas, Entergy Gulf States Louisiana,

Entergy Louisiana, and System Energy record regulatory assets or

liabilities for unrealized gains and losses on trust investments. For the

unregulated portion of River Bend, Entergy Gulf States Louisiana has

recorded an osetting amount of unrealized gains or losses in other

deferred credits due to existing contractual commitments with the

former owner.

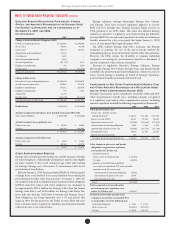

NOTE 18. ENTERGY NEW ORLEANS

BANKRUPTCY PROCEEDING

As a result of the eects of Hurricane Katrina and the eect of extensive

ooding that resulted from levee breaks in and around the New Orleans

area, on September 23, 2005, Entergy New Orleans led a voluntary

petition in bankruptcy court seeking reorganization relief under Chapter

11 of the U.S. Bankruptcy Code. On May 7, 2007, the bankruptcy

judge entered an order conrming Entergy New Orleans’ plan of

reorganization. With the receipt of CDBG funds, and the agreement on

insurance recovery with one of its excess insurers, Entergy New Orleans

waived the conditions precedent in its plan of reorganization, and the

plan became eective on May 8, 2007. Following are signicant terms in

Entergy New Orleans’ plan of reorganization:

n Entergy New Orleans paid in full, in cash, the allowed third-party

prepetition accounts payable (approximately $29 million, including

interest). Entergy New Orleans paid interest from September 23,

2005 at the Louisiana judicial rate of interest for 2005 (6%) and 2006

(8%), and at the Louisiana judicial rate of interest plus 1% for 2007

through the date of payment. e Louisiana judicial rate of interest

for 2007 is 9.5%.

n Entergy New Orleans issued notes due in three years in satisfaction

of its aliate prepetition accounts payable (approximately $74

million, including interest), including its indebtedness to the Entergy

System money pool. Entergy New Orleans included in the principal

amount of the notes accrued interest from September 23, 2005 at the

Louisiana judicial rate of interest for 2005 (6%) and 2006 (8%), and

at the Louisiana judicial rate of interest plus 1% for 2007 through the

date of issuance of the notes. Entergy New Orleans will pay interest

on the notes from their date of issuance at the Louisiana judicial rate

of interest plus 1%. e Louisiana judicial rate of interest is 9.5% for

2007 and 8.5% for 2008.

n Entergy New Orleans repaid in full, in cash, the outstanding

borrowings under the debtor-in-possession credit agreement

between Entergy New Orleans and Entergy Corporation

(approximately $67 million).

n Entergy New Orleans’ rst mortgage bonds will remain outstanding

with their current maturity dates and interest terms. Pursuant to

an agreement with its rst mortgage bondholders, Entergy New

Orleans paid the rst mortgage bondholders an amount equal to

the one year of interest from the bankruptcy petition date that the

bondholders had waived previously in the bankruptcy proceeding

(approximately $12 million).

n Entergy New Orleans’ preferred stock will remain outstanding on its

current dividend terms, and Entergy New Orleans paid its unpaid

preferred dividends in arrears (approximately $1 million).

n Litigation claims will generally be unaltered, and will generally

proceed as if Entergy New Orleans had not led for bankruptcy

protection, with exceptions for certain claims.

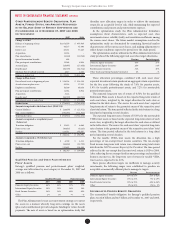

With conrmation of the plan of reorganization, Entergy

reconsolidated Entergy New Orleans in the second quarter 2007,

retroactive to January 1, 2007. Because Entergy owns all of the

common stock of Entergy New Orleans, reconsolidation does not

aect the amount of net income that Entergy records from Entergy

New Orleans’ operations for any current or prior periods, but

does result in Entergy New Orleans’ results being included in each

individual income statement line item in 2007, rather than just its

net income being presented as “Equity in earnings of unconsolidated

equity aliates,” as will remain the case for 2005 and 2006.

Entergy’s income statement for 2006 and 2005 includes $220 million

and $207 million, respectively, in operating revenues and $46 million

and $117 million, respectively, in purchased power expenses from

transactions between Entergy New Orleans and Entergy’s subsidiaries.

Entergy’s balance sheet as of December 31, 2006 includes $95 million

of accounts receivable that are payable to Entergy or its subsidiaries by

Entergy New Orleans, including $69.5 million of prepetition accounts.

Because Entergy owns all of the common stock of Entergy New Orleans,

however, the deconsolidation of Entergy New Orleans in 2005 and 2006

did not aect the amount of net income Entergy records resulting from

Entergy New Orleans’ operations.

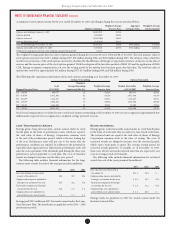

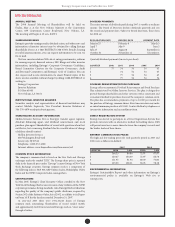

NOTE 19. QUARTERLY FINANCIAL DATA (UNAUDITED)

Operating results for the four quarters of 2007 and 2006 for Entergy

Corporation and subsidiaries were (in thousands):

Operating Operating Net

Revenues Income Income

2007:

First Quarter $2,600,230 $431,020 $212,195

Second Quarter $2,769,352 $478,040 $267,602

ird Quarter $3,289,087 $810,332 $461,159

Fourth Quarter $2,825,729 $336,976 $193,893

2006:

First Quarter $2,568,031 $394,763 $193,628

Second Quarter $2,628,502 $487,293 $281,802

ird Quarter $3,254,719 $644,408 $388,883

Fourth Quarter $2,480,906 $278,896 $268,289

EA R N I N G S P E R AV E R A G E CO M M O N SH A R E

2007 2006

Basic Diluted Basic Diluted

First Quarter $1.06 $1.03 $0.93 $0.92

Second Quarter $1.36 $1.32 $1.35 $1.33

ird Quarter $2.37 $2.30 $1.87 $1.83

Fourth Quarter $1.00 $0.96 $1.30 $1.27

e business of the Utility operating companies is subject to seasonal

uctuations with the peak periods occurring during the third quarter.

Notes to Consolidated Financial Statements concluded