Cabela's 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

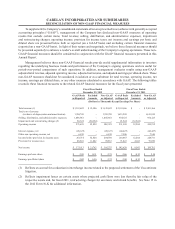

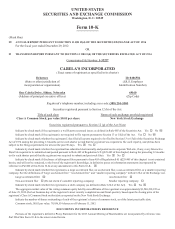

CABELA’S INCORPORATED AND SUBSIDIARIES

RETURN ON INVESTED CAPITAL

Return on invested capital (“ROIC”) is not a measure of financial performance under generally accepted

accounting principles (“GAAP”) and may not be defined and calculated by other companies in the same manner.

ROIC should be considered supplemental to and not a substitute for financial information prepared in accordance

with GAAP. The Company uses ROIC as a measure of efficiency and effectiveness of its use of capital.

The Company measures ROIC by dividing adjusted net income by average total capital. Adjusted net income

is calculated by adding interest expense, rent expense, and Retail segment depreciation and amortization (all after

tax) to reported net income excluding: (1) any losses on sales of assets, (2) any impairment charges or fixed asset

writedowns, and (3) any acceleration of depreciation charges caused by impairment of economic development bonds

(all after tax). Total capital is calculated by adding current maturities of long-term debt, deferred compensation,

operating leases capitalized at eight times next year’s annual minimum lease payments, and total stockholders’

equity to long-term debt (excluding all debt of World’s Foremost Bank (“WFB”)) and then subtracting cash and cash

equivalents (excluding cash and cash equivalents of WFB). Average total capital is calculated as the sum of current

and prior year ending total capital divided by two. The following table reconciles the components of ROIC to the most

comparable GAAP financial measures.

Fiscal Year Ended

December 29, 2012 December 31, 2011 January 1, 2011 January 2, 2010

(Dollars in Thousands)

Net income $ 173,513 $ 142,620 $ 112,159 $ 49,617

Add back:

Interest expense 20,171 24,454 27,482 23,223

Rent expense 13,605 9,541 7,506 8,624

Depreciation and amortization - Retail segment 46,997 41,506 40,011 41,822

Exclude:

Losses on sales of assets - - - -

Impairment charges or fixed asset writedowns 19,015 4,771 5,626 60,227

Acceleration of depreciation charges from

impairment of economic development bonds 1,309 6,538 - 2,099

101,097 86,810 80,625 135,995

After tax effect 67,027 57,729 54,253 88,179

Effective tax rate 33.70% 33.50% 32.71% 35.16%

Adjusted net income $ 240,540 $ 200,349 $ 166,412 $ 137,796

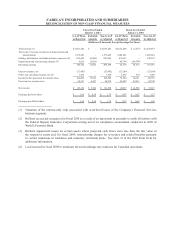

Total capital:

Current maturities of long-term debt $ 8,402 $ 8,387 $ 230 $ 3,101

Deferred compensation - - 291 349

Operating leases capitalized at 8x next year’s

annual minimum lease payments 95,168 85,968 55,864 53,608

Total stockholders’ equity 1,375,979 1,181,316 1,024,548 984,421

Long-term debt (excluding WFB debt) 328,133 336,535 344,922 345,178

1,807,682 1,612,206 1,425,855 1,386,657

Less:

Cash and cash equivalents (288,750) (304,679) (136,419) (582,185)

Add back cash and cash equivalents at WFB 91,365 117,035 81,904 371,408

(197,385) (187,644) (54,515) (210,777)

Adjusted total capital $ 1,610,297 $ 1,424,562 $ 1,371,340 $ 1,175,880

Average total capital $1,517,430 $1,397,951 $1,273,610 $1,255,845

Return on Invested Capital 15.9% 14.3% 13.1% 11.0%