CDW 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 CDW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We expect the competitive landscape in which we compete to continue changing as new technologies are developed. While innovation

can help our business as it creates new offerings for us to sell, it can also disrupt our business model and create new and stronger competitors.

For a discussion of the risks associated with competition, see “Risk Factors” included elsewhere in this report.

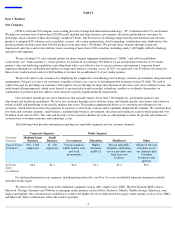

Marketing

We market the CDW brand on a national basis through a variety of public and community relations and corporate communications

efforts, and through brand advertising that includes the use of online, broadcast, print and other media. We also market to current and

prospective customers through integrated marketing programs that include print and online media, events and sponsorships. As a result of our

relationships with our vendor partners, a significant portion of our advertising and marketing expenses are reimbursed through cooperative

advertising reimbursement programs. These programs are at the discretion of our vendor partners and are typically tied to sales or purchasing

volumes or other commitments to be met by us within a specified period of time.

Coworkers

As of December 31, 2012, we employed more than 6,800 coworkers, none of whom is covered by collective bargaining agreements. We

consider our coworker relations to be good.

Intellectual Property

The CDW trademark and certain variations thereon are registered or subject to pending trademark applications in the U.S., Canada and

certain other jurisdictions. We believe our trademarks have significant value and are important factors in our marketing programs. In addition,

we own registrations for domain names, including cdw.com and cdwg.com, for certain of our primary trademarks. We also have unregistered

copyrights in our website content.

Equity Sponsors

Madison Dearborn Partners, LLC, based in Chicago, is an experienced private equity investment firm that has raised over $18 billion of

capital. Since its formation in 1992, it has invested in approximately 125 companies across a broad spectrum of industries, including basic

industries, business and government services, consumer, financial services, healthcare and telecom, media and technology services. Madison

Dearborn's objective is to invest in companies in partnership with outstanding management teams to achieve significant long-term appreciation

in equity value. To achieve this objective, Madison Dearborn seeks to partner with outstanding management teams that have a solid

understanding of their businesses as well as track records of building stockholder value.

Providence Equity Partners L.L.C. is a leading global private equity firm focused on media, communications, education and

information investments. Providence Equity has $27 billion of equity under management and has invested in more than 130 companies over its

23-

year history. Providence Equity is headquartered in Providence, Rhode Island and has offices in New York, London, Hong Kong, Beijing and

New Delhi. Providence's objective is to build extraordinary companies that will shape the future of the media, communications, education and

information industries. To achieve this objective, Providence Equity creates value by forging lasting partnerships with talented entrepreneurs and

executives and providing them with capital, industry expertise and a broad network of relationships that they need to succeed.

Item 1A. Risk Factors

There are many factors that affect our business and the results of operations, some of which are beyond our control. The following is a

description of some important factors that may cause the actual results of operations in future periods to differ materially from those currently

expected or desired.

Risks Related to Our Indebtedness

Our substantial indebtedness could have a material adverse effect on our financial condition and our business and our ability to incur

additional indebtedness could intensify these risks.

We are a highly leveraged company, and our substantial level of indebtedness increases the risk that we may be unable to generate

sufficient cash to pay amounts due in respect of our indebtedness. As of December 31, 2012, we had $3.8 billion of total long-term debt

outstanding, as defined by accounting principles generally accepted in the United States of America (“GAAP”), and $249.2 million of

obligations outstanding under our inventory financing agreements, and we had the ability to borrow an additional $622.4 million under our

senior secured asset-based revolving credit facility (the “Revolving Loan”). Subject to the limits contained in our senior credit facilities and

indentures, we may be able to incur additional debt from time

8