Dollar Tree 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

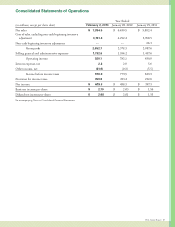

Management’s Discussion & Analysis of

Financial Condition and Results of Operations

Selling, General and Administrative Expenses.

Selling, general and administrative expenses, as a

percentageofnetsales,decreasedto24.1%for2011

comparedto24.8%for2010.edecreaseisprimarily

due to the following:

•Payrollexpensesdecreased45basispointsdueto

leveraging associated with the increase in comparable

store net sales in the current year, lower store

hourly payroll and lower incentive compensation

achievement.

•Depreciationdecreased25basispointsprimarily

due to the leveraging associated with the increase in

comparable store net sales in the current year.

Operating Income. Operating income margin was

11.8%in2011comparedto10.7%in2010.Excluding

the$26.3millionnon-cashadjustmenttobeginning

inventory,operatingincomemarginwas11.1%in2010.

Due to the reasons noted above, operating income

marginexcludingthischarge,improved70basispoints.

Income Taxes.Oureectivetaxratewas37.4%in2011

and36.9%in2010.

Fiscal year ended January 28, 2012 compared to

fiscal year ended January 29, 2011

Net Sales.Netsalesincreased12.7%,or$748.0million,

in2011comparedto2010,resultingfromsalesinour

newstoresanda6.0%increaseincomparablestorenet

sales.Comparablestorenetsalesarepositivelyaected

by our expanded and relocated stores, which we include

in the calculation, and, to a lesser extent, are negatively

aectedwhenweopennewstoresorexpandstoresnear

existing ones.

efollowingtablesummarizesthecomponents

ofthechangesinourstorecountforscalyearsended

January28,2012andJanuary29,2011.

January 28,

2012

January29,

2011

Newstores 278 235

Acquired stores —86

Expandedor

relocated stores 91 95

Closed stores (28) (26)

Ofthe2.4millionsellingsquarefootincreasein2011

approximately0.3millionwasaddedbyexpanding

existing stores.

Grossprotmarginwas35.9%in2011compared

to35.5%in2010.Excludingtheeectofthe$26.3

millionnon-cashbeginninginventoryadjustment,gross

protmarginremainedat35.9%.Improvementininitial

mark-up in many categories and occupancy and distribu-

tioncostleveragewereosetbyanincreaseinthemixof

higher cost consumer product merchandise and a smaller

reductionintheshrinkaccrualrateinscal2011thanin

scal2010.

2012AnnualReport17