Dillard's 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DILLARD’S

2002 Annual Report

Table of contents

-

Page 1

DILLARD'S 2002 Annual Report -

Page 2

... Data: Number of stores Number of employees Gross square footage (in thousands) *53 Weeks (1) During fiscal 2002, the Company adopted Statement of Financial Accounting Standards No. 142, "Goodwill and Other Intangible Assets". See Management's Discussion and Analysis of Financial Condition and... -

Page 3

... $65.8 million in the prior year. Throughout 2002, we executed key merchandising initiatives, which were previously noted as crucial to the continued success of our Company. These changes are designed to significantly improve our supply chain - the manner through which we provide our customers with... -

Page 4

... increased storewide penetration of our private brand merchandise to 18.2% of sales from 15.4% in 2001. We will continue to replace underperforming brands with private brands. Dillard's continues to develop our own exciting new shoe lines under such exclusive names as Antonio Melani and Gianni Bini... -

Page 5

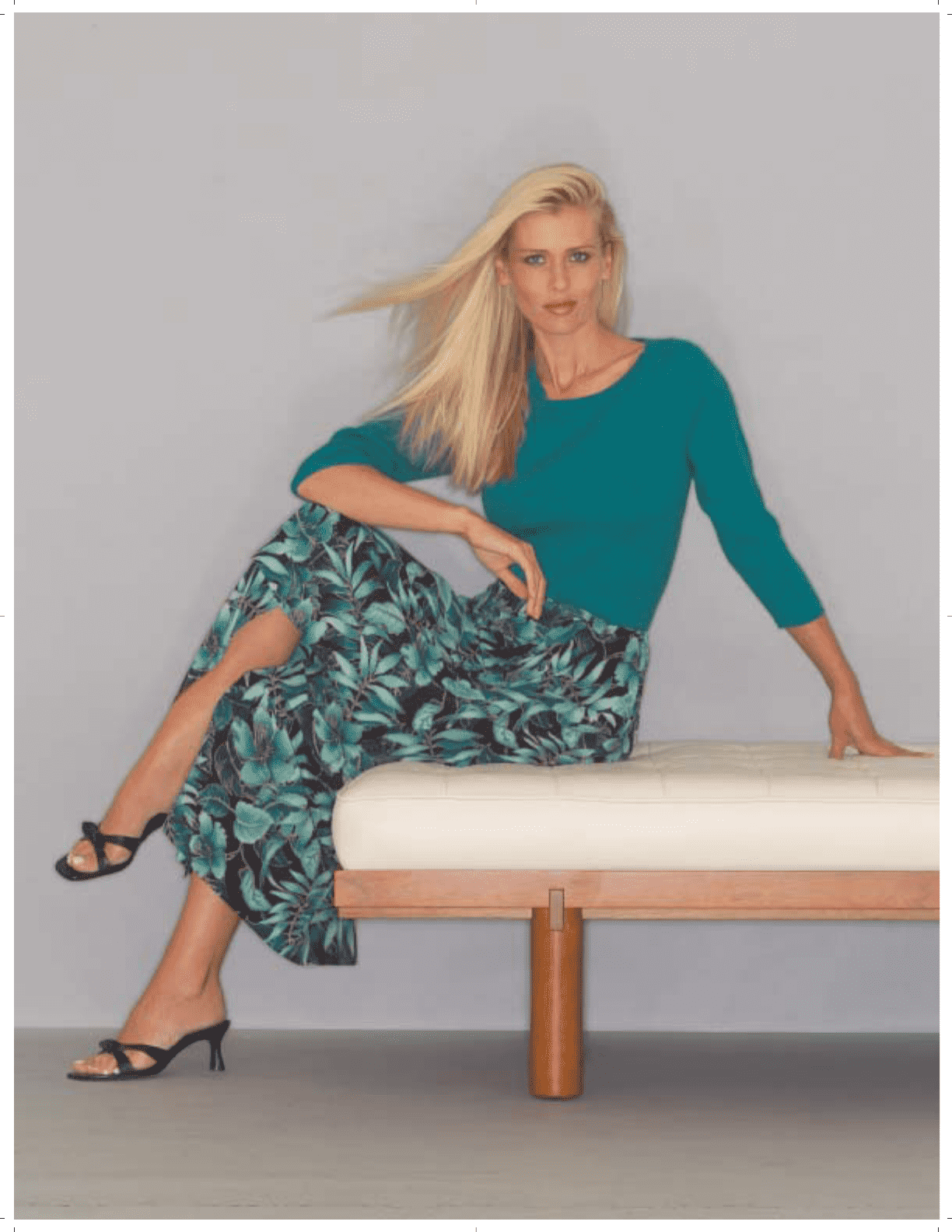

... fashions and fine fragrances from our cosmetic departments. At Dillard's, our male shoppers can count on finding their favorite basic shirt style from Roundtree & Yorke (left) in the most current colors. Daniel Cremieux (below), available exclusively in the United States at Dillard's, offers men... -

Page 6

... Board and Chief Executive Officer of Dillard's, Inc. James I. Freeman Senior Vice President and Chief Financial Officer of Dillard's, Inc. John Paul Hammerschmidt Retired Member of Congress Harrison, Arkansas John H. Johnson Chairman and Chief Executive Officer of Johnson Publishing Company, Inc... -

Page 7

...LITTLE ROCK, ARKANSAS 72201 (Address of principal executive office) (Zip Code) (501) 376-5200 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each Class Class A Common Stock Name of each exchange on which registered New York... -

Page 8

DOCUMENTS INCORPORATED BY REFERENCE Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 17, 2003 (the "Proxy Statement") are incorporated by reference into Part III. 2 -

Page 9

...," under item 6 hereof. The Company's annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K are available free of charge on Dillard's, Inc. Web site: www.dillards.com The information contained on the Company's web site is not incorporated by reference into... -

Page 10

... subsidiary vary. In general, the Company pays the cost of insurance, maintenance and any increase in real estate taxes related to the leases. At February 1, 2003 there were 333 stores in operation with gross square footage approximating 56.7 million feet. The Company owned or leased, from a wholly... -

Page 11

