DSW 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 DSW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPORT

Table of contents

-

Page 1

2009 ANNUAL REPORT -

Page 2

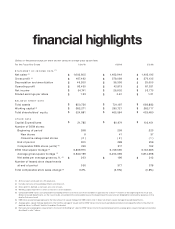

... Net sales per average gross sq. ft. Number of leased shoe departments at end of period Total comparable store sales change $ 203 356 $ 196 377 (5.9%) $ 212 378 (0.8%) (5) 3.2% (1) (2) (3) (4) All fiscal years are based on a 52- week year. Includes net sales of leased depar tments and dsw... -

Page 3

-

Page 4

-

Page 5

... DSW Drive, Columbus, Ohio (Address of principal executive offices) 43219 (Zip Code) Registrant's telephone number, including area code (614) 237-7100 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class: Name of Each Exchange on Which Registered: Class A Common Shares... -

Page 6

...Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Shareholder... -

Page 7

TABLE OF CONTENTS TO FINANCIAL STATEMENTS Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Shareholders' Equity ...Consolidated Statements of Cash Flows ...Notes to Consolidated Financial ... -

Page 8

... clear that the term only means the parent company. DSW is a controlled subsidiary of Retail Ventures. RVI Common Shares are listed for trading under the ticker symbol "RVI" on the NYSE. We own many trademarks and service marks. This Annual Report on Form 10-K may contain trade dress, tradenames and... -

Page 9

...our first DSW store in Dublin, Ohio in July 1991. In 1998, a predecessor of Retail Ventures purchased DSW and affiliated shoe businesses from Schottenstein Stores Corporation ("SSC") and Nacht Management, Inc. In July 2005, we completed an initial public offering ("IPO") of our Class A Common Shares... -

Page 10

... a sale event. In order to provide additional value to our customers, we maintain a loyalty program, "DSW Rewards", which rewards customers for shopping, both in stores and online at dsw.com. "DSW Rewards" members earn reward certificates that offer discounts on future purchases. Reward certificates... -

Page 11

... and become the shoe retailer of choice in each market. We plan to increase dsw.com sales through serving customers in areas where we do not currently operate stores and offering current customers additional styles and sizes not available in their local store. In our leased business, we are refining... -

Page 12

... our website and to gain market share by serving customers in areas where we do not currently have stores. We entered into a ten-year lease agreement for space to serve as a fulfillment center for dsw.com. We operate a call center to address our customer service needs in support of both DSW stores... -

Page 13

... a fulfillment center in Columbus, Ohio to process orders for dsw.com, which are shipped directly to customers using a third party shipping provider. Competition We view our primary competitors to be department stores and brand-oriented discounters. However, the fragmented shoe market means we face... -

Page 14

... new DSW stores on a profitable basis. During fiscal 2009, 2008 and 2007, we opened 9, 41 and 37 new DSW stores, respectively. We plan to open approximately ten stores in fiscal 2010 and are currently evaluating our strategy for fiscal 2011 and beyond. As of January 30, 2010, we have signed leases... -

Page 15

...• open new stores at costs not significantly greater than those anticipated; • successfully open new DSW stores in markets in which we currently have few or no stores; • control the costs of other capital investments associated with store openings; • hire, train and retain qualified managers... -

Page 16

...decreased customer interest in our stores, which could adversely affect our financial performance. During fiscal 2009, merchandise supplied to DSW by three key vendors accounted for approximately 21% of our net footwear sales. The loss of or a reduction in the amount of merchandise made available to... -

Page 17

... on our business and operations. For DSW stores and leased departments, the majority of our inventory is shipped directly from suppliers to our primary distribution center in Columbus, Ohio, where the inventory is then processed, sorted and shipped to one of our pool locations located throughout the... -

Page 18

...loyalty. "DSW Rewards" is a customer loyalty program that we rely on to drive customer traffic, sales and loyalty. "DSW Rewards" members earn reward certificates that offer discounts on future purchases. In fiscal 2009, shoppers in the loyalty program generated approximately 84% of DSW store and dsw... -

