Comerica 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Comerica annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comerica

Incorporated

2009

Annual

Report

URSE

STAYING

ON

Table of contents

-

Page 1

STAYING ON URSE Comerica Incorporated 2009 Annual Report -

Page 2

...(NYSE: CMA) is a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth & Institutional Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition... -

Page 3

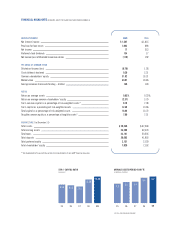

... 192 Diluted net income (loss) Cash dividends declared Common shareholders' equity Market value Average common shares outstanding - diluted RATIOS (0.79) 0.10 36.81 19.57 649 1.28 2.31 33.31 19.85 149 Return on average assets Return on average common shareholders' equity Tier 1 common capital as... -

Page 4

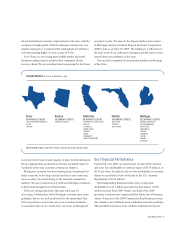

... market, predominantly California and also Arizona, we have added 74 banking centers and a corresponding $2.3 billion in deposits since 2004. The California economy has shown signs of strengthening in 2009, with stability in home prices and increasing home sales. In September, our chief economist... -

Page 5

... letter. PRIMARY MARKETS (ALL DATA AS OF DECEMBER 31, 2009) Texas 90 BANKING CENTERS DALLAS/FORT WORTH METROPLEX AUSTIN HOUSTON Arizona 66 BANKING CENTERS PHOENIX/SCOTTSDALE California 98 BANKING CENTERS SAN FRANCISCO & THE EAST BAY SAN JOSE LOS ANGELES ORANGE COUNTY SAN DIEGO FRESNO SACRAMENTO... -

Page 6

... II recessions. Overall, business customers in 2009 had lower sales volumes, which resulted in lower financing Our net interest margin came under pressure in 2009 from our asset-sensitive balance sheet as loans re-priced much faster than deposits in a declining rate environment. We believe that the... -

Page 7

... international trade services products, we provided companies with customized solutions that produced bottom-line results. In addition, our government electronic solutions group continued to support the U.S. Treasury Department's DirectExpress® Debit MasterCard® , a prepaid debit card for Social... -

Page 8

... economic environment. This and other sales-focused campaigns in our Retail Bank helped increase transaction deposit balances and deepen customer relationships. Our Wealth & Institutional Management division serves the needs of affluent clients, foundations and corporations, and represents... -

Page 9

... Sustainability Report in September 2009. The report, available COMERICA IS A RELATIONSHIP-BASED "MAIN STREET" BANK. WE on our Web site at www.comerica.com, was based ARE NOT A COMPLEX, TRANSACTION-ORIENTED "WALL STREET" on the Global Reporting Initiative framework, BANK. WE HAVE STAYED CLOSE... -

Page 10

...MARKET John M. Killian Executive Vice President and Chief Credit Officer Connie Beck Executive Vice President THE RETAIL BANK David E. Duprey Executive Vice President GENERAL AUDITOR Dale E. Greene Executive Vice President THE BUSINESS BANK Michael H. Michalak Executive Vice President CORPORATE... -

Page 11

FINANCIAL REVIEW AND REPORTS Comerica Incorporated and Subsidiaries Performance Graph ...Financial Results and Key Corporate Initiatives ...Overview ...Strategic Lines of Business ...Balance Sheet and Capital Funds Analysis ...Risk Management ...Critical Accounting Policies ...Supplemental ... -

Page 12

... Year Cumulative Total Return Among Comerica Incorporated, Keefe Bank Index, and S&P 500 Index (Assumes $100 Invested on 12/31/04 and Reinvestment of Dividends) $140 $120 $100 $80 $60 $40 $20 $0 Comerica Incorporated Keefe 50-Bank Index (a) Keefe Bank Index S&P 500 Index Comerica Incorporated Keefe... -

Page 13

... SHARE OF COMMON STOCK Diluted net income (loss) ...Cash dividends declared ...Common shareholders' equity ...Market value ...Average diluted shares (in thousands) . . YEAR-END BALANCES Total assets ...Total earning assets ...Total loans ...Total deposits ...Total medium- and long-term debt . Total... -

Page 14

...). Average loans declined in nearly all business lines, including declines in National Dealer Services (29 percent), Middle Market (14 percent), Specialty Businesses (13 percent), Commercial Real Estate (eight percent), Global Corporate Banking (seven percent) and Small Business (seven percent... -

Page 15

... in 2009. The Corporation expects to open 13 new banking centers in 2010 primarily in our growth markets of California, Texas and Arizona. The banking center expansion program for 2009 and planned program for 2010 was curtailed in comparison to earlier years due to the strained economic environment... -

Page 16

... to changes in the business environment in its primary geographic markets. To facilitate better balance among business segments and geographic markets, the Corporation opened 10 new banking centers in 2009 in markets with favorable demographics and plans to continue banking center expansion in... -

Page 17

......Total investment securities available-for-sale (f) . Federal funds sold and securities purchased under agreements to resell ...Interest-bearing deposits with banks (g) ...Other short-term investments ...Total earning assets ...Cash and due from banks ...Allowance for loan losses ...Accrued income... -

