Brother International 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

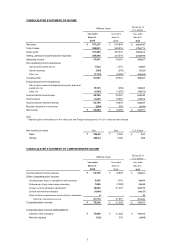

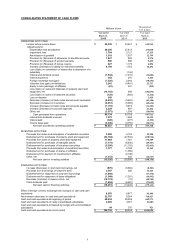

CONSOLIDATED STATEMENT OF CASH FLOW

S

OPERATING ACTIVITIES:

Income before income taxes Y 65,399

Y

33,527 $ 634,945

Adjustments for:

Depreciation and amortization 28,205 27,613 273,840

Impairment loss 1,784 2,121 17,325

A

mortization of goodwill 1,318 1,537 12,799

Provision for (Reversal of) allowance for doubtful accounts 1,027 883 9,974

Provision for (Reversal of) product warranty 586 898 5,692

Provision for (Reversal of) bonus reserve 627 1,176 6,096

Increase (Decrease) in liability for retirement benefit

s

4,784 1,752 46,452

-(144) -

Interest and dividend income (1,532) (1,515) (14,883)

Interest expenses 342 276 3,323

Foreign exchange loss (gain) (7,225) 2,092 (70,153)

Valuation loss (gain) on derivatives 2,341 (4,461) 22,737

Equity in loss (earnings) of affiliate

s

(61) 241 (599)

(15,743) 458 (152,853)

Loss (Gain) on sales of investment securities (125) (464) (1,214)

Loss on disaster 249 -2,424

Decrease (Increase) in trade notes and accounts receivable (6,293) (5,422) (61,106)

Decrease (Increase) in inventories (6,451) (5,993) (62,634)

Increase (Decrease) in trade notes and accounts payable (1,153) 6,973 (11,203)

Increase (Decrease) in accrued expenses 2,229 807 21,642

Other, net (3,573) 1,396 (34,694)

Cash generated from operations 66,734 63,756 647,911

Interest and dividends received 1,579 1,295 15,332

Interest paid (345) (277) (3,352)

Income taxes paid (9,946) (9,755) (96,571)

Net cash provided by operating activitie

s

Y 58,021

Y

55,019 $ 563,320

INVESTING ACTIVITIES:

Proceeds from sales and redemption of marketable securities 3,008 5,103 29,208

Disbursement for purchases of property, plant and equipmen

t

(23,784) (27,634) (230,916)

Proceeds from sales of property, plant and equipmen

t

17,964 1,361 174,409

Disbursement for purchases of intangible assets (7,179) (6,635) (69,707)

Disbursement for purchases of investment securities (5,398) (11,152) (52,413)

Proceeds from sales and redemption of investment securities 1,377 2,760 13,369

Disbursement for purchases of shares in affiliates -(1,058) -

Disbursement for payment of investments in affiliates -(2,188) -

Other, net (1,312) 343 (12,747)

Net cash used in investing activities Y (15,326)

Y

(39,099) $ (148,796)

FINANCING ACTIVITIES:

Increase (Decrease) in short-term borrowings, net (875) (5,684) (8,501)

Proceeds from borrowings of long-term debt 3,547 200 34,443

Disbursement for repayment of long-term borrowings (1,800) -(17,476)

Disbursement for repayment of lease obligation

s

(1,544) (1,251) (14,992)

Decrease (Increase) in treasury stock, net (10,174) (10) (98,785)

Cash dividends paid (7,604) (6,687) (73,829)

Net cash used in financing activities Y (18,451)

Y

(13,433) $ (179,141)

8,553 6,877 83,044

Net increase (decrease) in cash and cash equivalents 32,797 9,364 318,427

Cash and cash equivalents at beginning of period 68,934 55,059 669,271

Cash and cash equivalents of newly consolidated subsidiarie

s

2,905 4,301 28,205

94 210 921

Cash and cash equivalents at end of period Y 104,732

Y

68,934 $ 1,016,824

Millions of yen Thousands of

U.S. dollars

Year ended Year ended Year ended

2014 2015

Loss (Gain) on sales and disposals of property, plant and

equipment, net

March 31, March 31, March 31,

Effect of foreign currency exchange rate changes on cash and cash

equivalents

Cash and cash equivalents increased by merger with unconsolidated

subsidiaries

2015

Loss (Gain) on cancellation of shares due to absorption of a

subsidiary