Page 19

... could experience lower net sales than expected on a quarterly or annual basis and be forced to delay or slow our retail expansion plans. The current economic slowdown is also impacting credit card processors and financial institutions which hold our credit card receivables. We depend on credit card... -

Page 20

.... We are controlled directly by Retail Ventures and indirectly by SSC and its affiliates, whose interests may differ from our other shareholders. As of January 30, 2010, Retail Ventures, a public corporation, owns 100% of our outstanding Class B Common Shares, which represents approximately 62... -

Page 21

... to, business and inventory liquidations, apparel companies and real estate acquisitions. The provisions of the separation agreement also outline how corporate opportunities are to be assigned in the event that our, Retail Ventures' or SSC's directors and officers learn of corporate opportunities... -

Page 22

... of Retail Ventures and us with respect to tax liabilities and benefits, tax attributes, tax contests and other matters regarding taxes and related tax returns. Although Retail Ventures has informed us that it does not currently intend or plan to undertake a spin-off of our stock to Retail Ventures... -

Page 23

..." described in the offering prospectus, or if Retail Ventures elects, the cash equivalent thereof or a combination of cash and DSW Class A Common Shares. The settlement of the PIES will not change the number of DSW Common Shares outstanding. The market price of our Class A Common Shares is likely to... -

Page 24

... table on page 4 for a listing of the states where our DSW stores are located. Our primary distribution facility, our principal executive office and our dsw.com fulfillment center are located in Columbus, Ohio. The lease for our distribution center and our executive office space expires in December... -

Page 25

...,000 Class B Common Shares for an aggregate amount of $8.0 million. Total Number of Approximate Dollar Total Number Shares Purchased as Value of Shares That May of Shares Average Price Part of Publicly Yet be Purchased Under Purchased Paid per Share Announced Programs the Programs Period November... -

Page 26

... return of our Class A Common Shares with the cumulative total return of the S & P MidCap 400 Index and the S & P Retailing Index, both of which are published indexes. This comparison includes the period beginning June 29, 2005, our first day of trading after our initial public offering, and ending... -

Page 27

... ...Comparable DSW stores (units)(8) ...DSW total square footage(9) ...Average gross square footage(10) . . Net sales per average gross square foot(11) ...Number of leased departments at end of period ...Total comparable store sales change(8) . . . $ . . (1) Fiscal 2006 was based on a 53 week year... -

Page 28

... related to buying, information technology, depreciation expense for corporate cost centers, marketing, legal, finance, outside professional services, customer service center expenses, allocable costs to and from Retail Ventures, payroll and benefits for associates and payroll taxes. Corporate level... -

Page 29

... subsidiaries with key services relating to risk management, tax, financial services, benefits administration, payroll and information technology. The current term of the Amended and Restated Shared Services Agreement expired at the end of fiscal 2009, was extended automatically for fiscal 2010 and... -

Page 30

... affect our ability to acquire a majority interest in a joint venture. For fiscal years after fiscal 2007, DSW and RVI will no longer reimburse each other for the benefits or detriments derived from combined and unitary state and local filing positions. Critical Accounting Policies and Estimates As... -

Page 31

...the customer. Store occupancy costs include rent, utilities, repairs, maintenance, insurance, janitorial costs and occupancy-related taxes, which are primarily real estate taxes passed to us by our landlords. • Investments. Our investments are valued using a market-based approach using level 1 and... -

Page 32

... costs and loss development factors would increase or decrease our self-insurance accrual by approximately $0.1 million. • Customer Loyalty Program. We maintain a customer loyalty program for the DSW stores and dsw.com in which program members earn reward certificates that result in discounts... -

Page 33

...2009 new stores, dsw.com and closed store sales . . Net sales for the fiscal year ended January 30, 2010 ...The following table summarizes our sales change by segment and in total: $1,462.9 42.8 96.9 $1,602.6 For the Fiscal Years Ended January 30, January 31, 2010 2009 (In millions) DSW ...Leased... -

Page 34

... by segment and in total: Fiscal Year Ended January 30, 2010 DSW ...Leased departments ...Total DSW Inc... 4.0% (3.6)% 3.2% The increase in comparable store sales was primarily a result of an increase in traffic and average unit retail. DSW segment comparable sales increased in women's footwear by... -