Page 18

...-bearing deposits with banks . Other short-term investments ...Total interest income (FTE) ...Interest expense: Interest-bearing deposits: Money market and NOW accounts ...Savings deposits ...Customer certificates of deposit Other time deposits ...Foreign office time deposits ... (2) (1) (2) (773... -

Page 19

... average earnings assets, largely driven by growth in investment securities available-for-sale. The lease income charges reflected the reversal of previously recognized income resulting from projected changes in the timing of income tax cash flows on certain structured leasing transactions and will... -

Page 20

... the Commercial Real Estate provision for loan losses. In the first half of 2009, the national economy was hampered by turmoil in the financial markets, declining home values and a global recession. Signs of growth in the national economy began in the third quarter of 2009, as the credit and capital... -

Page 21

... letters of credit extended to customers in the Michigan commercial real estate industry. An analysis of the changes in the allowance for credit losses on lending-related commitments is presented in the ''Credit Risk'' section of this financial review. Net loan charge-offs in 2009 increased $397... -

Page 22

...underlying assets managed, which include both equity and fixed income securities, impact fiduciary income. The decrease in 2009 was primarily due to lower personal trust fees related to market value decline in late 2008 and a decline in institutional trust fees related to the sale of the Corporation... -

Page 23

... benefits ...Total salaries and employee benefits ...Net occupancy expense ...Equipment expense ...Outside processing fee expense ...FDIC Insurance expense ...Software expense ...Other real estate expense ...Legal fees ...Litigation and operational losses ...Customer services ...Provision for credit... -

Page 24

... business and business unit profitability, while executive incentives are tied to the Corporation's overall performance and peer-based comparisons of results. The decrease in regular salaries in 2009 was primarily the result of a decrease in staff of approximately 850 full-time equivalent employees... -

Page 25

... of auction-rate securities, refer to the ''Investment Securities Available-for-Sale'' portion of the ''Balance Sheet and Capital Funds Analysis'' section and ''Critical Accounting Policies'' section of this financial review and Note 4 to the consolidated financial statements. Customer services... -

Page 26

... 31, 2008. For further information on the Capital Purchase Program, refer to the ''Capital'' section of this financial review and Note 15 to the consolidated financial statements. At such time as feasible, management intends to redeem the $2.25 billion of Fixed Rate Cumulative Perpetual Preferred... -

Page 27

... an increase in charge-offs in the Middle Market, Commercial Real Estate, Global Corporate Banking, Small Business and Leasing loan portfolios. Noninterest income of $291 million in 2009 decreased $11 million from 2008, primarily due to a $14 million gain on the sale of MasterCard shares in 2008 and... -

Page 28

... for the Personal Banking loan portfolio (primarily the Midwest market). Noninterest income of $190 million decreased $68 million in 2009, from $258 million in 2008, primarily due to a $48 million gain on the sale of Visa shares in 2008, a decrease in service charges on deposit accounts ($6 million... -

Page 29

... the sale of Visa shares and $14 million on the sale of MasterCard shares in 2008, and decreases in fiduciary income ($28 million), service charges on deposit accounts ($9 million) and card fees ($8 million). Partially offsetting these decreases was an increase in investment banking fees ($9 million... -

Page 30

... in reserves in the Global Corporate Banking loan portfolio. Net credit-related charge-offs increased $46 million, primarily due to an increase in charge-offs in the Commercial Real Estate loan portfolio. Noninterest income of $51 million increased $3 million in 2009, compared to 2008, primarily due... -

Page 31

... Segments'' heading above. The following table lists the Corporation's banking centers by geographic market segment. 2009 December 31 2008 2007 Midwest (Michigan) ...Western: California ...Arizona ...Texas ...Florida ...International ...Total ... 232 98 16 114 90 10 1 447 233 96 12 108 87 10... -

Page 32

... ...Equity and other non-debt securities: Auction-rate preferred securities ...Money market and other mutual funds ...Total investment securities available-for-sale . Commercial loans ...Real estate construction loans: Commercial Real Estate business line (a) Other business lines (b) ...Total real... -

Page 33

... of this financial review. Loans The following tables detail the Corporation's average loan portfolio by loan type, business line and geographic market. Years Ended December 31 2009 2008 Change (dollar amounts in millions) Average Loans By Loan Type: Percent Change Commercial loans ...Real estate... -

Page 34

Years Ended December 31 2009 2008 Change (dollar amounts in millions) Average Loans By Business Line: Percent Change Middle Market ...Commercial Real Estate . . Global Corporate Banking National Dealer Services . Specialty Businesses (a) . . ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... -

Page 35

... information on real estate loans, refer to the ''Commercial and Residential Real Estate Lending'' portion of the ''Risk Management'' section of this financial review. Management expects low single-digit period-end loan growth for 2010, compared to period-end 2009. ANALYSIS OF INVESTMENT SECURITIES... -

Page 36

... market for these securities was not active. For additional information on the repurchase of auction-rate securities, refer to the ''Critical Accounting Policies'' section of this financial review and Note 4 to the consolidated financial statements. Management expects investment securities available... -

Page 37

... majority of business lines showed increases from 2008 to 2009, including Global Corporate Banking (47 percent), National Dealer Services (17 percent) and Private Banking (nine percent). Average core deposits increased in nearly all geographic markets from 2008 to 2009, including International (42... -

