Eli Lilly 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIALS

10

OnegZmV

8nbWVaiV

<ZboVg

=jbVad\

8^Va^h

:k^hiV

6c^bVa=ZVai]

=jbja^c

6a^biV

;dgiZd

HigViiZgV

H^mEgdYjXih:mXZZY&7^aa^dc

^cCZiHVaZh

b^aa^dch

.gʨÀ^ÒSÍÄÊ:^ÊgʨÀ^ÒSÍÊgÊ

gÚSgg^g^ÊdußßÊÊÊgÍÊÄ:gÄÊ

^ÒÀzÊÑßßÇ®Ê-ÚÊsÊÍgÄgʨÀ^ÒSÍÄnÊ

9Û¨ÀgÚ:[ÊÛJ:Í:[ÊgÞ:À[ÊÒ:z[Ê

:Ä[Ê:^ÊØÄÍ:ngÚSgg^g^Êd£ÊJÊ

ÊÑßßÇ®ÊÍÊÀgÊÍ:Êd£®£ÊJÊÊ

Ä:gÄÊÊÑßßÇ[Ê:ÄÊÀg:Sg^Ê

ºJSJÒÄÍgÀ»ÊÄÍ:ÍÒÄÊÊÍÄÊsÒÀÍÊÛg:ÀÊ

ÊÍgÊ:ÀgÍ®Ê:Êg:ÍÊÄ:gÄÊ

ÍÍ:g^Êdu®lÊÊÊÑßßÇ[Ê^ÀØgÊ

JÛÊSÀg:Äg^Ê^g:^[ÊÍgÊ:SµÒÄÍÊ

sÊØÛÊ:Êg:Í[Ê:^ÊgÙÊ

S¨:Ê::ʨÀ^ÒSÍÊ:ÒSgÄ®ÊÊ

&!),*

&!*.'

)!,+&

'!&%(

&!&))

&!%.&

-*)

.-*

..+

,%.

*+.

Review of Operations

EXECUTIVE OVERVIEW

This section provides an overview of our fi nancial re-

sults, signifi cant business development, recent product

and late-stage pipeline developments, and legal, regu-

latory, and other matters affecting our company and the

pharmaceutical industry.

Financial Results

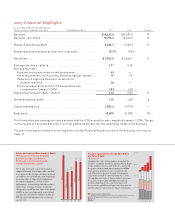

We achieved worldwide sales growth of 19 percent. This

growth was primarily driven by volume increases in a

number of key products, with a signifi cant portion of

this increase in volume resulting from the acquisition

of ICOS. Our additional investments in marketing and

selling expenses in support of key products, primarily

Cymbalta® and the diabetes care products, contributed

to this sales growth and enabled us to increase our

investment in research and development 11 percent

in 2007. While cost of sales and operating expenses in

the aggregate grew at approximately the same rate as

sales, other income—net decreased and the effective

tax rate increased. As a result, net income and earn-

ings per share increased 11 percent, to $2.95 billion, or

$2.71 per share, in 2007 as compared with $2.66 billion,

or $2.45 per share, in 2006. Net income comparisons

between 2007 and 2006 are affected by the impact of

the following signifi cant items that are refl ected in our

fi nancial results (see Notes 3, 4, and 13 to the consoli-

dated fi nancial statements for additional information):

2007

• We recognized asset impairments, restructuring,

and other special charges of $98.2 million (pretax)

in the fourth quarter, which decreased earnings per

share by $.07. In the fi rst quarter, we recognized

similar charges associated with previously announced

strategic decisions affecting manufacturing and

research facilities of $123.0 million (pretax), which

decreased earnings per share by $.08 (Note 4).

• We incurred a special charge following a settlement

with one of our insurance carriers over Zyprexa®

product liability claims, which led to a reduction of our

expected product liability insurance recoveries. This

resulted in a charge of $81.3 million (pretax), which

decreased earnings per share by $.06 in the third

quarter (Notes 4 and 13).

• We incurred in-process research and development

(IPR&D) charges associated with our licensing

arrangement with Glenmark Pharmaceuticals Limited

India of $45.0 million (pretax) and our licensing

arrangement with MacroGenics, Inc., of $44.0 million

(pretax), which decreased earnings per share by $.05 in

the fourth quarter (Note 3).

• We incurred IPR&D charges associated with the

acquisition of Hypnion, Inc. (Hypnion), of $291.1 million

(no tax benefi t) and the acquisition of Ivy Animal

Health, Inc. (Ivy), of $37.0 million (pretax), which

decreased earnings per share by $.29 in the second

quarter (Note 3).

• We incurred IPR&D charges associated with the

acquisition of ICOS of $303.5 million (no tax benefi t)

and a licensing arrangement with OSI Pharmaceuticals

of $25.0 million (pretax), which decreased earnings per

share by $.29 in the fi rst quarter (Note 3).

2006

• We recognized asset impairments, restructuring, and

other special charges of $450.3 million (pretax) in the

fourth quarter, which decreased earnings per share by

$.31 (Note 4).

•

In the fourth quarter, we incurred a charge related to

Zyprexa product liability litigation matters of $494.9 mil-

lion (pretax), or $.42 per share (Notes 4 and 13).

Late-Stage Pipeline Developments and Business

Development Activity

Our long-term success depends, to a great extent, on

our ability to continue to discover and develop innova-

tive pharmaceutical products and acquire or collabo-

rate on compounds currently in development by other

biotechnology or pharmaceutical companies. We have

achieved a number of successes with late-stage pipe-

line developments and recent business development

transactions within the past year, including:

Pipeline

• On December 26, 2007, together with our collaboration

partner Daiichi Sankyo Company, Limited, we

submitted a New Drug Application (NDA) for prasugrel

to the U.S. Food and Drug Administration (FDA). The

proposed trademark for prasugrel is Effi ent™. The

submission follows the release of results of the

TRITON TIMI-38 Phase III head-to-head study of