Page 35

...and closed store sales . . Net sales for the fiscal year ended January 31, 2009 ...The following table summarizes our sales by segment and in total: $1,405.6 (74.6) 131.9 $1,462.9 For the Fiscal Years Ended January 31, February 2, 2009 2008 (In millions) DSW ...Leased departments ...Total DSW Inc... -

Page 36

...the start-up and operation of dsw.com. Home office expenses as a percent of sales increased by 130 basis points due to increases in personnel and bonus costs, a one-time severance charge related to the fourth quarter workforce reduction and unreimbursed expenses related to services provided to Value... -

Page 37

... distribution and fulfillment centers and our office facilities from leased facilities. All lease obligations are accounted for as operating leases. We disclose the minimum payments due under operating leases in the notes to the financial statements included elsewhere in this Annual Report on Form... -

Page 38

... and information technology programs that we undertake and the timing of these expenditures. In fiscal 2009, we opened nine new DSW stores. We plan to open approximately ten stores in fiscal 2010. During fiscal 2009, the average investment required to open a typical new DSW store was approximately... -

Page 39

... us to pay contingent rent based on sales, common area maintenance costs and real estate taxes. Contingent rent, costs and taxes vary year by year and are based almost entirely on actual amounts incurred. As such, they are not included in the lease obligations presented above. Other non-current... -

Page 40

... amended (the "Exchange Act")). Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded, as of the end of the period covered by this Annual Report, that such disclosure controls and procedures were effective. Management's Report on Internal Control over Financial... -

Page 41

...Warrants and Rights (a) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))(c) Plan Category Equity compensation plans approved by... -

Page 42

... Statements The documents listed below are filed as part of this Form 10-K: Page in Form 10-K Report of Independent Registered Public Accounting Firm...Consolidated Balance Sheets as of January 30, 2010 and January 31, 2009...Consolidated Statements of Income for the years ended January 30, 2010... -

Page 43

..., thereunto duly authorized. DSW INC. By: /s/ Douglas J. Probst Douglas J. Probst, Executive Vice President and Chief Financial Officer March 23, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons in the capacities and... -

Page 44

Signature Title Date * Allan J. Tanenbaum * Heywood Wilanksy *By: /s/ Douglas J. Probst Douglas J. Probst, (Attorney-in-fact) Director March 23, 2010 Director March 23, 2010 40 -

Page 45

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of DSW Inc. Columbus, Ohio We have audited the accompanying consolidated balance sheets of DSW Inc. and its subsidiaries (the "Company") as of January 30, 2010 and January 31, 2009, and the related ... -

Page 46

... expenses: Compensation ...Taxes ...Gift cards and merchandise credits ...Other ...Total current liabilities ...Non-current liabilities ...Commitments and contingencies Shareholders' equity: Class A Common Shares, no par value; 170,000,000 authorized; 16,508,581 and 16,315,746 issued and outstanding... -

Page 47

... YEARS ENDED JANUARY 30, 2010, JANUARY 31, 2009 AND FEBRUARY 2, 2008 January 30, January 31, February 2, 2010 2009 2008 (In thousands, except per share amounts) Net sales ...Cost of sales ...Operating expenses ...Operating profit ...Interest expense ...Interest income ...Interest income, net ...Non... -

Page 48

... units granted ...Exercise of stock options ...Vesting of restricted stock units, net of settlement of taxes ...Non-cash capital contribution from RVI ...Stock-based compensation expense, before related tax effects ...Purchase of DSW Class B Common Shares from RVI ...Balance, January 30, 2010 ... 16... -

Page 49

... ...Excess tax benefit - related to stock option exercises ...Purchase of DSW Class B Common Shares from RVI ...Net cash (used in) provided by financing activities ...Net increase (decrease) in cash and equivalents ...Cash and equivalents, beginning of period ...Cash and equivalents, end of period... -