Page 38

...savings into FDIC insured deposits. Average other time deposits decreased $2.6 billion and average foreign office time deposits decreased $273 million in 2009, compared to 2008. Other time deposits represent certificates of deposit issued to institutional investors in denominations in excess of $100... -

Page 39

...summary of changes in total shareholders' equity in 2009: (in millions) Balance at January 1, 2009 ...Retention of earnings (net income less cash dividends declared) . Change in accumulated other comprehensive loss: Investment securities available-for-sale ...Cash flow hedges ...Defined benefit and... -

Page 40

... and business units and has reporting responsibility to the Enterprise Risk Committee of the Board. CREDIT RISK Credit risk represents the risk of loss due to failure of a customer or counterparty to meet its financial obligations in accordance with contractual terms. The Corporation manages credit... -

Page 41

... year ...Loan charge-offs: Domestic Commercial ...Real estate construction: Commercial Real Estate business line (a) ...Other business lines (b) ...Total real estate construction ...Commercial mortgage: Commercial Real Estate business line (a) ...Other business lines (b) ...Total commercial mortgage... -

Page 42

... periodic reviews by the Corporation's senior management. The Corporation defines business loans as those belonging to the commercial, real estate construction, commercial mortgage, lease financing and international loan portfolios. The Corporation performs a detailed credit quality review quarterly... -

Page 43

... markets), Global Corporate Banking (primarily the International and Western markets), Private Banking (primarily the Western market) and Commercial Real Estate (primarily in the Texas and Florida markets, partially offset by a decline in the Western market) loan portfolios. Commercial Real Estate... -

Page 44

... sale of unfunded lending-related commitments. SUMMARY OF NONPERFORMING ASSETS AND PAST DUE LOANS 2009 December 31 2008 2007 2006 (dollar amounts in millions) 2005 Nonaccrual loans: Commercial ...Real estate construction: Commerical Real Estate business line (a) ...Other business lines (b) ...Total... -

Page 45

...Residential real estate loans, which consist of traditional residential mortgages and home equity loans and lines of credit, are generally placed on nonaccrual status and charged off to current appraised values, less costs to sell, during the foreclosure process, normally no later than 180 days past... -

Page 46

... mortgage loan charge-offs. Excludes business loan gross charge-offs and nonaccrual business loans sold. The following table presents the number of nonaccrual loan relationships greater than $2 million and balance by size of relationship at December 31, 2009. Nonaccrual Relationship Size Number... -

Page 47

... market. The Corporation sold $64 million of nonaccrual business loans in 2009, including $36 million and $19 million of loans from the Global Corporate Banking and Commercial Real Estate loan portfolios, respectively. Loans past due 90 days or more and still accruing interest generally represent... -

Page 48

... December 31, 2009 Loans Transferred Net Loan to Nonaccrual (a) Charge-Offs (dollar amounts in millions) Real estate ...Services ...Manufacturing ...Holding & other investment Retail trade ...Wholesale trade ...Automotive ...Information ...Hotels ...Natural resources ...Finance ...Transportation... -

Page 49

... at December 31, 2009, $58 million were in the Commercial Real Estate business line, including $33 million in the Western market. At December 31, 2009 and 2008, there were no foreclosed properties with a carrying value greater than $10 million. Concentration of Credit The Corporation has an industry... -

Page 50

... millions) Production: Domestic ...Foreign ...Total production ...Dealer ...Total automotive net loan charge-offs ... $50 4 $54 - $54 $ 6 - $ 6 - $ 6 All other industry concentrations, as defined by management, individually represented less than 10 percent of total loans at December 31, 2009. 48 -

Page 51

...lending activities by limiting exposure to those borrowers directly involved in the commercial real estate markets and adhering to conservative policies on loan-to-value ratios for such loans. Commercial real estate loans, consisting of real estate construction and commercial mortgage loans, totaled... -

Page 52

... portfolio reviews performed by the Corporation's senior management. When appropriate, extensions, renewals and restructurings of real estate construction loans are approved after giving consideration to the project's status, the borrower's financial condition, and the collateral protection based... -

Page 53

... in the Florida market at December 31, 2009. A substantial majority of the home equity portfolio was secured by junior liens. The Corporation rarely originates residential real estate loans with a loan-to-value ratio at origination above 100 percent, has no sub-prime mortgage programs and does not... -

Page 54

...business activities of extending loans and accepting deposits. The Corporation's balance sheet is predominantly characterized by floating-rate commercial loans funded by a combination of core deposits and wholesale borrowings. This creates a natural imbalance between the floating-rate loan portfolio... -

Page 55

...2008 to December 31, 2009 was primarily driven by changes in the Corporation's deposit mix resulting from movement of fixed-rate certificates of deposit into other deposit products. Interest rate risk is actively managed principally through the use of either on-balance sheet financial instruments or... -

Page 56

... (fixed) interest rates ...Floating interest rates ...Total ... (a) Includes demand loans, loans having no stated repayment schedule or maturity and overdrafts. The Corporation uses investment securities and derivative instruments, predominantly interest rate swaps, as asset and liability management... -

