Cathay Pacific 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cathay Pacific Airways Limited Annual Report 2011 3

Chairman’s Letter

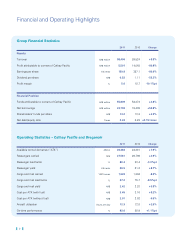

The Cathay Pacific Group reported an attributable profit of HK$5,501 million for 2011.

This compares to the profit of HK$14,048 million for 2010, which was a record

year for the Group. The 2010 results included HK$3,033 million of significant

non-recurring items being the profit on the sales of our shareholdings in Hong Kong

Air Cargo Terminals Limited (“Hactl”) and Hong Kong Aircraft Engineering Company

Limited (“HAECO”) and the gain on the deemed disposal of part of our interest in

Air China. Adjusting for these items, the attributable profit in 2011 decreased by

HK$5,514 million or 50.1% from 2010. Earnings per share fell by 60.9% to HK139.8

cents. Turnover for the year increased by 9.9% to HK$98,406 million.

In 2011 the core business of the Cathay Pacific Group

was materially affected by instability and uncertainty in

the world’s major economies. The passenger business of

Cathay Pacific and Dragonair held up relatively well mainly

as a result of strong demand for premium class travel.

The cargo business was adversely affected by a

substantial reduction in demand for shipments from our

two key export markets, Hong Kong and Mainland China.

Fuel is our biggest single cost and the persistently high

jet fuel prices had a significant effect on our operating

results in 2011. Disregarding the effect of fuel hedging,

the Group’s gross fuel costs increased by HK$12,455

million (or 44.1%) in 2011. The increase reflected both

higher fuel prices and the fact that we operated more

flights. Managing the risk associated with changing fuel

prices remains a high priority. To this end we have an

active fuel hedging programme. In 2011 we realised a

profit of HK$1,813 million from fuel hedging activities,

with unrealised mark-to-market gains of HK$436 million in

the reserves at 31st December 2011.

Passenger revenue for the year was HK$67,778 million,

an increase of 14.2% compared with 2010. Capacity

increased by 9.2%. We carried a total of 27.6 million

passengers, a rise of 2.9% compared with 2010. The load

factor fell by 3.0 percentage points. Yield increased by

8.7% to HK66.5 cents. The relative strength of a number

of the currencies in which we receive revenues made a

positive contribution to our revenues. Demand for

premium class travel remained robust in 2011. Firm

demand for business class seats on short-haul routes

reflected the relative strength of the Asian economy.

Load factors in economy class remained generally high,

particularly on the North American and Southeast Asian

routes. However, there was a reduction in economy class

yield on long-haul routes. Business to and from Japan

was affected by the earthquake and subsequent tsunami

which took place in March 2011. Business to and from

Thailand was affected by the serious floods there in

October and November.

Cargo revenue for 2011 was up by 0.3% to HK$25,980

million compared with 2010. Cargo business performed

reasonably well in the first quarter of 2011. However,

from April onwards, demand for shipments from our two

most important markets, Hong Kong and Mainland China,

weakened significantly and remained weak for the rest of

the year. We managed capacity in order to keep it in line

with demand and continued to seek opportunities in new

markets. Yield was up by 3.9% to HK$2.42. Capacity

increased by 6.9%. The load factor, however, fell by 8.5

percentage points to 67.2%. In 2011 we started cargo

services to Bengaluru in India, Chongqing and Chengdu in

Western China and Zaragoza in Spain.

We continue to acquire new aircraft to replace older, less

efficient aircraft and to increase the size of the fleet. In

2011, we took delivery of six Boeing 777-300ERs, three

Airbus A330-300s and four Boeing 747-8F freighters. Two

new Airbus A320-200s joined the Dragonair fleet in

February 2012. In March 2011, we announced orders for

27 new aircraft, including two Airbus A350-900s (which

had been ordered in December 2010), 15 Airbus

A330-300s and 10 Boeing 777-300ERs. In August 2011,

we announced the acquisition of four more Boeing