Page 50

... ACCOUNTING POLICIES Business Operations - DSW Inc. ("DSW") and its wholly-owned subsidiaries are herein referred to collectively as DSW or the "Company". DSW's Class A Common Shares are listed on the New York Stock Exchange under the ticker symbol "DSW". As of January 30, 2010, Retail Ventures... -

Page 51

.... At times, such amounts may be in excess of Federal Deposit Insurance Corporation ("FDIC") insurance limits. Concentration of Vendor Risk - During fiscal 2009, 2008 and 2007, merchandise supplied to the Company by three key vendors accounted for approximately 21%, 20% and 21% of net footwear sales... -

Page 52

..., 2009, the balance of goodwill related to the DSW stores was $25.9 million. Goodwill is tested for impairment at least annually. The Company has never recorded goodwill impairment. Management evaluates the fair value of the reporting unit using market-based analysis to review market capitalization... -

Page 53

..., the Company supplies footwear, under supply arrangements, to four retailers. Sales for these leased departments are net of returns and sales tax, as reported by the lessor, and are included in net sales. Leased department sales represented 9.2%, 11.2% and 12.5% of total net sales for fiscal 2009... -

Page 54

... services, customer service center expenses, allocable costs to and from Retail Ventures, payroll and benefits for associates and payroll taxes. Corporate level expenses are primarily attributable to operations at the corporate offices in Columbus, Ohio. Stock-Based Compensation - The fair value... -

Page 55

... and ending balances of the level 3 classification and provide greater disaggregation for each class of assets and liabilities that use fair value measurements. Except for the detailed level 3 disclosures, the new standard is effective for the Company for interim and annual reporting periods... -

Page 56

... to DSW 320,000 Class B Common Shares, without par value, of DSW, for an aggregate amount of $8.0 million. Schottenstein Stores Corporation ("SSC") - SSC and its affiliates are the majority shareholders of RVI. The Company leases certain store, office space and distribution center locations owned... -

Page 57

... the Company's stock option plan and related per share weighted average exercise prices ("WAEP") and weighted average grant date fair value using the Black-Scholes option pricing model (shares and intrinsic value in thousands): January 30, 2010 Shares WAEP Fiscal Years Ended January 31, 2009 Shares... -

Page 58

.... The number of stock units granted to each non-employee director is calculated by dividing one-half of the director's annual retainer (including committee retainer fees but excluding any amount paid for service as the chair of a board committee) by the fair market value of a share of the DSW Class... -

Page 59

... center and one distribution center for a total annual minimum rent of $10.9 million and additional contingent rents based on aggregate sales in excess of specified sales for the store locations. Under supply agreements, the Company pays contingent rents based on sales for the leased departments... -

Page 60

... periods presented: Short-Term Investments, Net Long-Term Investments, Net January 30, January 31, January 30, January 31, 2010 2009 2010 2009 (In thousands) Available-for-sale: Tax exempt, tax advantaged and taxable bonds ...Variable rate demand notes ...Tax exempt commercial paper ...Certificates... -

Page 61

...financial institutions, as well as credit card receivables that generally settle within three days. The Company's investments in auction rate securities were recorded at fair value using an income approach valuation model that uses level 3 inputs such as the financial condition of the issuers of the... -

Page 62

... its fair value, based on a discounted cash flow analysis using a discount rate determined by management. Should an impairment loss be realized, it will generally be included in cost of sales. The impairment charges were recorded within the DSW reportable segment. 7. DSW $150 MILLION CREDIT FACILITY... -

Page 63

... than the average market price of the common shares for the period and, therefore, the effect would be anti-dilutive. 9. OTHER BENEFIT PLANS The Company participates in a 401(k) Plan. Eligible employees may contribute up to thirty percent of their compensation to the 401(k) Plan, on a pre-tax basis... -

Page 64

..., production processes, target customers and distribution methods. The Company has identified such segments based on internal management reporting and management responsibilities and measures segment profit as gross profit, which is defined as net sales less cost of sales. All operations are located... -

Page 65

... of the expected income taxes based upon the statutory rate: January 30, 2010 Fiscal Years Ended January 31, February 2, 2009 2008 (In thousands) Income tax expense at federal statutory rate ...State and local taxes-net ...Permanent book/tax differences ...Income tax provision ... $32,162 3,332... -

