Einstein Bros 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

http://www.sec.gov/Archives/edgar/data/949373/000119312509042707/d10k.htm[9/11/2014 10:10:56 AM]

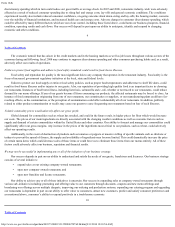

The following selected financial data for each fiscal year was extracted or derived from our consolidated financial statements which have

been audited by Grant Thornton LLP, our independent registered public accounting firm.

Fiscal years ended (1):

2004

(52 weeks)

2005

(53 weeks)

2006

(52 weeks)

2007

(52 weeks)

2008

(52 weeks)

(in thousands of dollars, except per share data and as otherwise indicated)

Selected Statements of Operations Data:

Revenues $ 373,860 $ 389,093 $ 389,962 $ 402,902 $ 413,450

Gross profit 67,199 73,702 78,632 80,930 81,768

Gross profit percentage 18.0% 18.9% 20.2% 20.1% 19.8%

General and administrative expenses 32,755 36,096 37,484 40,635 36,356

California wage and hour settlements — — — — 1,900

Senior management transition costs — — — — 1,335

Income from operations 5,458 9,368 21,438 28,266 27,616

Interest expense, net(2) 23,196 23,698 19,555 12,387 5,439

Write-off of debt discount upon redemption

of senior notes — — — 528 —

Prepayment penalty upon redemption of

senior notes — — 4,800 240 —

Write-off of debt issuance costs upon

redemption of senior notes — — 3,956 2,071 —

Income (loss) before income taxes (17,454) (14,018) (6,868) 13,040 22,177

Provision (benefit) for income taxes (49) — — 454 1,100

Net income (loss) $ (17,405) $ (14,018) $ (6,868) $ 12,586 $ 21,077

Per share data:

Weighted average number of common

shares outstanding -

Basic 9,842,414 9,878,665 10,356,415 13,497,841 15,934,796

Diluted 9,842,414 9,878,665 10,356,415 14,235,625 16,378,965

Net income (loss) available to common

stockholders per share -

Basic $ (1.77) $ (1.42) $ (0.66) $ 0.93 $ 1.32

Diluted $ (1.77) $ (1.42) $ (0.66) $ 0.88 $ 1.29

Cash dividends declared $— $— $— $— $—

Other Data:

Capital expenditures(4) $ 9,393 $ 10,264 $ 13,172 $ 25,869 $ 26,690

Percent increase (decrease) in comparable

store sales for company-owned

restaurants(5) (1.9%) 5.2% 4.5% 3.7% (0.1%)

23

Table of Contents

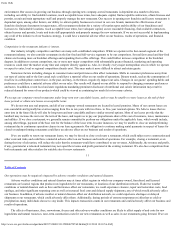

As of fiscal year ended (1):

2004 2005 2006 2007 2008

(in thousands of dollars, except per share data and as otherwise

indicated)

Selected Balance Sheet Data:

Cash and cash equivalents $ 9,752 $ 1,556 $ 5,477 $ 9,436 $ 24,216

Property, plant and equipment, net 41,855 33,359 33,889 47,714 59,747

Total assets 158,456 130,924 133,154 148,562 172,929

Short-term debt, capital leases and current portion of long-term

debt 311 299 3,681 1,035 8,088

Mandatorily redeemable Series Z preferred stock, $.001 par value,

$1,000 per share liquidation value(3) 57,000 57,000 57,000 57,000 57,000

Senior notes, capital leases and other long-term debt, net of

discount 160,871 160,589 166,680 88,942 79,787

Total stockholders’ deficit (112,483) (126,211) (132,231) (33,607) (13,651)