Page 57

... interest rate and foreign currency risks associated with specific assets and liabilities (e.g., customer loans or deposits denominated in foreign currencies). Such instruments may include interest rate caps and floors, total return swaps, foreign exchange forward contracts and foreign exchange swap... -

Page 58

... 31, 2009 Total Commitments to purchase investment securities . Commitments to sell investment securities ...Commitments to fund indirect private equity and venture capital investments ...Unused commitments to extend credit ...Standby letters of credit and financial guarantees Commercial letters... -

Page 59

... to institutional investors in denominations in excess of $100,000 and to retail customers in denominations of less than $100,000 through brokers (''other time deposits'' on the consolidated balance sheets), foreign office time deposits and short-term borrowings. Purchased funds totaled $2.1 billion... -

Page 60

... Securities At December 31, 2009, the Corporation had a $57 million portfolio of investments in indirect private equity and venture capital funds, with commitments of $27 million to fund additional investments in future periods. The value of these investments is at risk to changes in equity markets... -

Page 61

... such investments in 2009. The following table provides information on the Corporation's indirect private equity and venture capital funds investment portfolio. December 31, 2009 (dollar amounts in millions) Number of investments ...Balance of investments ...Largest single investment ...Commitments... -

Page 62

... levels of credit risk and may allocate a specific portion of the allowance to such loans based upon this review. The Corporation defines business loans as those belonging to the commercial, real estate construction, commercial mortgage, lease financing and international loan portfolios. The portion... -

Page 63

... included primarily auction-rate securities at December 31, 2009. Additionally, from time to time, the Corporation may be required to record at fair value other financial assets or liabilities on a nonrecurring basis. Note 3 to the consolidated financial statements includes information about the... -

Page 64

...18 to the consolidated financial statements for further discussion of share-based compensation expense. Nonmarketable Equity Securities At December 31, 2009, the Corporation had a $57 million portfolio of investments in indirect private equity and venture capital investments, with commitments of $27... -

Page 65

... for these assets. In addition, the value of auction-rate securities is at risk to changes in equity markets, general economic conditions and other factors. PENSION PLAN ACCOUNTING The Corporation has defined benefit pension plans in effect for substantially all full-time employees hired before... -

Page 66

...the current benefit obligation, the long-term rate of return expected on plan assets and the rate of compensation increase. The assumed discount rate is determined by matching the expected cash flows of the pension plans to a yield curve that is representative of long-term, high-quality fixed income... -

Page 67

Given the salaries expense included in 2009 segment results, defined benefit pension expense was allocated approximately 40 percent, 29 percent, 26 percent and 5 percent to the Retail Bank, Business Bank, Wealth & Institutional Management and Finance segments, respectively, in 2009. INCOME TAXES The... -

Page 68

... equity ratio ... (a) Tier 1 capital and risk-weighted assets as defined by regulation. The Tier 1 common capital ratio removes preferred stock and qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with bank regulations. The tangible common equity... -

Page 69

... report includes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. In addition, the Corporation may make other written and oral communications from time to time that contain such statements. All statements regarding the Corporation's expected financial... -

Page 70

...rates and their impact on deposit pricing, could adversely affect the Corporation's net interest income and balance sheet; • competitive product and pricing pressures among financial institutions within the Corporation's markets may change; • customer borrowing, repayment, investment and deposit... -

Page 71

... 2009 2008 (in millions, except share data) ASSETS Cash and due from banks ...Federal funds sold and securities purchased under agreements to resell ...Interest-bearing deposits with banks ...Other short-term investments ...Investment securities available-for-sale ...Commercial loans ...Real estate... -

Page 72

... loan losses ...Net interest income after provision for loan losses ...NONINTEREST INCOME Service charges on deposit accounts Fiduciary income ...Commercial lending fees ...Letter of credit fees ...Card fees ...Foreign exchange income ...Bank-owned life insurance ...Brokerage fees ...Net securities... -

Page 73

... of discount on preferred stock ...Net issuance of common stock under employee stock plans ...Share-based compensation ...Other ... $5,345 $(1,629) 17 - - - (113) (30) - (22) (36) - - - - (1) - 48 - 1 BALANCE AT DECEMBER 31, 2009 ... $5,161 $(1,581) See notes to consolidated financial statements... -

Page 74

...-for-sale ...Purchases of investment securities available-for-sale ...Sales (purchases) of Federal Home Loan Bank stock ...Net decrease (increase) in loans ...Proceeds from early termination of leveraged leases ...Net increase in fixed assets ...Net decrease in customers' liability on acceptances... -

Page 75

... the Corporation conform to U.S. generally accepted accounting principles (GAAP) and prevailing practices within the banking industry. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and... -

Page 76

... income. For further information regarding the Corporation's investments in VIEs, refer to Note 11. Fair Value Measurements Fair value measurement applies whenever accounting guidance requires or permits assets or liabilities to be measured at fair value. Fair value is defined as the exchange price... -

Page 77

... discount rates and estimates of future cash flows, could significantly affect the results of current or future values. For further information about fair value measurements, refer to Note 3. Other Short-Term Investments Other short-term investments include trading securities and loans held-for-sale... -

Page 78

... periodic reviews by the Corporation's senior management. The Corporation defines business loans as those belonging to the commercial, real estate construction, commercial mortgage, lease financing and international loan portfolios. The Corporation performs a detailed credit quality review quarterly... -

