Circuit City 2003 Annual Report Download - page 16

Download and view the complete annual report

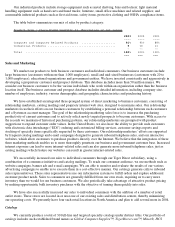

Please find page 16 of the 2003 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 2002 March 31 June 30 September 30 December 31

---- -------- ------- ------------ -----------

Net sales........................................ $412 $364 $372 $403

Percentage of year's net sales .................. 26.6% 23.4% 24.0% 26.0%

Gross profit..................................... $74 $62 $63 $67

Income (loss) from operations.................... $1 $(14) $2 $4

Financial Condition, Liquidity and Capital Resources

Liquidity is the ability to generate sufficient cash flows to meet obligations and commitments from operating

activities and the ability to obtain appropriate financing and to convert into cash those assets that are no longer required

to meet existing strategic and financing objectives. Therefore, liquidity cannot be considered separately from capital

resources that consist of current and potentially available funds for use in achieving long-range business objectives and

meeting debt service commitments. Currently, our liquidity needs arise primarily from working capital requirements and

capital expenditures.

Our working capital was $149 million at December 31, 2003, an increase of $16 million from $133 million at the

end of 2002. This was due principally to a $36 million increase in inventories, a $4 million increase in accounts

receivable and a $13 million decrease in accrued expense and other current liabilities offset by a $24 million decrease in

cash, a $3 million decrease in prepaid expenses and other current assets and a $10 million increase in accounts payable.

Our inventories increased to meet the needs of our growing consumer base, as increased stock levels facilitate such sales,

while sales to business customers include a large portion of merchandise shipped directly by our vendors. The increase

in accounts receivable was less pronounced, as sales to consumers are generally paid by credit card, which have a 2-3

day shipment-to-cash cycle compared to the normal 30-

day payment terms offered to our business customers. We expect

that future accounts receivable and inventory balances will fluctuate with the mix of our net sales between consumer and

business customers.

We maintain our cash and cash equivalents primarily in money market funds or their equivalent. As of December

31, 2003, all of our investments mature in less than three months. Accordingly, we do not believe that our investments

have significant exposure to interest rate risk.

Our cash balance decreased $24.3 million to $38.7 million during the year ended December 31, 2003. Net cash

used in operating activities was $6.9 million in 2003, compared with net cash provided by operating activities of $4.9

million in 2002 and $95.6 million in 2001. The decrease in cash provided by operations in 2003 resulted from changes in

our working capital accounts, which used $31.7 million in cash compared to $16.8 million in 2002, and resulted

primarily from the increase in our inventories and a decrease in accounts payable and accrued expenses. This was

partially offset by an increase in cash generated from net income adjusted by other non-cash items, which provided

$24.8 million in 2003, compared to $21.6 million provided by these items in 2002. The decrease of $90.7 million in cash

provided by operations in 2002 was primarily a result of changes in working capital, which used $16.8 million in cash

compared to $66.2 million provided in 2001, and resulted primarily from increases in our inventories, accounts

receivable and prepaid expenses. Cash was provided by operations in 2001 by inventory reductions, decreases in

accounts receivable and receipt of a tax refund resulting from the loss recorded in the United States in 2000, offset by a

decrease in accounts payable.

In 2003, $11.2 million of cash was used in investing activities, principally $8.7 million for the purchase of

property, plant and equipment, and $2.6 million for the acquisition of the minority interest in our Netherlands subsidiary.

The capital expenditures in 2003 included upgrades and enhancements to our information and communications systems

hardware and facilities costs for the opening of several retail stores. Cash of $14.7 million was used in investing

activities in 2002. This included $15.4 million of additions to property, plant and equipment, primarily for the

completion of a new facility for our United Kingdom operations. In 2001 we used cash in investing activities of $23.8

million, primarily for property, plant and equipment additions. These expenditures included $9.5 million for software

and systems development and $5.5 million toward the construction of our United Kingdom facility. We anticipate no

major capital expenditures in 2004 and will fund any capital expenditures out of cash from operations and borrowings

under our credit lines.

Net cash of $1.9 million was used in financing activities in 2003. Cash of $4.2 million was used to repay short

and long

-

term obligations, which was partially offset by $1.5 million of cash provided by the issuance of capital leases