... the fourth quarter of the year ended February 1, 2003. PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS. The Company's common stock trades on the New York Stock Exchange under the Ticker Symbol "DDS". Stock Prices and Dividends by Quarter 2002 High Low $25.87... -

Page 12

... Preferred Beneficial Interests in the Company's Subordinated Debentures Stockholders' equity Number of employees - average Gross square footage (in thousands) Number of stores Opened Acquired Closed Total - end of year 2002 $7,910,996 -3% 5,254,134 66.4% 182,940 211,100 74,800 136,300 (4,374) (530... -

Page 13

...their related maturity dates net of the write-off of unamortized deferred financing costs relating thereto and the retirement of Reset Put Securities ("REPS") prior to their maturity dates. Cumulative effect of accounting change. Effective February 3, 2002, the Company adopted Statement of Financial... -

Page 14

... similar customers including bankruptcy and write-off trends, current aging information and year-end balances. Management believes that the allowance for uncollectible accounts is adequate to cover anticipated losses in the reported credit card receivable portfolio under current conditions; however... -

Page 15

...in men's clothing and accessories and home, which decreased 6% and 4%, respectively. The Company continues to emphasize its private brand merchandise in order to build penetration and recognition of those private brands. During the fiscal years 2002, 2001 and 2000, sales of private brand merchandise... -

Page 16

.... The Company viewed the changes in the vendor arrangements as a new purchasing model that will enhance its merchandising decisions. Since the vendor allowances were directly related to purchases, the Company accounted for such fixed discount arrangements as a reduction of inventoriable product cost... -

Page 17

... $200 million through scheduled debt maturities and repurchases of notes prior to their related maturity dates. Capital expenditures were $233 million for 2002. During 2002, the Company opened four new stores, Randolph Mall in Asheboro, North Carolina; Parkway Place in Huntsville, Alabama; Triangle... -

Page 18

... space. The Company closed twelve store locations, including the three replacement stores, during the year totaling approximately 1.5 million square feet of retail space. Capital expenditures for 2003 are expected to be approximately $250 million. The Company plans to open five new stores in fiscal... -

Page 19

... Company's financial position or results of operations. In December 2002, the FASB issued SFAS No. 148, "Accounting for Stock-Based Compensation-Transition and Disclosure" ("SFAS No. 148") which amends SFAS No. 123, "Accounting for Stock-Based Compensation." SFAS No. 148 provides alternative methods... -

