Chesapeake Energy 1997 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1997 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholders:

e began fiscal 1997 optimistic about the contin-

ued growth and prosperity of Chesapeake.

Unfortunately, the year ended with great disap-

pointment as we wrote down the value of the company's assets

by $236 million and incurred an after-tax loss of $183 million.

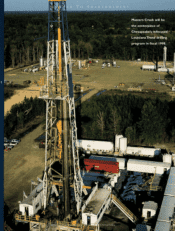

It was our first Louisiana well, the James 7, that generated

substantial enthusiasm regarding the potential of extending

"...We are also modifying our historical approach of achieving growth

exclusively through the drilibit by selectively acquiring underdeveloped

producing properties and undercapitalized companies."

A

the Austin Chalk drilling program from the Giddings Field

in Texas across the border into Louisiana. The well began pro-

ducing on June 29, 1996 and during July 1997 averaged 2,000

barrels of oil and 8.5 million cubic feet of natural gas produc-

tion per day. This well, other highly productive wells drilled by

our competitors in the Masters Creek area, and the extensive

2-D seismic control and well log information obtained from

over 500 prior penetrations of the Austin Chalk formation

seemed to confirm that the Louisiana Austin Chalk Trend

would prove productive across a large portion of central and

southeastern Louisiana.

Other companies arrived at similar conclusions, resulting in

one of the most competitive oil and gas lease acquisition efforts

in the past fifteen years over a 200 mile-long trend in Louisiana.

Chesapeake's geologists, geophysicists and landmen, along with

scores of contract lease brokers, competed aressively to

increase our position in this highly regarded acreage. By the end

of fiscal 1997, Chesapeake had invested over $175 million

acquiring more than one million acres the dominant leasehold

position in the Louisiana Trend and greater than the collective

ownership of our major competitors Union Pacific Resources,

Sonat, Occidental, and Amoco. It was clearly a major

LETTER To SHAREHOLDERS

CHESAPEAKE ENERGY CORPORATION

investment for our company. However, we believed the substan-

tial benefit of building a multi-year inventory of future drillsites

in what appeared to be the most attractive onshore exploration

play of recent years justified the inherent risks.

Consistent with our commitment to the company's share-

holders, Chesapeake initiated an agaressive exploration program

across six Louisiana Trend prospect areas: South Brookeland,

Leesville, Masters Creek, St. Landry, Baton Rouge, and

Livingston. Unfortunately, this program yielded two

conclusions as fiscal 1997 drew to a close. First, the technologi-

cal challenges and drilling costs in the Louisiana Trend were

substantially greater than we had encountered previously.

Second, the reservoir qi iility in the Louisiana Austin Chalk was

not as consistently productive as the Austin Chalk in the

Giddings Field in Texas.

Accordingly, in the last days of the fourth quarter of fiscal

1997, we determined that a

significant portion of the com-

pany's Louisiana Trend lease-

hold had become evaluated

under the full cost accounting

method, which in combina-

tion with significant related

drilling costs, caused us to

exceed our full cost ceiling limitation and required a writedown

of our assets. This writedown and the resulting loss for the year

disappointed all Chesapeake shareholders, especially us. After all,

we had personally purchased $30 million of Chesapeake stock

in February 1997, reflecting our confidence in the likely success

of the company's Louisiana drilling program. Notwithstanding

recent setbacks, we remain proud to own approximately 33% of

Oil and Gas Production Growth