Page 79

... assets consist of loans, including loans held-for-sale, and debt securities for which the accrual of interest has been discontinued, loans for which the terms have been renegotiated to less than market rates due to a serious weakening of the borrower's financial condition, and real estate... -

Page 80

...Residential real estate loans, which consist of traditional residential mortgages and home equity loans and lines of credit, are generally placed on nonaccrual status and charged off to current appraised values, less costs to sell, during the foreclosure process, normally no later than 180 days past... -

Page 81

... Equity Securities The Corporation has a portfolio of investments in indirect private equity and venture capital funds. The majority of these investments are not readily marketable and are included in ''accrued income and other assets'' on the consolidated balance sheets. The investments... -

Page 82

... derivatives by primary underlying risk exposure (e.g., interest rate, credit or foreign exchange rate) and by purpose or strategy (fair value hedge, cash flow hedge, net investment hedge and non-hedges), (2) information about the volume of derivative activity in a flexible format that the preparer... -

Page 83

... current benefit obligation and a long-term expected rate of return on plan assets. Net periodic defined benefit pension expense includes service cost, interest cost based on the assumed discount rate, an expected return on plan assets based on an actuarially derived market-related value of assets... -

Page 84

... new guidance on accounting for the income tax benefits of dividends on share-based payment awards. The new guidance requires the Corporation to recognize the income tax benefit realized from dividends charged to retained earnings and paid to employees for nonvested restricted stock awards as an... -

Page 85

...Loss) The Corporation has elected to present information on comprehensive income in the consolidated statements of changes in shareholders' equity and in Note 16. Note 2 - Pending Accounting Pronouncements In June 2009, the FASB issued SFAS No. 166, ''Accounting for Transfers of Financial Assets, an... -

Page 86

...basis. Additionally, from time to time, the Corporation may be required to record other assets and liabilities at fair value on a nonrecurring basis, such as impaired loans, other real estate (primarily foreclosed properties), indirect private equity and venture capital investments and certain other... -

Page 87

... traded by dealers or brokers in active over-the-counter markets and money market funds. Level 2 securities primarily include residential mortgage-backed securities issued by U.S. government-sponsored enterprises. Securities classified as Level 3, of which the substantial majority are auction-rate... -

Page 88

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Business loans consist of commercial, real estate construction, commercial mortgage, lease financing and international loans. The estimated fair value for variable rate business loans that reprice frequently is based on carrying values... -

Page 89

... STATEMENTS Comerica Incorporated and Subsidiaries there is not a readily determinable fair value, the Corporation estimates fair value for indirect private equity and venture capital investments based on percentage ownership in the net asset value of the entire fund, as reported by the fund... -

Page 90

... in foreign offices approximates their estimated fair value, while the estimated fair value of term deposits is calculated by discounting the scheduled cash flows using the year-end rates offered on these instruments. Short-term borrowings The carrying amount of federal funds purchased, securities... -

Page 91

... residential mortgage-backed securities State and municipal securities (a) ...Corporate debt securities: Auction-rate debt securities ...Other corporate debt securities ...Equity and other non-debt securities: Auction-rate preferred securities ...Money market and other mutual funds ... ... $ 107... -

Page 92

... December 31, 2009 Trading securities ...Investment securities available-for-sale: State and municipal securities (a) ...Auction-rate debt securities ...Other corporate debt securities . Auction-rate preferred securities Total investment securities available-for-sale ...Derivative assets (warrants... -

Page 93

..., 2009 Investment securities available-for-sale: Other corporate debt securities . . Auction-rate preferred securities . Total investment securities available-for-sale ...Derivative assets (warrants) ...Other liabilities ...Year Ended December 31, 2008 Investment securities available-for-sale: Other... -

Page 94

... income'' on the consolidated statements of income) during the years ended December 31, 2009 and 2008, respectively, based on the estimated fair value of the funds. (c) Includes other real estate (primarily foreclosed properties), loans held-for-sale and loan servicing rights. (d) The Corporation... -

Page 95

...-sale ...Total loans, net of allowance for loan losses (a) ...Customers' liability on acceptances outstanding ...Loan servicing rights ...Nonmarketable equity securities (b) ...Liabilities Demand deposits (noninterest-bearing) ...Interest-bearing deposits ...Total deposits ...Short-term borrowings... -

Page 96

... ...Corporate debt securities: Auction-rate debt securities ...Other corporate debt securities ...Equity and other non-debt securities: Auction-rate preferred securities ...Money market and other mutual funds ...December 31, 2008 U.S. Treasury and other U.S. government agency securities Government... -

Page 97

... residential mortgage-backed securities ...State and municipal securities (a) ...Corporate debt securities: Auction-rate debt securities ...Other corporate debt securities ...Equity and other non-debt securities: Auction-rate preferred securities ...Money market and other mutual funds . . Total... -

Page 98

... 350 6,261 706 99 $7,416 Subtotal ...Residential mortgage-backed securities . . Equity and other nondebt securities: Auction-rate preferred securities ...Money market and other mutual funds ... Total investment securities available-for-sale ... Included in the contractual maturity distribution in... -

