Einstein Bros 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000110465906016136/a06-3178_110k.htm[9/11/2014 10:13:03 AM]

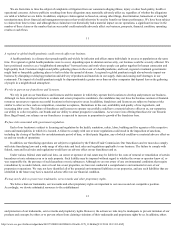

abandonment of assets, net 314 1,557 (558) (79.8)% * 0.1% 0.4% (0.1)%

Charges (adjustments) of integration and

reorganization cost 5 (869) 2,132 * * 0.0% (0.2)% 0.6%

Impairment charges and other related

costs 1,603 450 5,292 * (91.5)% 0.4% 0.1% 1.4%

Income (loss) from operations

9,368 5,458 (17,057) 71.6% (132.0)% 2.4% 1.5% (4.4)%

Other expense (income):

Interest expense, net 23,698 23,196 34,184 2.2% (32.1)% 6.1% 6.2% 8.9%

Cumulative change in the fair value

of derivatives — — (993) * * 0.0% 0.0% (0.3)%

Gain on investment in debt securities — — (374) * * 0.0% 0.0% (0.1)%

Loss on exchange of Series F

Preferred Stock — — 23,007 * * 0.0% 0.0% 6.0%

Other (312) (284) (172) 9.9% 65.1% (0.1)% (0.1)% (0.0)%

Loss before income taxes

(14,018) (17,454) (72,709) (19.7)% (76.0)% (3.6)% (4.7)% (19.0)%

Provision (benefit) for state income

taxes — (49) 812 * * 0.0% (0.0)% 0.2%

Net loss

(14,018) (17,405) (73,521) (19.5)% (76.3)% (3.6)% (4.7)% (19.2)%

Dividends and accretion on Preferred

Stock — — (14,423) * * 0.0% 0.0% (3.8)%

Net loss available to common

stockholders

$ (14,018)$ (17,405)$ (87,944)

(19.5)%

(80.2)%

(3.6)%

(4.7)%

(22.9)%

* not meaningful

25

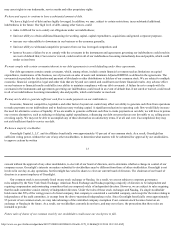

Revenues

Total revenues for fiscal 2005 were slightly below our expectations predominantly due to lower manufacturing revenues, license fees and a

lower level of increased transactions at our company operated restaurants but represented positive sales performance over prior years. Total

revenue improved 4.1% during fiscal 2005 compared to fiscal 2004. This improvement was primarily attributable to an increase in retail sales.

During fiscal 2005, we derived 93.3% of our total revenue from our company-operated restaurants. Our company operated retail sales increased

2.4% when calculated on a comparative 53-week basis for both fiscal 2005 and 2004. Retail comparable store sales increased 5.2% for fiscal 2005

due to an increase of 5.4% in check average offset by 0.2% decrease in transactions. Comparable store sales represent sales at restaurants that were

open for one full year and have not been relocated or closed during the current year. Comparable store sales are also referred to as “same-store”

sales and as “comp sales” within the restaurant industry.

Total revenues for fiscal 2004 were consistent with our expectations. Total revenues decreased 2.5% for fiscal 2004 compared to fiscal 2003.

The decrease in total revenue primarily resulted from the decline in company operated retail sales. Retail comparable store sales decreased 1.9%

for fiscal 2004 due to a reduction in transactions of 5.4% partially offset by an increase of 3.8% in check average.

Throughout fiscal 2004, the trend of lower comparable store sales began to reverse and ultimately became positive during the fourth quarter of

2004. The following table summarizes the elements of comparable store sales for each quarter in fiscal 2004 and 2005:

Comparable Average

Store Sales Check Transactions

Fiscal Year 2004:

First Quarter

(4.8)%

0.7%

(5.5)%

Second Quarter

(3.7)%

3.9%

(7.3)%

Third Quarter

(1.6)%

5.0%

(6.3)%

Fourth Quarter

2.6%

5.2%

(2.5)%

Fiscal Year 2005:

First Quarter

4.6%

6.4%

(1.7)%

Second Quarter

6.3%

6.0%

0.3%

Third Quarter

5.9%

5.5%

0.4%

Fourth Quarter

3.9%

3.8%

0.1%

We believe the positive trend in comparable store sales is a result of price increases coupled with a shift in the product mix to higher priced

items, improvements in the operation of our restaurants including initiatives in customer service and overall store appearance, the introduction of

new menu items, further development of catering programs in selected markets, and advertising campaigns that were initiated in the fourth quarter