Circuit City 1997 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1997 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of offset against amounts otherwise due the supplier, including a contractual right to offset $4 million paid by the Company to one of the

lenders under a letter of credit. The Company believes that the ultimate outcome of this matter will not have a material adverse effect on the

Company's consolidated financial position or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

During the quarter ended December 31, 1997, there were no matters submitted to a vote of the Company's security holders.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

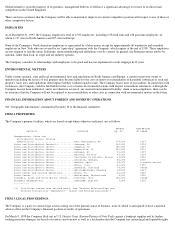

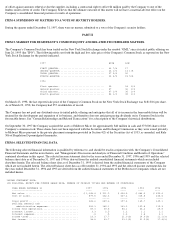

The Company's Common Stock has been traded on the New York Stock Exchange under the symbol "GML" since its initial public offering on

June 26, 1995 (the "IPO"). The following table sets forth the high and low sales price of the Company's Common Stock as reported on the New

York Stock Exchange for the periods indicated.

On March 23, 1998, the last reported sale price of the Company's Common Stock on the New York Stock Exchange was $1813/16 per share.

As of March 23, 1998, the Company had 255 stockholders of record.

The Company has not paid any dividends since its initial public offering and anticipates that all of its income in the foreseeable future will be

retained for the development and expansion of its business, and therefore does not anticipate paying dividends on its Common Stock in the

foreseeable future. See "Certain Relationships and Related Transactions" for a description of the Company's historical distributions.

On September 30, 1997 the Company acquired the assets of Midwest Micro for approximately $40 million in cash and 375,000 shares of the

Company's common stock. These shares have not been registered with the Securities and Exchange Commission as they were issued privately

to Midwest Micro pursuant to the private placement exemption provided in Section 4(2) of the Securities Act of 1933, as amended, and Rule

506 of Regulation D promulgated thereunder.

ITEM 6. SELECTED FINANCIAL DATA.

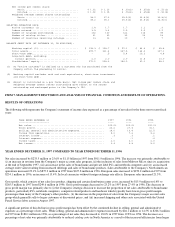

The following selected financial information is qualified by reference to, and should be read in conjunction with, the Company's Consolidated

Financial Statements and the notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations"

contained elsewhere in this report. The selected income statement data for the years ended December 31, 1997, 1996 and 1995 and the selected

balance sheet data as of December 31, 1997 and 1996 is derived from the audited consolidated financial statements which are included

elsewhere herein. The selected balance sheet data as of December 31, 1995 is derived from the audited financial statements of the Company

which are not included herein. The selected balance sheet data as of December 31, 1994 and 1993 and the selected income statement data for

the years ended December 31, 1994 and 1993 are derived from the audited financial statements of the Predecessor Companies which are not

included herein.

1997 HIGH LOW

FIRST QUARTER.................................. 43 7/8 17

SECOND QUARTER................................. 26 1/4 13 1/8

THIRD QUARTER.................................. 27 3/4 20

FOURTH QUARTER................................. 22 3/8 15 5/8

1996

First quarter.................................. 35 24 1/4

Second quarter................................. 47 32 1/8

Third quarter.................................. 47 1/4 36 1/4

Fourth quarter................................. 52 1/4 39 1/4

INCOME STATEMENT DATA:

(IN MILLIONS, EXCEPT PER COMMON SHARE DATA, NUMBER OF CATALOG TITLES AND NUMBER OF COUNTRIES)

YEAR ENDED DECEMBER 31 1997 1996 1995 1994 1993

---------------------- ---- ---- ---- ---- ----

Net sales....................................... $ 1,145.4 $ 911.9 $ 634.5 $ 484.2 $ 393.6

Cost of sales................................... 879.8 662.3 437.2 318.5 244.5

----- ----- ----- ----- -----

Gross profit.................................... 265.6 249.6 197.3 165.7 149.1

Selling, general and

administrative expenses...................... 206.3 180.1 143.2 129.5 119.3

Income from operations.......................... 59.3 69.5 54.1 36.2 29.8

Interest income................................. 3.3 2.5 1.2 1.1 1.1

Interest expense................................ .4 .5 1.3 1.8 2.1

Income taxes.................................... 23.3 27.7 21.0(3) 14.0(3) 11.1(3)

Net income...................................... 38.8 43.7 33.1(3) 21.9(3) 17.4(3)