Page 99

... December 2008. The following table summarizes auction-rate securities activity for the years ended December 31, 2009 and 2008. Par Value Fair Repurchase Value (a) Charge (b) (in millions) Securities Gains Balance at January 1, 2008 ...Repurchased from customers ...Called or redeemed subsequent to... -

Page 100

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Nonaccrual and reduced-rate loans are included in the corresponding loan line items and real estate acquired through foreclosure is included in ''accrued income and other assets'' on the consolidated balance sheets. December 31 2009... -

Page 101

... part of credit policies. The Corporation is a regional financial services holding company with a geographic concentration of its on-balance-sheet and off-balance-sheet activities in Michigan, California and Texas. The Corporation has an industry concentration with the automotive industry. Loans to... -

Page 102

...loans: Commercial Real Estate business line (a) ...Other business lines (b) ...Total commercial mortgage loans ...Total commercial real estate loans ...Total unused commitments on commercial real estate loans ...(a) Primarily loans to real estate investors and developers. (b) Primarily loans secured... -

Page 103

... impairment charge was required. The impairment test performed as of July 1, 2009 utilized assumptions that incorporate the Corporation's view that the current market conditions reflected only a short-term, distressed view of recent and near-term results rather than future long-term earning capacity... -

Page 104

... cash, investment securities, accounts receivable, equipment or real estate. Market risk is the potential loss that may result from movements in interest rates, foreign currency exchange rates or energy commodity prices that cause an unfavorable change in the value of a financial instrument. Market... -

Page 105

... and floors are option-based contracts which entitle the buyer to receive cash payments based on the difference between a designated reference rate and the strike price, applied to a notional amount. Written options, primarily caps, expose the Corporation to market risk but not credit risk. A fee is... -

Page 106

... - cash flow - receive fixed/pay floating . . Swaps - fair value - receive fixed/pay floating . . Total risk management interest rate swaps designated as hedging instruments ...Derivatives used as economic hedges Foreign exchange contracts: Spot and forwards ...Swaps ...Total risk management foreign... -

Page 107

... securities related to the trading account portfolio totaled $19 million and $10 million at December 31, 2009 and 2008, respectively. Outstanding commitments expose the Corporation to both credit and market risk. Risk Management As an end-user, the Corporation employs a variety of financial... -

Page 108

... income (ineffective portion) ...Gain reclassified from accumulated OCI into interest and fees on loans (effective portion) ... $15 (2) 34 $69 - 24 Foreign exchange rate risk arises from changes in the value of certain assets and liabilities denominated in foreign currencies. The Corporation... -

Page 109

..., 2009 Swaps - cash flow - receive fixed/pay floating rate: Variable rate loan designation ...Swaps - fair value - receive fixed/pay floating rate: Medium- and long-term debt designation ...Total risk management interest rate swaps ...December 31, 2008 Swaps - cash flow - receive fixed/pay floating... -

Page 110

... exchange contracts Total Other noninterest income ...Other noninterest income ...Foreign exchange income ... $ 8 1 34 $43 $15 1 40 $56 Credit-Related Financial Instruments The Corporation issues off-balance sheet financial instruments in connection with commercial and consumer lending activities... -

Page 111

... a summary of total internally classified watch list standby and commercial letters of credit and financial guarantees (generally consistent with regulatory defined special mention, substandard and doubtful) at December 31, 2009 and 2008. The Corporation manages credit risk through underwriting... -

Page 112

... returns of the trust are absorbed by the trust preferred stock holders. The trust preferred securities held by this entity ($500 million at December 31, 2009) qualify as Tier 1 capital and are classified as subordinated debt included in ''medium- and long-term debt'' on the consolidated balance... -

Page 113

...recorded as a reduction of income tax expense (or an increase to income tax benefit) and a reduction of federal income taxes payable. These income tax credits and deductions are allocated to the funds' investors based on their ownership percentages. Investment balances, including all legally binding... -

Page 114

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... $1,657 1,142 1,333 536 $4,668 $ 3,834 2,152 5,211 1,234 $12,431 Total ... All foreign office time deposits of $542 million and $470 million at December 31, 2009 and 2008, respectively, were in denominations of $100,000 or more. 112 -

Page 115

...within one to four days from the transaction date. Other short-term borrowings, which may consist of Federal Reserve Term Auction Facility borrowings, commercial paper, borrowed securities, term federal funds purchased, short-term notes and treasury tax and loan deposits, generally mature within one... -

Page 116

... rate based on Federal Funds indices due 2009 ...Federal Home Loan Bank advances: Floating rate based on LIBOR indices due 2009 to 2014 ...Other notes: 6.0% - 6.4% fixed rate notes due 2020 ...Total subsidiaries ...Total medium- and long-term debt ... The carrying value of medium- and long-term... -

Page 117

... provides short- and long-term funding collateralized by mortgage-related assets to its members. FHLB advances bear interest at variable rates based on LIBOR and were secured by $2.8 billion of real estate-related loans and $3.2 billion of mortgage-backed investment securities at December 31, 2009... -

Page 118

... all shares purchased as part of the Corporation's publicly announced repurchase program were transacted in the open market and were within the scope of Rule 10b-18, which provides a safe harbor for purchases in a given day if an issuer of equity securities satisfies the manner, timing, price and... -

