Dollar Tree 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

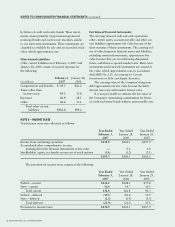

Comprehensive Income

The Company’s comprehensive income reflects the effect of recording derivative financial instruments pursuant

to SFAS No. 133. The following table provides a reconciliation of net income to total comprehensive income:

Year Ended Year Ended Year Ended

February 3, January 28, January 29,

(in millions) 2007 2006 2005

Net income $192.0 $173.9 $180.3

Fair value adjustment-derivative cash flow hedging instrument —0.6 1.0

Income tax expense —0.2 0.4

Fair value adjustment, net of tax —0.4 0.6

Amortization of SFAS No. 133 cumulative effect ———

Income tax benefit ———

Amortization of SFAS No. 133 cumulative effect, net of tax ———

Total comprehensive income $192.0 $174.3 $180.9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

42 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT

The cumulative effect recorded in “accumulated

other comprehensive income (loss)” is being amor-

tized over the remaining lives of the related interest

rate swaps.

Share Repurchase Programs

In March 2005, the Company’s Board of Directors

authorized the repurchase of up to $300.0 million of

the Company’s common stock through March 2008.

During fiscal 2006, the Company repurchased

5,650,871 shares for approximately $148.2 million

under the March 2005 authorization.

In November 2006, the Company’s Board of

Directors authorized the repurchase of up to $500.0

million of the Company’s common stock. This

amount was in addition to the $27.0 million remain-

ing on the March 2005 authorization. In December

2006, the Company entered into two agreements with

a third party to repurchase approximately $100.0

million of the Company’s common shares under an

Accelerated Share Repurchase Agreement (ASR).

The first $50.0 million was executed in an

“uncollared” agreement. In this transaction the

Company initially received 1,656,178 shares based on

the market price of the Company’s stock of $30.19

as of the trade date (December 8, 2006). A weighted

average price is calculated using stock prices from

December 16, 2006 – March 8, 2007. This represents

the calculation period for the weighted average price.

If the weighted average market price, as defined in the

agreement, during the calculation period is greater

than the $30.19 price per share, the Company will

deliver to the third party cash or shares of Common

Stock (at the Company’s option) equal to the price

difference. If the weighted average market price is less

than $30.19 then the third party will deliver to Dollar

Tree cash equal to the price difference. The weighted

average market price of the Company’s common

stock through February 3, 2007 was $31.00. There-

fore, if the transaction had settled on February 3,

2007, the Company would have had to return 43,207

shares to the third party which were included in the

Company’s weighted average dilutive potential com-

mon shares outstanding calculation. The weighted

average stock price of the Company’s common stock as

defined in the “uncollared” agreement as of March 8,

2007 (termination date) was $32.17. The Company

paid the third party an additional $3.3 million on

March 8, 2007 for the 1,656,178 shares delivered

under this agreement.

The remaining $50.0 million relates to a “col-

lared” agreement in which the Company initially

received 1,500,703 shares on December 8, 2006, rep-

resenting the minimum number of shares under the

agreement. The maximum number of shares that can

be received under the agreement is 1,693,101. The

number of shares is determined based on the weighted

average market price of the Company’s common