Page 66

...: Basis differences in inventory ...Construction and tenant allowances ...Accrued rent ...Stock-based compensation - restricted stock and director stock units ...Accrued expenses ...Stock-based compensation - non-qualified stock options ...Benefit from uncertain tax positions...Unredeemed gift cards... -

Page 67

...current and future tax examinations to be insignificant at this time. 13. QUARTERLY FINANCIAL DATA (UNAUDITED) May 2, 2009 Thirteen Weeks Ended August 1, October 31, January 30, 2009 2009 2010 (In thousands, except per share data) Net sales ...Cost of sales ...Operating expenses ...Operating profit... -

Page 68

..., dated July 5, 2005, among Schottenstein Stores Corporation, Retail Ventures, Inc., Schottenstein Management Company and DSW Inc. related thereto. Incorporated by reference to Exhibit 5 to Retail Ventures' Form 8-K (file no. 1-10767) filed July 11, 2005. Employment Agreement, dated March 4, 2005... -

Page 69

...and DSW Shoe Warehouse, Inc. re: Denton, TX DSW store.* Lease, dated October 28, 2003, by and between JLP-RICHMOND LLC, an affiliate of Schottenstein Stores Corporation, and Shonac Corporation, re: Richmond, VA DSW store. Incorporated by reference to Exhibit 10.47 to Retail Ventures' Form 10-K (file... -

Page 70

...between Shonac Corporation, as assignor, and DSW Shoe Warehouse, Inc., as assignee, re: Columbus, OH (Polaris) DSW store. Incorporated by reference to Exhibit 10.53.1 to Retail Ventures' Form 10-K/A (file no. 1-10767) filed May 12, 2005. Lease, dated August 30, 2002, by and between JLP-Cary, LLC, an... -

Page 71

... DSW Inc., re: Lynnhaven, Virginia DSW store. Incorporated by reference to Exhibit 10.2 to Form 10-Q (file no. 1-32545) filed December 6, 2006. Agreement of Lease, dated November 30, 2006, between 4300 Venture 34910 LLC, an affiliate of Schottenstein Stores Corporation, and DSW Inc., re: Home office... -

Page 72

... home office. Incorporated by reference to Exhibit 10.3 to Form 8-K (file no. 1-32545) filed March 6, 2008. Lease Amendment, dated November 30, 2006 between 4300 Venture 6729 LLC, an affiliate of Schottenstein Stores Corporation, and DSW Inc., re: warehouse and corporate headquarters. Incorporated... -

Page 73

....* Section 1350 Certification - Principal Executive Officer.* Section 1350 Certification - Principal Financial Officer.* * Filed herewith. ** Previously filed as the same Exhibit Number to DSW's Form S-1 (Registration Statement No. 333-123289) filed with the Securities and Exchange Commission on... -

Page 74

... report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Michael R. MacDonald Michael R. MacDonald, President and Chief Executive Officer... -

Page 75

...financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Douglas J. Probst Douglas J. Probst, Executive Vice President and Chief Financial Officer... -

Page 76

... 1350 CERTIFICATION* In connection with the Annual Report of DSW Inc. (the "Company") on Form 10-K for the fiscal year ended January 30, 2010 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Michael R. MacDonald, President and Chief Executive Officer of... -

Page 77

... CERTIFICATION* In connection with the Annual Report of DSW Inc. (the "Company") on Form 10-K for the fiscal year ended January 30, 2010 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Douglas J, Probst, Executive Vice President, and Chief Financial Officer... -

Page 78

-

Page 79

...DSW Inc. Home Ofï¬ce 810 DSW Drive, Columbus, Ohio 43219 Phone: (614) 237-7100 dswinc.com Douglas J. Probst Executive Vice President and Chief Financial Officer Jon J. Ricker Executive Vice President and Chief Strategy Officer Stock Listing DSW's Class A common shares trade on the New York Stock... -

Page 80

DSW INC. 810 DSW DRIVE, COLUMBUS, OHIO 43219 DSW.COM