Page 119

... Treasury holds equity issued under the Capital Purchase Program. These standards generally apply to the chief executive officer, the chief financial officer, and the three most highly compensated executive officers (the senior executive officers), plus the 20 most highly compensated employees. In... -

Page 120

... in net unrealized gains and losses on investment securities available-for-sale, the change in accumulated net gains and losses on cash flow hedges and the change in the accumulated defined benefit and other postretirement plans adjustment. Total comprehensive income (loss) was ($10) million, $81... -

Page 121

... the following table. Years Ended December 31 2009 2008 2007 (in millions, except per share data) Basic and diluted Income from continuing operations ...Less: Preferred stock dividends ...Income allocated to participating securities ...Income (loss) from continuing operations attributable to common... -

Page 122

.... Note 18 - Share-Based Compensation Share-based compensation expense is charged to ''salaries'' expense on the consolidated statements of income. The components of share-based compensation expense for all share-based compensation plans and related tax benefits are as follows: 2009 2008 2007 (in... -

Page 123

...4.62 4.62 58 34 6.4 6.6 A summary of the Corporation's stock option activity and related information for the year ended December 31, 2009 follows: Weighted-Average Remaining Exercise Contractual Price Term per Share (in years) Aggregate Intrinsic Value (in millions) Number of Options (in thousands... -

Page 124

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries totaled less than $0.5 million for the year ended December 31, 2008 and $8 million for the year ended December 31, 2007. A summary of the Corporation's restricted stock activity and related information for 2009 follows: Number of Shares... -

Page 125

... Benefit Plan 2009 2008 Change in projected benefit obligation: Projected benefit obligation at January 1 Service cost ...Interest cost ...Actuarial (gain) loss ...Benefits paid ...Plan change ...Change in plan assets: Fair value of plan assets at January Actual return on plan assets ...Employer... -

Page 126

... 2009, 2008 and 2007, and changes for the years then ended, for the qualified defined benefit pension plan, non-qualified defined benefit pension plan and postretirement benefit plan. Qualified Defined Benefit Pension Plan Prior Service Net (Cost) Transition Net Net Loss Credit Obligation Total Loss... -

Page 127

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Postretirement Benefit Plan Total Prior Prior Service Net Service Net (Cost) Transition (Cost) Transition Net Loss Credit Obligation Total Net Loss Credit Obligation Total (in millions) Balance at December 31, 2006, ... -

Page 128

...31 2009 2008 2007 2009 2008 2007 (in millions) Service cost ...Interest cost ...Expected return on plan assets ...Amortization of prior service cost (credit) Amortization of net loss ...Recognition of special agreement benefits ... ... $ 28 69 (104) 6 38 - $ 37 $ 200 $ 28 66 (100) 7 4 - $ 5 $ 30... -

Page 129

...after considering both long-term returns in the general market and long-term returns experienced by the assets in the plan. The returns on the various asset categories are blended to derive one long-term rate of return. The Corporation reviews its pension plan assumptions on an annual basis with its... -

Page 130

... money market funds. Level 2 securities include collective investment funds measured using the NAV. Common stock Fair value measurement is based upon the closing price reported on the New York Stock Exchange. Level 1 common stock includes domestic and foreign stock and real estate investment trusts... -

Page 131

... future cash flows, and is included in Level 2 of the fair value hierarchy. Private placements Fair value is measured using the NAV provided by fund management, as quoted prices in active markets are not available. Management considers additional discounts to the provided NAV for market and credit... -

Page 132

...5 $633 28 - $28 ... Total investments at fair value ...December 31, 2008 Equity securities: Collective investment and mutual funds ...Common stock ...Fixed income securities: U.S. Treasury and other U.S. government agency securities Mortgage-backed securities ...Corporate and municipal bonds and... -

Page 133

...the current IRS compensation limit), invested based on employee investment elections. Effective September 16, 2008, the Corporation eliminated Comerica Stock as an investment option for future deposits, including employee contributions, matching contributions and transfers. Employee benefits expense... -

Page 134

... to investments in low income housing partnerships. Tax interest, state and foreign taxes are then added to the federal tax provision. In the ordinary course of business, the Corporation enters into certain transactions that have tax consequences. From time to time, the Internal Revenue Service (IRS... -

Page 135

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries In 2009 there was a decline in unrecognized tax benefits due to the closing of the IRS examination of years 2001-2004, the amending of certain state income tax returns and the recognition of certain anticipated refunds... -

Page 136

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The current and deferred components of the provision for income taxes for continuing operations were as follows: 2009 December 31 2008 2007 (in millions) Current Federal ...Foreign ...State and local ...Total current ... -

Page 137

... were as follows: December 31 2009 2008 (in millions) Deferred tax assets: Allowance for loan losses ...Deferred loan origination fees and costs Other comprehensive income ...Employee benefits ...Foreign tax credit ...Tax interest ...Auction-rate securities ...Other temporary differences, net... -

Page 138

...) Tax based on federal statutory rate ...State income taxes ...Affordable housing and historic credits ...Bank-owned life insurance ...Disallowance of foreign tax credit ...Termination of structured leasing transactions Other changes in unrecognized tax benefits . Interest on income tax liabilities... -

