CompUSA 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

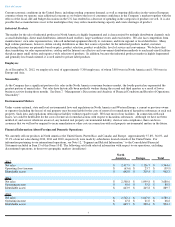

We require significant levels of capital in our business to finance accounts receivable and inventory. We maintain credit facilities

in the United States to finance increases in our working capital if available cash is insufficient. The amount of credit available to us

at any point in time may be adversely affected by the quality or value of the assets collateralizing these credit lines. In addition, in

recent years global financial markets have experienced diminished liquidity and lending constraints. Our ability to obtain future

and/or increased financing to satisfy our requirements as our business expands could be adversely affected by economic and market

conditions, credit availability and lender perception of our Company and industry . However, we currently have no reason to

believe that we will not be able to renew or replace our facilities when they reach maturity.

Our United States revolving credit agreement contains covenants restricting or limiting our ability to, among other things:

• incur additional debt

• create or permit liens on assets

• make capital expenditures or investments

• pay dividends

If we fail to comply with the covenants and other requirements set forth in the credit agreement, we would be in default and would

need to negotiate a waiver agreement with the lenders. Failure to agree on such a waiver could result in the lenders terminating the

credit agreement and demanding repayment of any outstanding borrowings, which could adversely affect our cash position and

adversely affect the availability of financing to us, which could materially impact our operations.

As of December 31, 2012, we had approximately 5,300 employees, 1,500 of which are located in Europe and Asia. We have

workers’ councils representing the employees of our France, Germany, and Netherlands operations, and trade unions representing

our employees in Italy and Sweden and elected employee representatives for our employees in the United Kingdom and Spain.

Most of these European employees are employed in countries in which employment laws provide greater bargaining or other rights

to employees than the laws of the U.S. Such employment rights require us to work collaboratively with the legal representatives of

the employees to effect any changes to labor arrangements. For example, most of our employees in Europe are represented by

unions or workers’ councils that must approve certain changes in conditions of employment, including salaries and benefits and

staff changes, and may impede efforts to restructure our workforce. The establishment of our shared services center in Hungary

regarding related reductions in force is subject to discussion with and approval of certain of the workers councils. We believe that

we have a generally good relationship with these councils and unions. We have entered into consultation processes under local laws

at our Germany, France, Netherlands and Italy locations for, among other things, restructuring our operations and effecting

reductions in force in connection with implementing our shared services center in Hungary. Although we believe that we have a

good working relationship with our employees, a strike, work stoppage or slowdown by our employees or significant dispute with

our employees could result in a significant disruption of our operations or higher ongoing labor costs.

We currently have 41 retail stores operating in North America at December 31, 2012. The Company needs to effectively manage

its cost structure including the additional inventory needs, retail point of sales IT systems, retail personnel and leased

facilities. Future growth in retail will also be dependent on the ability to attract customers and build brand loyalty. The retail

computer and consumer electronics business is highly competitive and has narrow gross margins. If we fail to manage our growth

and cost structure while maintaining high levels of service and meeting competitive pressures adequately, our business plan may

not be achieved and may lead to reduced profitability .

Table of Contents

• We depend on bank credit facilities to address our working capital and cash flow needs from time to time, and if we are unable to

renew or replace these facilities, or borrowing capacity were to be reduced our liquidity and capital resources may be adversely

affected.

•

If we fail to observe certain restrictions and covenants under our credit facilities the lenders could refuse to waive such default,

terminate the credit facility and demand immediate repayment, which would adversely affect our cash position and materially

adversely affect our operations.

• Our European employees are represented by unions or workers’ councils or are employed subject to local laws that are less

favorable to employers than the laws of the U.S.

• We operate retail stores in North America and we must effectively manage our cost structure, such as inventory needs, point of

sales systems, personnel and lease expense.

12