Page 20

... conditions for regions in which the Company's stores are located and the effect of these factors on the buying patterns of the Company's customers; the impact of competitive pressures in the department store industry and other retail channels including specialty, off-price, discount, internet... -

Page 21

.... The Company also retired the remaining $143 million of its 6.31% Reset Put Securities due August 1, 2012 prior to their maturity date. The Company is exposed to market risk from changes in the interest rates on certain receivable financing facilities and $331.6 million of the Guaranteed Beneficial... -

Page 22

...benefit relationship of possible controls and procedures. The Company's management, including William Dillard, II, Chairman of the Board of Directors and Chief Executive Officer (principal executive officer) and James I. Freeman, Senior Vice-President and Chief Financial Officer (principal financial... -

Page 23

... authorized. Dillard's, Inc. Registrant Date: April 8, 2003 /s/ James I. Freeman James I. Freeman, Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 24

/s/ William Dillard II William Dillard II Chief Executive Officer and Director (Principal Executive Officer) /s/ James I. Freeman James I. Freeman Senior Vice President and Chief Financial Officer and Director /s/ John Paul Hammerschmidt John Paul Hammerschmidt Director /s/ John H. Johnson John ... -

Page 25

... respect to the period covered by this annual report; 3. Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and... -

Page 26

I, James I. Freeman, certify that: 1. I have reviewed this annual report on Form 10-K of Dillard's, Inc.; 2. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the ... -

Page 27

... 3, 2001. Consolidated Statements of Cash Flows - Fiscal years ended February 1, 2003, February 2, 2002 and February 3, 2001. Notes to Consolidated Financial Statements - Fiscal years ended February 1, 2003, February 2, 2002 and February 3, 2001. Schedule II - Valuation and Qualifying Accounts... -

Page 28

... Auditors' Report To the Stockholders and Board of Directors of Dillard's, Inc. Little Rock, Arkansas We have audited the accompanying consolidated balance sheets of Dillard's, Inc. and subsidiaries as of February 1, 2003 and February 2, 2002, and the related consolidated statements of operations... -

Page 29

... Balance Sheets Dollars in Thousands Assets Current Assets: Cash and cash equivalents Accounts receivable (net of allowance for doubtful accounts of $49,755 and $37,385) Merchandise inventories Other current assets Total current assets Property and Equipment: Land and land improvements Buildings... -

Page 30

... change Net Income (Loss) See notes to consolidated financial statements. $7,910,996 322,943 8,233,939 5,254,134 2,164,033 301,407 68,101 182,940 52,224 8,022,839 211,100 74,800 136,300 (4,374) (530,331) $(398,405) $1.61 (.05) (6.27) $(4.71) $1.60 (.05) (6.22) $(4.67) Years Ended February 2, 2002... -

Page 31

...869,985 shares under stock option, employee savings and stock bonus plans 9 Cash dividends declared: Common stock, $.16 per share - Balance, February 1, 2003 $1,127 See notes to consolidated financial statements. Common Stock Class A Class B $1,115 $40 - - Treasury Stock $(443,395) - Total $2,832... -

Page 32

... Purchase of treasury stock Net cash used in financing activities Decrease in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year See notes to consolidated financial statements. $(398,405) Years Ended February 2, 2002 $71,798 February... -

Page 33

... recent economic events, additional analyses are required to appropriately estimate losses inherent in the portfolio. The Company's current credit processing system charges off an account automatically when a customer has failed to make a required payment in each of the six billing cycles following... -

Page 34

...enhance its merchandising decisions. Since the vendor allowances are directly related to purchases, the Company accounts for such fixed discount arrangements as a reduction of inventoriable product cost. As the Company moves toward the new purchasing model, it plans to continue to negotiate up-front... -

Page 35

... to Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," the Company accounts for stock-based employee compensation arrangements using the intrinsic value method. Accordingly, no compensation expense has been recorded in the Consolidated Financial Statements with... -

Page 36

...and service charges and interest on the Company's proprietary credit card. The Company's merchandise sales mix by product category for the last three years was as follows: Product Categories Cosmetics Women's and Juniors' Clothing Children's Clothing Men's Clothing and Accessories Shoes, Accessories... -

Page 37

...of these reporting units was estimated using the expected discounted future cash flows and market values of related businesses, where appropriate. Related to the 1998 acquisition of Mercantile Stores Company Inc., the Company had $570 million in goodwill recorded in its consolidated balance sheet at... -