Page 139

... have a direct material effect on the Corporation's financial statements. At December 31, 2009 and 2008, the Corporation and its U. S. banking subsidiaries exceeded the ratios required for an institution to be considered ''well capitalized'' (total risk-based capital, Tier 1 risk-based capital and... -

Page 140

... review. The Business Bank is primarily composed of the following businesses: Middle Market, Commercial Real Estate, National Dealer Services, International Finance, Global Corporate, Leasing, Financial Services, and Technology and Life Sciences. This business segment meets the needs of medium-size... -

Page 141

..., capital market products, international trade finance, letters of credit, foreign exchange management services and loan syndication services. The Retail Bank includes small business banking and personal financial services, consisting of consumer lending, consumer deposit gathering and mortgage loan... -

Page 142

... and attributed equity. Net interest margin is calculated based on the greater of average earning assets or average deposits and purchased funds. 2008 included an $88 million net charge ($56 million, after-tax) related to the repurchase of auction-rate securities from customers. FTE - Fully... -

Page 143

... segment includes the Corporation's securities portfolio, asset and liability management activities, discontinued operations, the income and expense impact of equity and cash not assigned to specific business/market segments, tax benefits not assigned to specific business/market segments and... -

Page 144

...Noninterest income ...Noninterest expenses ...Provision (benefit) for income taxes (FTE) ...Income from discontinued operations, net of tax ...Net income (loss) ...Net credit-related charge-offs ...Selected average balances: Assets ...Loans ...Deposits ...Liabilities ...Attributed equity ... $ 807... -

Page 145

... and attributed equity. (b) Net interest margin is calculated based on the greater of average earning assets or average deposits and purchased funds. (c) 2008 included an $88 million net charge ($56 million, after-tax) related to the repurchase of auction-rate securities from customers. FTE - Fully... -

Page 146

... Company Financial Statements BALANCE SHEETS - COMERICA INCORPORATED December 31 2009 2008 (in millions, except share data) ASSETS Cash and due from subsidiary bank ...Short-term investments with subsidiary bank Other short-term investments ...Investment in subsidiaries, principally banks Premises... -

Page 147

... (22) 588 98 $686 $680 Total income ...EXPENSES Interest on medium- and long-term debt . Salaries and employee benefits ...Net occupancy expense ...Equipment expense ...Other noninterest expenses ... Total expenses ...Income before income taxes and equity in undistributed earnings of subsidiaries... -

Page 148

...activities ...INVESTING ACTIVITIES Net proceeds from private equity and venture capital investments ...Capital transactions with subsidiaries ...Net increase in fixed assets ...Net cash (used in) provided by investing activities ...FINANCING ACTIVITIES Proceeds from issuance of medium- and long-term... -

Page 149

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Note 26 - Sales of Businesses/Discontinued Operations In December 2006, the Corporation sold its ownership interest in Munder Capital Management (Munder) to an investor group. The sale agreement included an interest-... -

Page 150

... Quarter (in millions, except per share data) Interest income ...Interest expense ...Net interest income ...Provision for loan losses ...Net securities gains ...Noninterest income (excluding net securities gains) Noninterest expenses ...Provision (benefit) for income taxes ... $ 479 83 396 256... -

Page 151

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries 2008 Fourth Third Second First Quarter Quarter Quarter Quarter (in millions, except per share data) Interest income ...Interest expense ...Net interest income ...Provision for loan losses ...Net securities gains ...Noninterest income... -

Page 152

...'s Chief Executive Officer and Chief Financial Officer, internal control over financial reporting as it relates to the Corporation's consolidated financial statements presented in conformity with U.S. generally accepted accounting principles as of December 31, 2009. The assessment was based on... -

Page 153

... accurately and fairly reflect the transactions and dispositions of the assets of the Corporation; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts... -

Page 154

... statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2009. These financial statements are the responsibility of the Corporation's management. Our responsibility is to express an opinion on these financial statements based... -

Page 155

...ASSETS Cash and due from banks ...Federal funds sold and securities purchased under agreements to resell ...Interest-bearing deposits with banks ...Other short-term investments ...Investment securities available-for-sale ...Commercial loans ...Real estate construction loans Commercial mortgage loans... -

Page 156

... REVIEW - STATEMENTS OF INCOME Comerica Incorporated and Subsidiaries CONSOLIDATED FINANCIAL INFORMATION Years Ended December 31 2009 2008 2007 2006 2005 (in millions, except per share data) INTEREST INCOME Interest and fees on loans ...Interest on investment securities ...Interest on short-term... -

Page 157

... . Interest-bearing deposits with banks ...Other short-term investments ...Investment securities available-for-sale ...Commercial loans ...Real estate construction loans . Commercial mortgage loans . . Residential mortgage loans . . Consumer loans ...Lease financing ...International loans ... 0.32... -

Page 158

... investor relations information about Comerica, including stock quotes, news releases and financial data. Shareholder Assistance Inquiries related to shareholder records, change of name, address or ownership of stock, and lost or stolen stock certificates should be directed to the transfer agent... -

Page 159

comerica.com COMERICA CORPORATE HEADQUARTERS COMERICA BANK TOWER 1717 MAIN STREET DALLAS, TEXAS 75201 Cert no. XXX-XXX-XXX X -

Page 160

COMERICA INCORPORATED 2009 ANNUAL REPORT