Bridgestone 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Bridgestone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Bridgestone Annual Report 2004

Growth in vehicle ownership

enlarges the tire market struc-

turally. New-vehicle sales—and

attendant demand for original

equipment tires—fluctuate with

economic trends. But demand

for replacement tires is remark-

ably constant over the medium

term. And even demand for orig-

inal equipment tires displays a

consistent rising trend over the

long term.

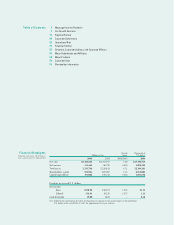

Expanding: 1

Our

Growth

Scenario

Driving the expansion of the global market for tires is the growth in vehicle ownership. Rates of

vehicle ownership—vehicles per 1,000 people—are rising steadily in China, India, Russia, eastern

Europe, and Latin America, and populations, too, continue to expand in most of those nations and

regions.

The authoritative market research firm LMC International projects average annual growth of

3.6% in global unit demand for tires between 2002 and 2008. That projection squares closely with

our projections for market growth. We are deploying production capacity in accordance with that

basic outlook.

Our global capital spending program provides for (1) deploying production resources to serve the

shift in demand for passenger car and light truck tires in industrialized markets toward high-per-

formance tires and tires of large rim sizes; (2) expanding production capacity to serve the growth in

global demand for passenger car tires, especially in emerging markets; (3) expanding production

capacity to serve the growth in global demand for truck and bus tires and for off-the-road tires; and

(4) acquiring and fostering expanded capabilities in producing raw materials for tires to respond

increasing tire production capacity.

We have earmarked ¥227 billion for investment in the four sectors from 2003 to 2007. All of the

yen figures for investment that appear on pages 4 to 11 are totals for the five years to 2007.

Global demand for tires is poised to continue expanding for the foreseeable future. We are

positioning the Bridgestone Group to achieve sustainable growth in unit tire sales that will

(1) exceed the overall expansion in demand and (2) support continuing growth in earnings.

That positioning reflects our basic management emphasis on strategic, qualitative growth.

Priorities

More vehicles