Dominion Power 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Dominion 2005

Electric

Natural Gas

Corporate Headquarters

Richmond, Virginia

Regulated tilities er ice reas

so ecember 1

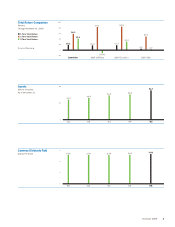

Share Price Closes 2005 Nearly 14 Percent Higher

The hurricanes took a financial toll on many businesses in

2005, including Dominion. However, investors demonstrat-

ed their confidence in the long-term prospects of our

integrated businesses. Our share price held up. In fact, we

hit more than two dozen all-time highs last year.

Thanks in part to our employees and to broad strength in

the energy sector, our share price closed up 14 percent

in 2005 at $77.20 compared to $67.74 at year-end 2004.

Including our annual dividend, we delivered a total return

of more than 18 percent in 2005, topping a total return of

more than 17 percent by the Standard & Poor’s 500

Electric Utilities Index and a total return of more than 16

percent by the S&P 500 Utilities Index. Beyond our sector,

the S&P 500 delivered a total return of just under 5 percent

in 2005, and the Dow Jones Industrial Average returned

less than 2 percent.

Taking a longer view, our total five-year return to

shareholders from Dec. 31, 2000, to Dec. 31, 2005, has

topped 40 percent. That compares favorably to a

30-percent total return by the S&P 500 Electric Utilities

Index and a negative total return of nearly 11 percent by

the S&P 500 Utilities. During the same five-year period, the

broader S&P 500 delivered a total return of less than

3 percent, while the Dow Jones Industrial Average returned

more than 10 percent.

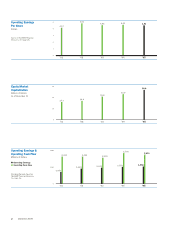

Hurricane Damage, Virginia Fuel Expense

Lower 2005 Earnings

In 2005, we earned $3.00 per share under Generally

Accepted Accounting Principles (GAAP), down from $3.78

per share a year earlier. Both Gulf hurricanes were major

factors behind the shortfall. Unrecoverable fuel expenses at

our Dominion Virginia Power unit were another factor.

Operating earnings in 2005 were $4.53 per share, down