DuPont 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 DuPont annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10FEB201017513591

Part II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES, continued

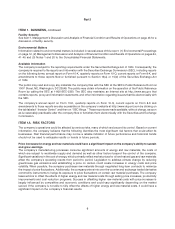

Stock Performance Graph

The following graph presents the cumulative five-year total return for the company’s common stock compared with the

S&P 500 Stock Index and a self-constructed peer group of companies. The peer group companies for the year ended

December 31, 2009 are 3M Company; Abbott Laboratories; Air Products & Chemicals, Inc.; Baxter International Inc.;

The Boeing Company; Caterpillar Inc.; Eastman Kodak Company; Emerson Electric Co.; Hewlett-Packard Company;

Honeywell International Inc.; Ingersoll-Rand Company Limited; Johnson & Johnson; Johnson Controls, Inc.; Kimberly-

Clark Corporation; Merck & Co. Inc.; Monsanto Company; Motorola Inc.; The Procter & Gamble Company; and United

Technologies Corporation.

Stock Performance Graph

$50

$75

$100

$125

$150

$175

2004 2005 2006 2007 2008 2009

DuPont

S&P 500

Peer Group

12/31/2004 12/31/2005 12/31/2006 12/31/2007 12/31/2008 12/31/2009

DuPont $100 $ 89 $106 $ 99 $ 59 $ 84

S&P 500 Index $100 $105 $121 $128 $ 81 $102

Peer Group $100 $108 $128 $151 $111 $133

The graph assumes that the value of DuPont Common Stock, the S&P 500 Stock Index and the peer group of

companies was each $100 on December 31, 2004 and that all dividends were reinvested. The peer group is weighted

by market capitalization.

15