Eli Lilly 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

To Our Shareholders

For Eli Lilly and Company, 2013 was a year of transition

and achievement. Once again, we confronted the chal-

lenges of a major patent expiration—in this instance, our

U.S. Cymbalta® patent in December. At the same time, we

completed four major regulatory lings for new products, a

record for our company.

Looking ahead, 2014 represents the most challenging

year of this period—which we’ve called “YZ”—when we lose

patent protection on several of our largest products, culmi-

nating with Evista® in March. But we have prepared for this

challenge and are positioned to return to growth and expand-

ing margins in 2015 and beyond.

Indeed, we view 2014 as a new beginning for Lilly when

we start to emerge from YZ with the anticipated launch

of three new medicines. e prospect of these launches—

with more to follow in 2015—represents the fruit of our

innovation-based strategy and is a testament to the thousands

of Lilly people who have performed so well through this

challenging period.

Since I became CEO in 2008, I’ve been candid about

both our challenges and our opportunities, as we have

rearmed Lilly’s commitment to innovation as our best path

forward to create value for patients, physicians, payers—and

for shareholders.

We’ve undertaken extensive eorts to transform our

company to address not only the challenge of patent expira-

tions, but also the demands of patients and payers alike for

greater value from medicine. We’ve delivered on our commit-

ments, we’ve adjusted to complications encountered along the

way, and we’ve positioned the company to bridge one of the

most signicant patent clis in the industry—while remain-

ing independent.

We’ve also successfully rebuilt our late-stage pipeline.

e four potential medicines we submitted this past year for

regulatory review include three to treat diabetes—dulaglutide,

empagliozin, and our new insulin glargine product—as

well as ramucirumab as a single-agent treatment in advanced

gastric cancer. In 2014, we expect to submit necitumumab

for squamous non-small cell lung cancer, as well as additional

indications for ramucirumab.

After a brief review of 2013 results, I’ll focus on the two

therapeutic areas where we expect to launch new medicines

this year—diabetes and oncology—which represent key areas

of growth for Lilly in the years ahead. And I’ll review our

broad research eorts to sustain progress in our pipeline.

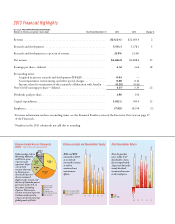

2013 Results

In 2013, revenue increased 2 percent to $23.1 billion—

following the loss of U.S. exclusivity for Cymbalta in the fourth

quarter. Even while we increased R&D spending by 5percent,

total operating expenses decreased 1percent due to lower sell-

ing and marketing expenses. Reported net income increased

15 percent, and earnings per share increased 18percent.

Eight of our products and our Elanco animal health

business exceeded $1 billion in annual sales. Japan and

China delivered double-digit volume increases, and Elanco

continued to exceed overall industry growth. is strong

performance, combined with our discipline in managing

costs, generated $5.7billion of operating cash ow, covering

capital expenditures of $1 billion and allowing the company

to return approximately $3.8billion in cash to shareholders

through the dividend and our share repurchase program.

Creating an Unmatched Portfolio of Diabetes Medicines

In 2013, Lilly took important steps to further address the

growing global epidemic of diabetes. A long-time leader in

insulins with Humulin® and Humalog®, Lilly is developing a

portfolio of diabetes medicines with unmatched breadth,

including insulins, other injectable treatments, and oral

(continued on page 4)