Page 38

... Rate plus 1.75%. The line of credit agreement is secured by inventory of certain Company stores. The agreement expires on May 9, 2005 and cannot be withdrawn except in the case of defaults by the Company. The Company pays an annual commitment fee of 0.375% of the committed amount to the banks... -

Page 39

... its receivable financing from other revenue to interest expense on its consolidated statements of operations for all periods presented. The Company reclassified $11.3 million and $15.0 million for the twelve-month periods ended February 2, 2002 and February 3, 2001, respectively. 5. Trade Accounts... -

Page 40

... $44,030 (in thousands of dollars) Current: Federal State Deferred: Federal State A reconciliation between the Company's income tax provision and income taxes using the federal statutory income tax rate is presented below: Fiscal Fiscal Fiscal (in thousands of dollars) 2002 2001 2000 Income tax at... -

Page 41

... are used to purchase Class A Common Stock of the Company for the account of the employee. The terms of the plan provide a six-year graduated-vesting schedule for the Company contribution portion of the plan. The Company incurred expense of $18 million, $19 million and $19 million for fiscal 2002... -

Page 42

...: Fiscal 2002 7.25% 6.75% 2.50% Fiscal 2001 7.25% 7.25% 2.50% Fiscal 2000 7.25% 7.25% 2.50% Discount rate-net periodic pension cost Discount rate-benefit obligations Rate of compensation increases The components of net periodic benefit costs are as follows: (in thousands of dollars) Components... -

Page 43

...acquiring person or group) will be entitled to receive, upon payment of the exercise price, shares of Class A common stock having a market value of two times the exercise price. The rights will expire, unless extended, redeemed or exchanged by the Company, on March 2, 2012. 10. Earnings per Share In... -

Page 44

... value method of accounting for stock options. No compensation cost has been recognized in the consolidated statements of operations for the Company's stock option plans. The fair value of each option grant is estimated on the date of each grant using the Black-Scholes option-pricing model with... -

Page 45

... value to its fair value, which is generally calculated using discounted cash flows. During fiscal 2002, the Company recorded a pre-tax charge of $52.2 million for asset impairment and store closing costs. The charge includes a write-down to fair value for certain under-performing properties in... -

Page 46

... a current market exchange. The fair value of trade accounts receivable is determined by discounting the estimated future cash flows at current market rates, after consideration of credit risks and servicing costs using historical rates. The fair value of the Company's long-term debt and Guaranteed... -

Page 47

... credit card securitizations Servicing fees received Cash flows received on retained interests $200,000 580,000 7,844 39,147 The following table presents information about principal balances of managed and securitized credit card receivables as of and for the year ended February 2, 2002. (dollars... -

Page 48

... of the accounting change as of February 3, 2002 was to decrease net income for fiscal year 2002 by $530 million or $6.22 per diluted share. The Company has restated the first quarter of 2002 in accordance with SFAS No. 3, "Reporting Accounting Changes in Interim Financial Statements," as follows... -

Page 49

... E Column F Description Balance at Beginning of Period Additions Charged to Charged to Costs and Other Expenses Accounts Deductions (1) Balance at End of Period Allowance for losses on accounts receivable: Year Ended February 1, 2003 Year Ended February 2, 2002 Year Ended February 3, 2001... -

Page 50

...29, 1994 in 1-6140). Amendment No. 1 to the Corporate Officers Non-Qualified Pension Plan. Senior Management Cash Bonus Plan (Exhibit 10(d) to Form 10-K for the fiscal year ended January 28, 1995 in 1-6140). 2000 Incentive and Nonqualified Stock Option Plan (Exhibit 10(e) to Form 10-K for the fiscal... -

Page 51

... Executive Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350). Certification of Chief Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350). * Incorporated by reference as indicated. ** A management contract or compensatory plan... -

Page 52

... reports, press releases and other Company information are available on the Dillard's, Inc. Web site: www.dillards.com Individuals or securities analysts with questions regarding Dillard's, Inc. may contact: Julie J. Bull Director of Investor Relations 1600 Cantrell Road Little Rock, Arkansas... -

Page 53

Dillard's, Inc. 1600 Cantrell Road Little Rock, Arkansas 72201 www.dillards.com