Circuit City 2002 Annual Report Download - page 20

Download and view the complete annual report

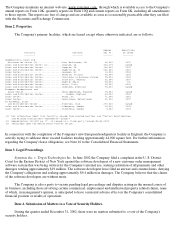

Please find page 20 of the 2002 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.purchase order, which indicates title to the product and risk of ownership passes to the customer upon shipment. Sales

are shown net of returns and allowances. Reserves for estimated returns and allowances are provided when sales are

recorded based on historical experience and current trends. The Company evaluates the collectibility of accounts

receivable based on a combination of factors, including (1) an analysis of the age of customer accounts and (2) the

Company's historical experience with accounts receivable write-offs. The analysis also includes the financial condition

of a specific customer or industry, and general economic conditions. In circumstances where the Company is aware of

customer charge-backs or a specific customer's inability to meet its financial obligations, a specific reserve for bad

debts applicable to amounts due to reduce the net recognized receivable to the amount management reasonably believes

will be collected is recorded. In those situations with ongoing discussions, the amount of bad debt recognized is based

on the status of the discussions. While bad debt allowances have been within expectations and the provisions

established, there can be no guarantee that the Company will continue to experience the same allowance rate it has in

the past.

Inventories.

The Company values its inventories at the lower of cost or market, cost being determined on the first-in,

first-out method. Reserves for excess and obsolete or unmarketable merchandise are provided based on historical

experience, assumptions about future product demand and market conditions. The adequacy of these reserves are

evaluated quarterly. If market conditions are less favorable than projected or if technological developments result in

accelerated obsolescence, additional write-downs may be required. While markdowns and obsolescence have been

within expectations and the provisions established, there can be no guarantee that the Company will continue to

experience the same level of markdowns it has in the past.

Long

-lived Assets. Management exercises judgment in evaluating the Company's long-lived assets for impairment. The

Company believes it will generate sufficient undiscounted cash flow to more than recover the investments made in

property, plant and equipment. While the Company believes that its estimates of future cash flows are reasonable,

different assumptions regarding such cash flows could materially affect its evaluations

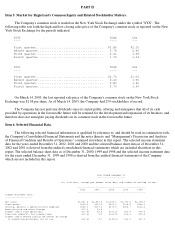

Accounting for Income Taxes.

The determination of the Company's tax provision is complex and requires significant

management judgement in the determination of foreign tax liabilities, deferred tax assets and liabilities and any

valuation allowances that might be required against the deferred tax assets.

Since the Company conducts operations internationally, its effective tax rate has and will continue to depend upon the

geographic distribution of its pre-tax income or losses among locations with varying tax rates. As the geographic mix

of the Company's pre-tax results among its various tax jurisdictions changes, the effective tax rate may vary from

period to period. The Company is also subject to periodic examination from domestic and foreign tax authorities

regarding the amount of taxes due. These examinations include questions regarding the timing and amount of

deductions and the allocation of income among various tax jurisdictions. The Company has established, and

periodically reevaluates, an estimated income tax reserve on its consolidated balance sheet to provide for the possibility

of adverse outcomes in income tax proceedings. While management believes that it has identified all reasonably

identifiable exposures and that the reserve it has established for identifiable exposures is appropriate under the

circumstances, it is possible that additional exposures exist and that exposures may be settled at amounts different than

the amounts reserved.

The Company accounts for income taxes in accordance with Statement of Financial Accounting Standards ("SFAS")

109, "Accounting for Income Taxes", which requires that deferred tax assets and liabilities be recognized for the effect

of temporary differences between the book and tax bases of recorded assets and liabilities. The realization of net

deferred tax assets is dependent upon the Company's ability to generate sufficient future taxable income. Where it is

more likely than not that some portion or all of the deferred tax asset will not be realized, the Company has provided a

valuation allowance. If the realization of those deferred tax assets in the future is considered more likely than not, an

adjustment to the deferred tax assets would increase net income in the period such determination is made. In the event

that actual results differ from these estimates or the Company adjusts these estimates in future periods, an adjustment to

the valuation allowance may be required, which could materially affect the Company's financial position and results of

operations. In preparing estimates of future taxable income, the Company has used the same assumptions and

projections utilized in its internal forecasts and estimates.

Stock-based Compensation. The Company applies the provisions of Accounting Principles Board ("APB") Opinion 25,

"Accounting for Stock Issued to Employees," in accounting for stock

-

based compensation; therefore, no compensation